New Republican Retirement Plan: How It Impacts Your Savings (If You're In Your 30s)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Republican Retirement Plan: How It Impacts Your Savings (If You're in Your 30s)

Are you in your 30s and worried about retirement? The recently proposed Republican retirement plan has significant implications for your financial future, potentially altering how you save and invest for your golden years. Understanding these changes is crucial to ensuring you're on track to achieve your retirement goals. This article breaks down the key aspects of the plan and how they specifically impact those in their 30s.

What's in the Republican Retirement Plan?

The Republican plan, while still under development and subject to change, generally focuses on several key areas:

-

Increased Contribution Limits: The proposal aims to increase the contribution limits for 401(k)s and other retirement accounts. This means you could potentially save more each year, boosting your retirement nest egg. However, the exact increase amounts are yet to be finalized.

-

Tax Incentives: The plan likely includes adjustments to tax incentives related to retirement savings. This could involve lowering taxes on investment gains within retirement accounts or offering greater tax deductions for contributions. These changes could make saving for retirement more attractive financially.

-

Simplified Rules: Streamlining the complex rules and regulations surrounding retirement accounts is another potential component. This could make it easier for individuals to understand and navigate the retirement savings system, encouraging greater participation.

-

Emphasis on Private Retirement Accounts: The plan might emphasize private retirement accounts over government-sponsored programs. This shift could lead to increased reliance on individual savings and investment strategies.

How Does This Affect You in Your 30s?

For those in their 30s, the impact of this proposed plan is significant. This is a crucial decade for building retirement savings, as you have more time to benefit from the power of compounding.

-

Maximize Contribution Increases: Increased contribution limits directly translate to more money saved. If the proposed increases are substantial, taking advantage of them could significantly accelerate your retirement savings.

-

Strategic Tax Planning: Changes to tax incentives offer opportunities for strategic tax planning. Consulting with a financial advisor can help you optimize your contributions and minimize your tax burden.

-

Long-Term Growth Potential: The longer your money has to grow, the more substantial your retirement nest egg will become. Starting or maximizing your contributions in your 30s offers maximum time for compound growth.

Potential Downsides and Considerations:

While the plan presents several advantages, it's important to consider potential drawbacks:

-

Uncertainty: The plan is still under development, and the specifics may change. It’s important to remain informed about the final legislation.

-

Market Volatility: Retirement savings are subject to market fluctuations. While increased contribution limits are beneficial, it's crucial to diversify your investments and manage risk.

-

Individual Responsibility: The emphasis on private retirement accounts underscores the importance of proactive personal financial planning. It's crucial to develop a solid retirement savings strategy.

What You Can Do Now:

Regardless of the final details of the Republican retirement plan, taking proactive steps towards securing your financial future is essential.

-

Consult a Financial Advisor: A financial advisor can provide personalized guidance based on your financial situation and retirement goals.

-

Review Your Current Savings Plan: Assess your current retirement savings strategy and identify areas for improvement.

-

Increase Contributions: If possible, increase your contributions to your 401(k) or IRA, even before the potential changes take effect.

-

Stay Informed: Keep abreast of developments regarding the retirement plan and any potential impact on your savings.

The Republican retirement plan presents both opportunities and challenges for those in their 30s. By understanding the potential changes and taking proactive steps, you can significantly improve your chances of achieving a comfortable retirement. Remember to consult with a financial professional to create a personalized retirement plan that addresses your specific needs and goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Republican Retirement Plan: How It Impacts Your Savings (If You're In Your 30s). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Penn State And Nfl Stars Jersey A New Exhibit At The Smithsonian

Jun 05, 2025

Former Penn State And Nfl Stars Jersey A New Exhibit At The Smithsonian

Jun 05, 2025 -

Tariffs Squeeze Americans Dollar Generals Unexpected Rise

Jun 05, 2025

Tariffs Squeeze Americans Dollar Generals Unexpected Rise

Jun 05, 2025 -

Summer Houses Paige De Sorbo Announces Departure After Season 7

Jun 05, 2025

Summer Houses Paige De Sorbo Announces Departure After Season 7

Jun 05, 2025 -

Warren Buffetts Latest Investment A 7 700 Growth Story And A Bank Stock Sale

Jun 05, 2025

Warren Buffetts Latest Investment A 7 700 Growth Story And A Bank Stock Sale

Jun 05, 2025 -

Grace Potter Shares Previously Unreleased Music A Look Inside The Vault

Jun 05, 2025

Grace Potter Shares Previously Unreleased Music A Look Inside The Vault

Jun 05, 2025

Latest Posts

-

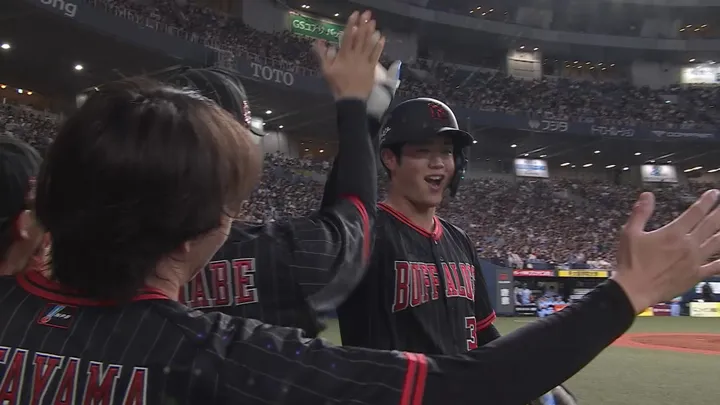

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025 -

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025 -

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025 -

Northwest Ranks Poorly In Latest Livability Study

Aug 17, 2025

Northwest Ranks Poorly In Latest Livability Study

Aug 17, 2025