New Rules For Buy Now, Pay Later Services: Increased Consumer Safeguards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Rules for Buy Now, Pay Later Services: Increased Consumer Safeguards

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth has also raised concerns about consumer debt and financial vulnerability. Responding to these concerns, regulators across the globe are implementing stricter rules designed to increase consumer safeguards and promote responsible lending practices within the BNPL industry. This article explores the key changes and their impact on both consumers and the BNPL sector.

The Rise of BNPL and the Need for Regulation

BNPL services, offered by companies like Klarna, Afterpay (now owned by Square), and Affirm, allow customers to spread the cost of purchases over several interest-free installments. While convenient, this seemingly simple payment option has contributed to a rise in consumer debt for some. The lack of stringent regulation initially allowed for rapid expansion, but also created vulnerabilities. Consumers, unaware of the potential pitfalls, could easily accumulate debt without fully understanding the implications. This led to calls for stricter oversight from consumer protection agencies and financial regulators.

Key Changes in the New Regulations:

The new regulations vary slightly depending on the jurisdiction, but several common themes emerge:

-

Improved Credit Checks: Many jurisdictions are implementing stricter credit checks before approving BNPL loans. This helps ensure that consumers are only offered credit they can realistically afford. This move aims to prevent over-indebtedness and protect vulnerable individuals.

-

Increased Transparency: Regulations are mandating greater transparency regarding fees, interest rates (if applicable), and repayment schedules. Consumers will have clearer understanding of the total cost of their purchases, reducing the risk of unexpected charges.

-

Debt Collection Practices: New rules are being implemented to govern debt collection practices by BNPL providers. This includes limitations on aggressive collection tactics and a greater emphasis on fair treatment of consumers who fall behind on payments.

-

Affordability Assessments: Several regulatory bodies are pushing for more robust affordability assessments before approving BNPL applications. This involves a more thorough evaluation of a consumer's income and existing debts to determine their ability to repay the loan.

-

Stronger Consumer Protections: Many regulations explicitly strengthen consumer rights, including the right to dispute charges and access clear and concise information about their BNPL agreements.

Impact on Consumers and the BNPL Industry:

These new regulations will have a significant impact on both consumers and the BNPL industry. Consumers can expect more protection against irresponsible lending practices and greater transparency regarding the cost of their purchases. However, they may also face a more stringent application process.

For the BNPL industry, the changes mean increased compliance costs and potentially reduced profitability. Companies will need to invest in robust systems to meet the new regulatory requirements. This could lead to a consolidation of the market, with only the larger, well-capitalized companies able to navigate the stricter regulatory landscape.

Looking Ahead:

The implementation of these new rules marks a significant step towards responsible lending within the BNPL sector. While the changes may initially present challenges for both consumers and businesses, the long-term benefits of increased consumer protection and financial stability are undeniable. It remains to be seen how the industry will adapt to these changes, but the focus on responsible lending is a positive development for the future of consumer finance. Consumers should always carefully review the terms and conditions before using any BNPL service and ensure they understand the repayment terms and potential implications on their credit score. For further information on specific regulations in your region, consult your local consumer protection agency or financial regulator.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Rules For Buy Now, Pay Later Services: Increased Consumer Safeguards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ubisoft Milans Big Budget Rayman Game Hiring Now

May 21, 2025

Ubisoft Milans Big Budget Rayman Game Hiring Now

May 21, 2025 -

Watch Now A Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025

Watch Now A Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025 -

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025 -

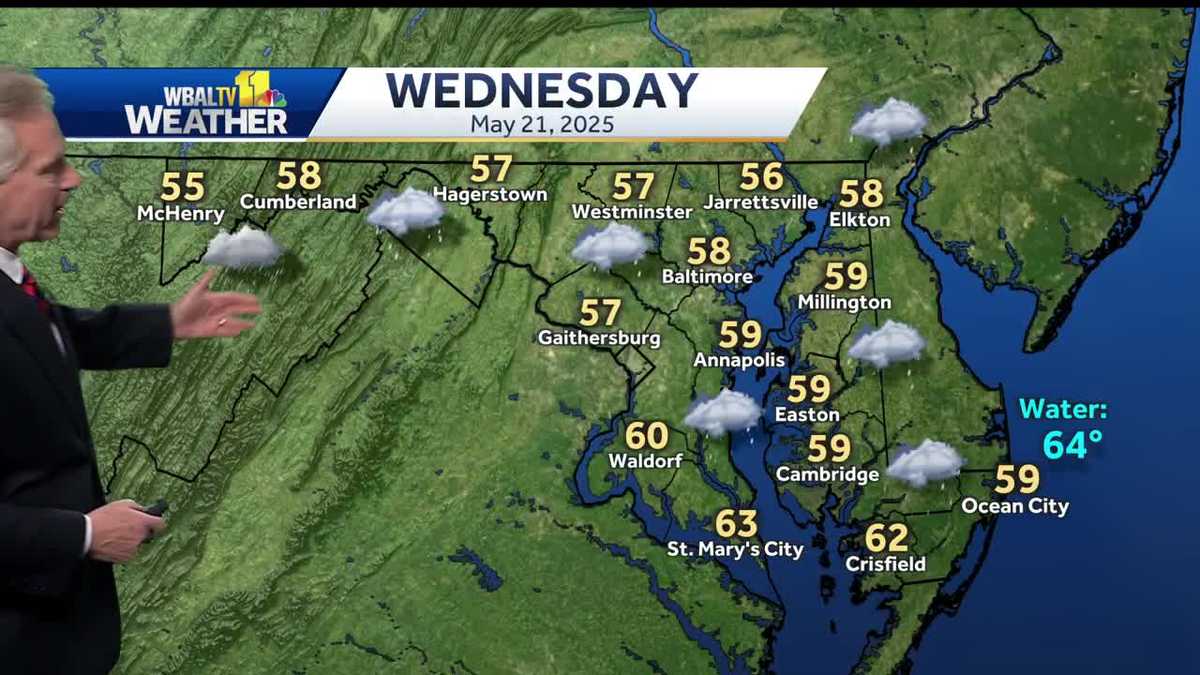

Chilly Rain To Impact Region Throughout Wednesday

May 21, 2025

Chilly Rain To Impact Region Throughout Wednesday

May 21, 2025 -

Jeremy Bowen On Gaza Will International Demands End The Offensive

May 21, 2025

Jeremy Bowen On Gaza Will International Demands End The Offensive

May 21, 2025

Latest Posts

-

Urgent Care Needed Thousands Of Chicks Abandoned Delaware Shelter Desperately Seeking Assistance

May 21, 2025

Urgent Care Needed Thousands Of Chicks Abandoned Delaware Shelter Desperately Seeking Assistance

May 21, 2025 -

Costa Rican Prison Drug Smuggling Cat Caught In The Act

May 21, 2025

Costa Rican Prison Drug Smuggling Cat Caught In The Act

May 21, 2025 -

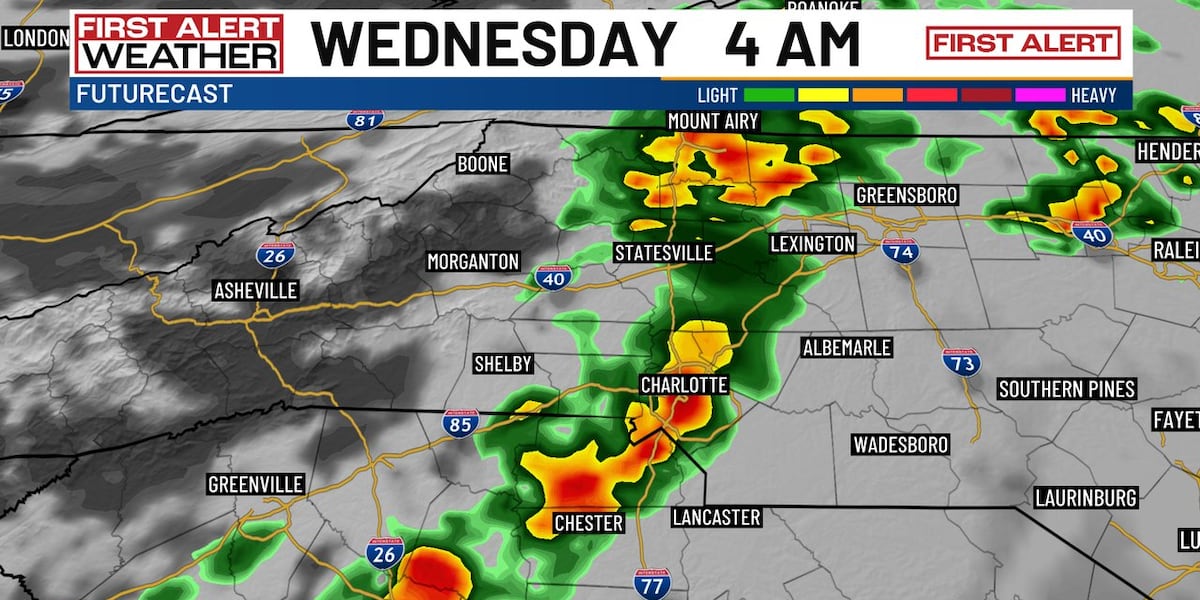

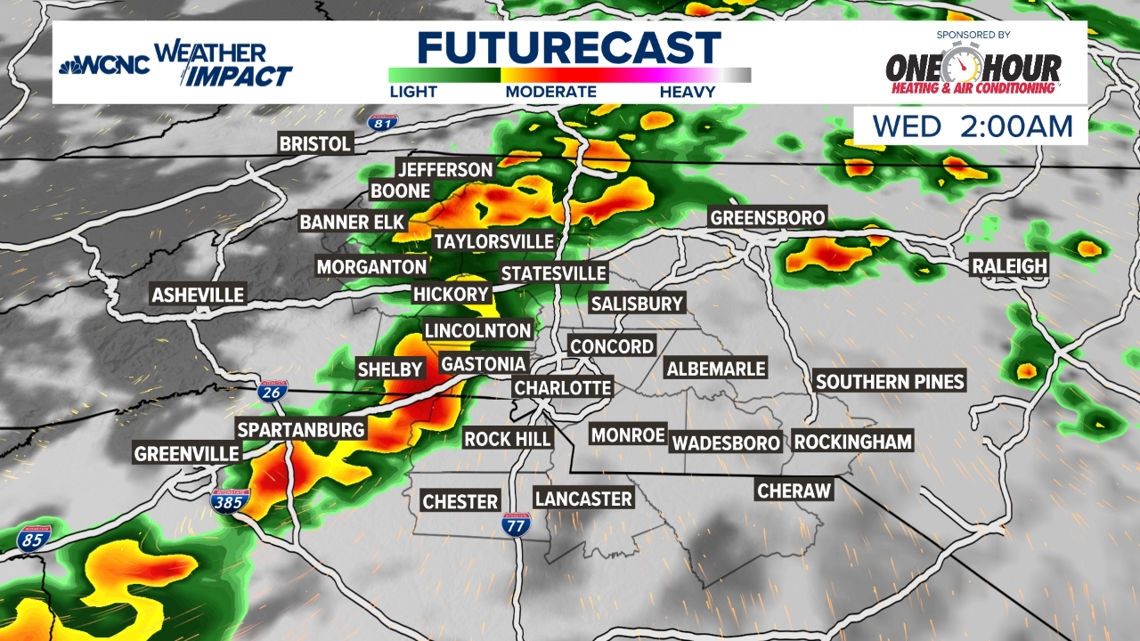

Charlotte Brace For Overnight Storms Cooldown Coming

May 21, 2025

Charlotte Brace For Overnight Storms Cooldown Coming

May 21, 2025 -

Strong Storm Potential Tuesday Night Very Isolated Areas Affected

May 21, 2025

Strong Storm Potential Tuesday Night Very Isolated Areas Affected

May 21, 2025 -

Church Defilement Santa Rosa Teens Charged With Public Indecency

May 21, 2025

Church Defilement Santa Rosa Teens Charged With Public Indecency

May 21, 2025