No Rate Hike: Australia's Central Bank Holds Policy Rate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Rate Hike: Australia's Central Bank Holds Policy Rate Steady Amidst Economic Uncertainty

Australia's Reserve Bank of Australia (RBA) has surprised markets by holding the official cash rate steady at 4.1% for the second consecutive month. This unexpected decision marks a pause in the aggressive rate hiking cycle that has characterized the bank's monetary policy over the past year, offering a glimmer of relief to mortgage holders and businesses grappling with rising borrowing costs. The decision, announced this morning, comes amidst growing concerns about the resilience of the Australian economy and the potential for a sharper-than-expected slowdown.

RBA's Justification: A Balancing Act

The RBA's statement accompanying the decision highlights a delicate balancing act. While acknowledging persistent inflation pressures, the bank cited increasing evidence of a weakening economy. Key factors influencing the RBA's decision include:

- Slowing Growth: Recent economic data points to a slowdown in consumer spending and business investment. Retail sales figures have been underwhelming, and the housing market continues to cool.

- Inflation Concerns Remain: Although inflation is gradually easing, it remains stubbornly above the RBA's target range of 2-3%. The bank acknowledged the need for continued vigilance on this front.

- Global Economic Uncertainty: The global economic outlook remains uncertain, with risks stemming from geopolitical tensions and persistent supply chain disruptions. The RBA is clearly factoring in these external headwinds.

Market Reaction and Analyst Opinions

The decision has sparked a mixed reaction in the markets. While some analysts applaud the RBA's cautious approach, others express concerns that the pause might not be sufficient to tame inflation effectively. The Australian dollar initially dipped following the announcement, but has since recovered slightly.

Many economists are now divided on the RBA's future course of action. Some predict further rate hikes in the coming months, citing lingering inflation concerns, while others believe the current pause signifies a shift towards a more accommodative monetary policy stance. This uncertainty underscores the challenging environment facing the RBA as it navigates the delicate balance between controlling inflation and supporting economic growth.

What This Means for Australians:

For homeowners with variable-rate mortgages, the pause provides temporary respite from further interest rate increases. However, existing high rates continue to place a strain on household budgets. Businesses will also welcome the pause, providing some breathing room for investment and expansion plans. However, the ongoing uncertainty regarding future rate movements means that businesses need to remain cautious in their financial planning.

Looking Ahead: The Path to Stability

The RBA's decision underscores the complexity of managing the Australian economy in the current environment. The coming months will be crucial in determining whether this pause is a temporary reprieve or the start of a significant shift in monetary policy. The RBA will be closely monitoring economic indicators – particularly inflation data and employment figures – to inform future decisions. The path to sustained economic stability remains uncertain, requiring careful navigation by the central bank. Further updates and analysis from leading economists will undoubtedly shape market expectations and guide consumer and business decisions in the weeks and months to come. Stay tuned for further developments.

Keywords: RBA, Reserve Bank of Australia, interest rates, cash rate, monetary policy, inflation, Australian economy, economic growth, mortgage rates, housing market, Australian dollar, economic outlook, global economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Rate Hike: Australia's Central Bank Holds Policy Rate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Texas House Floats Down River After Flash Flood Cnn Video Shows Dramatic Rescue

Jul 09, 2025

Texas House Floats Down River After Flash Flood Cnn Video Shows Dramatic Rescue

Jul 09, 2025 -

Political Crisis Deepens Pm Battles Backbench Revolt Over Healthcare Access

Jul 09, 2025

Political Crisis Deepens Pm Battles Backbench Revolt Over Healthcare Access

Jul 09, 2025 -

Lottery Ticket Fraud Neillsville Womans Court Appearance And Plea

Jul 09, 2025

Lottery Ticket Fraud Neillsville Womans Court Appearance And Plea

Jul 09, 2025 -

Holiday Travel Chaos 5 000 Us Flights Disrupted Leaving Passengers Stranded

Jul 09, 2025

Holiday Travel Chaos 5 000 Us Flights Disrupted Leaving Passengers Stranded

Jul 09, 2025 -

Watch Live 28 Starlink Satellites Launch Aboard Space X Falcon 9 Rocket

Jul 09, 2025

Watch Live 28 Starlink Satellites Launch Aboard Space X Falcon 9 Rocket

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

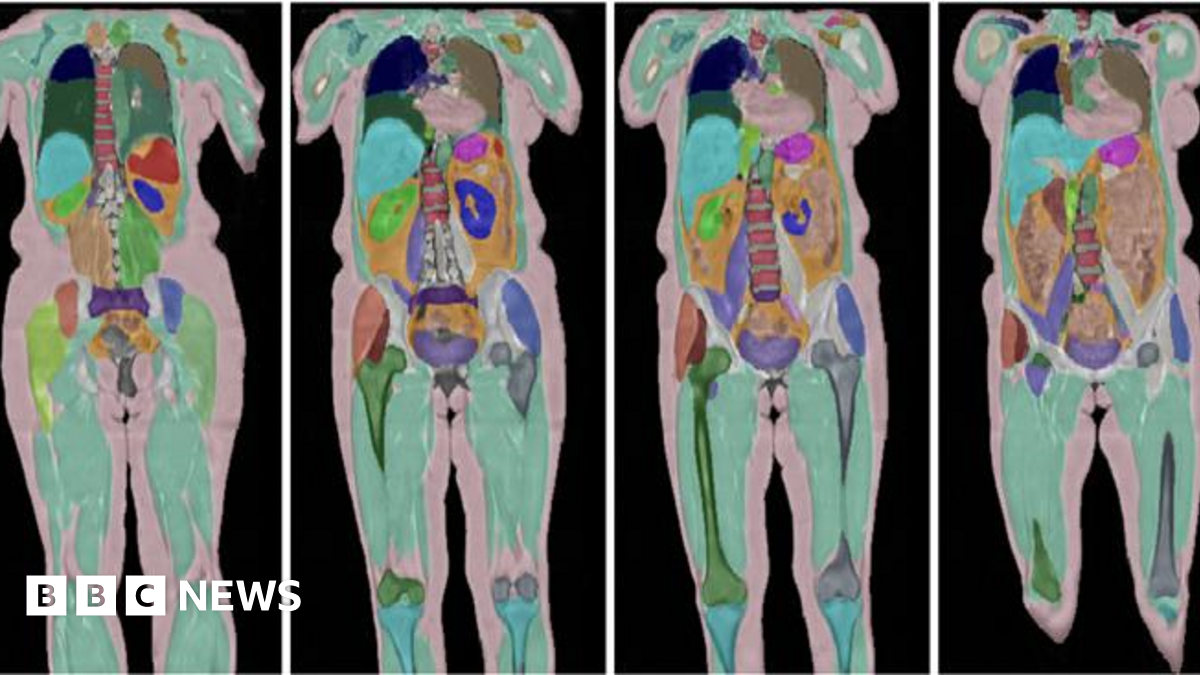

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025