No Tax On Overtime? No Tax On Tips? Separating Fact From Fiction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Tax on Overtime? No Tax on Tips? Separating Fact from Fiction

Are you confused about how overtime and tips are taxed? Many people believe there are loopholes, whispers of untaxed income circulating in workplaces. The truth, however, is more nuanced than the rumors suggest. Let's separate fact from fiction regarding the taxation of overtime pay and tips.

The Myth of Untaxed Overtime

The persistent myth that overtime pay isn't subject to taxes is completely false. Overtime wages, like regular wages, are considered taxable income under federal and most state income tax laws. The extra pay you receive for working beyond your regular hours is added to your regular earnings and taxed accordingly. Your employer is legally obligated to withhold taxes from your overtime pay, just as they do with your regular salary.

Understanding Overtime Tax Withholding

The amount of tax withheld from your overtime pay depends on several factors, including your:

- Tax bracket: Higher earners will see a larger percentage withheld.

- Filing status: Single, married filing jointly, etc., all impact your tax liability.

- W-4 form: The information you provide on your W-4 form determines the amount your employer withholds. If you're unsure about your W-4, consulting a tax professional or using the IRS's online withholding calculator is recommended.

Failing to Withhold Taxes: What Happens?

While your employer is responsible for withholding taxes, mistakes can happen. If your employer fails to withhold taxes correctly, you may still owe taxes when you file your annual return. It is crucial to review your pay stubs regularly to ensure the correct amount is being withheld. If you discover discrepancies, contact your employer and the IRS to address the issue.

The Reality of Tip Taxation

Tips, like overtime pay, are also considered taxable income. Many restaurants and service industry workers are familiar with the complexities of tip reporting. While your employer may not directly withhold taxes from your tips, you are still responsible for reporting them on your tax return. Failure to do so can lead to significant penalties and interest.

Reporting Tips Accurately:

There are several ways to report tips, depending on your employment situation:

- Employer-reported tips: Some employers track tips and report them directly to the IRS, which simplifies the process for the employee.

- Self-reported tips: If your employer doesn't track tips, you must report them yourself using Form W-2. Keep accurate records of your tips throughout the year.

- Allocated tips: In some cases, the IRS may allocate tips to employees based on industry averages.

Consequences of Not Reporting Tips

The IRS takes tip reporting seriously. Underreporting tips can lead to significant financial penalties, including back taxes, interest, and even potential legal action. Accurate record-keeping is essential for avoiding these issues.

Seeking Professional Advice

Navigating the complexities of tax laws, especially concerning overtime and tips, can be challenging. If you're unsure about your tax obligations, consulting with a qualified tax professional is always recommended. They can provide personalized guidance based on your specific circumstances. The IRS also offers numerous resources, including publications and online tools, to assist taxpayers.

In Conclusion:

The notion of untaxed overtime or tips is a misconception. Both are taxable income, and accurate reporting is crucial to avoid financial penalties. Stay informed, maintain thorough records, and don't hesitate to seek professional assistance when needed. Your financial future depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Tax On Overtime? No Tax On Tips? Separating Fact From Fiction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

46 Jump In Dubai Real Estate Sales Q2 2025 Market Value Tops 41 3 Billion

Jul 22, 2025

46 Jump In Dubai Real Estate Sales Q2 2025 Market Value Tops 41 3 Billion

Jul 22, 2025 -

Rory Mc Ilroys Double Ball Shot A Viral Golfing Moment

Jul 22, 2025

Rory Mc Ilroys Double Ball Shot A Viral Golfing Moment

Jul 22, 2025 -

Wizz Air A321 Forced Emergency Landing Details Emerge From Amsterdam Incident

Jul 22, 2025

Wizz Air A321 Forced Emergency Landing Details Emerge From Amsterdam Incident

Jul 22, 2025 -

California Mother And Son Rescued Handwritten Notes Guide Rescuers In Remote Forest

Jul 22, 2025

California Mother And Son Rescued Handwritten Notes Guide Rescuers In Remote Forest

Jul 22, 2025 -

The Impact Of Shrinking Populations On Global Development

Jul 22, 2025

The Impact Of Shrinking Populations On Global Development

Jul 22, 2025

Latest Posts

-

Mlb Game 102 Lineup Guardians Orioles July 24th 2025

Jul 25, 2025

Mlb Game 102 Lineup Guardians Orioles July 24th 2025

Jul 25, 2025 -

Archaeological Discovery A Secret Tunnel System Beneath Rome

Jul 25, 2025

Archaeological Discovery A Secret Tunnel System Beneath Rome

Jul 25, 2025 -

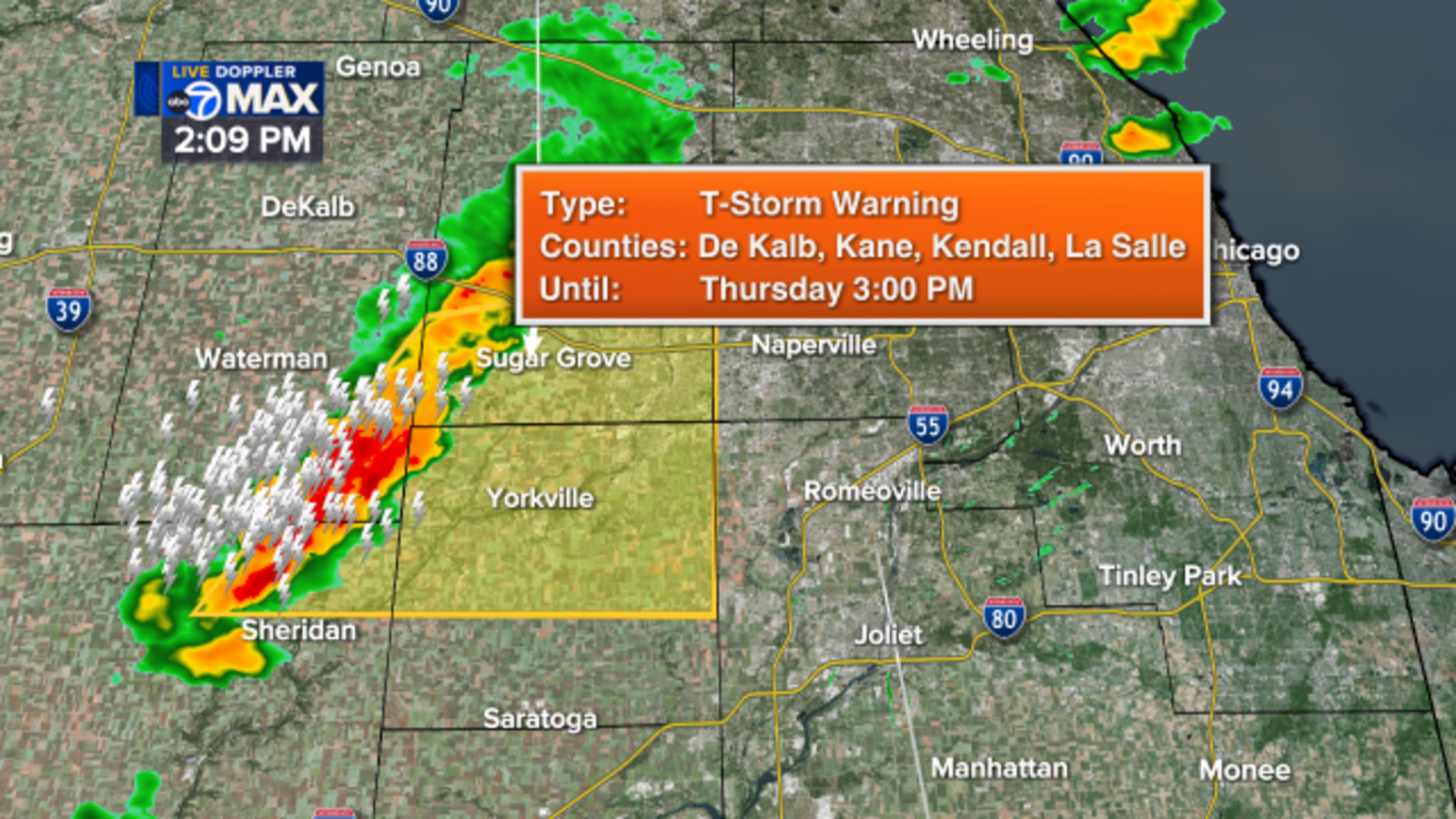

Chicago Heat Advisory 100 Heat Index Expected Thursday

Jul 25, 2025

Chicago Heat Advisory 100 Heat Index Expected Thursday

Jul 25, 2025 -

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Jul 25, 2025 -

American Dream Fulfilled Normandy Adventure For Two

Jul 25, 2025

American Dream Fulfilled Normandy Adventure For Two

Jul 25, 2025