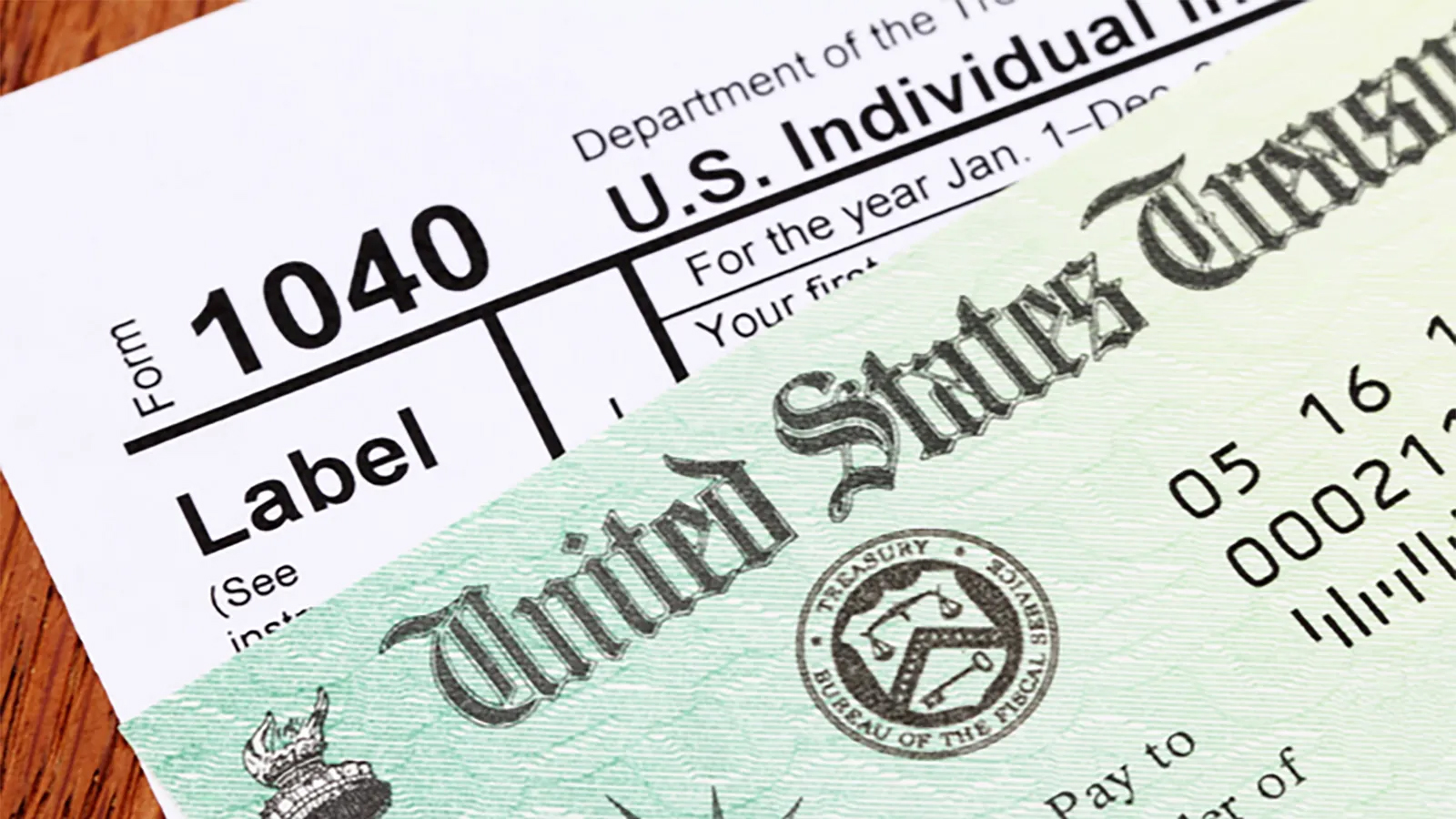

No Tax On Overtime Or Tips? Separating Fact From Fiction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Tax on Overtime or Tips? Separating Fact from Fiction

Are you an hourly worker who's ever wondered, "Is my overtime pay or tips really tax-free?" The short answer is: no. While the idea of untaxed overtime or tips sounds appealing, it's a misconception that can lead to significant tax problems down the line. This article separates fact from fiction, clarifying the tax implications of overtime pay and tips for employees in the United States.

The Myth of Tax-Free Overtime and Tips

The rumor mill often spins tales of tax-free income, especially concerning overtime and tips. This misconception likely stems from a desire for more disposable income and a lack of clear understanding regarding tax laws. However, both overtime pay and tips are considered taxable income by the IRS. This means they're subject to federal, state, and potentially local income taxes, as well as Social Security and Medicare taxes (FICA).

Understanding the Taxation of Overtime Pay

Overtime pay, typically earned for working beyond your regular hours (often exceeding 40 hours per week), is simply additional compensation for your services. The IRS treats this extra pay no differently than your regular wages. It's added to your gross income and taxed accordingly. Your employer is legally obligated to withhold these taxes from your paycheck, just as they do with your regular earnings. Failing to report overtime income can lead to significant penalties and back taxes.

Tips: Taxable Income, Despite the Name

Tips, whether received in cash or through credit card charges, are also considered taxable income. Many people mistakenly believe that because tips are given directly by customers, they somehow bypass the tax system. This is incorrect. While your employer might not directly track every tip you receive (depending on your workplace), you are still responsible for reporting all tips accurately on your tax return. Failure to do so can result in substantial tax liabilities and potential legal ramifications.

How to Properly Report Overtime and Tips

-

Overtime: Your employer will automatically withhold taxes from your overtime pay. Review your pay stubs regularly to ensure the amounts are accurate and consistent with your earnings.

-

Tips: This is where accurate record-keeping is crucial. Keep a detailed log of all tips received, including the date, amount, and payment method (cash, credit card, etc.). Some employers provide tip reporting forms, which should be meticulously completed. If you don't receive such forms, it's vital to maintain your own accurate records. You'll report these tips on your tax return, either using Form W-2 (if reported by your employer) or Form 1040, Schedule C (if self-employed or if your employer doesn't report your tips).

Penalties for Non-Compliance

Failing to accurately report overtime pay and tips is a serious offense. The IRS takes tax evasion very seriously, and penalties can be severe, including:

- Back taxes: You'll owe taxes on unreported income, plus interest.

- Penalties: The IRS can impose substantial penalties, often a percentage of the unpaid taxes.

- Interest: Interest accrues on unpaid taxes, further increasing your debt.

Seeking Professional Guidance

If you're unsure about how to properly report your overtime pay and tips, seeking professional advice from a tax accountant or financial advisor is recommended. They can help you understand your obligations and ensure you comply with all relevant tax laws.

Conclusion: The myth of tax-free overtime and tips is just that – a myth. Accurate reporting is essential to avoid significant financial consequences. Maintain meticulous records, understand your tax obligations, and consult a professional if you need assistance. Don't let misinformation cost you financially. Take control of your finances and ensure you're paying the correct amount of taxes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Tax On Overtime Or Tips? Separating Fact From Fiction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Discover Town Name Montana A Foodie And Outdoor Adventurers Paradise

Jul 21, 2025

Discover Town Name Montana A Foodie And Outdoor Adventurers Paradise

Jul 21, 2025 -

Destiny 2 Raid Race Addressing The Growing List Of Disabled Items

Jul 21, 2025

Destiny 2 Raid Race Addressing The Growing List Of Disabled Items

Jul 21, 2025 -

Company Under Fire Internal Investigation Into Leaked Coldplay Video

Jul 21, 2025

Company Under Fire Internal Investigation Into Leaked Coldplay Video

Jul 21, 2025 -

White House Anxiety Mounts Over Netanyahus Mideast Plans

Jul 21, 2025

White House Anxiety Mounts Over Netanyahus Mideast Plans

Jul 21, 2025 -

My Chemical Romance Concert Review High Octane Performance In Seattle

Jul 21, 2025

My Chemical Romance Concert Review High Octane Performance In Seattle

Jul 21, 2025

Latest Posts

-

Trump Administration Targets Transgender People A Comprehensive Analysis Of Policy Changes

Jul 23, 2025

Trump Administration Targets Transgender People A Comprehensive Analysis Of Policy Changes

Jul 23, 2025 -

Yellowstone Supervolcano Understanding The Risks And The Reality

Jul 23, 2025

Yellowstone Supervolcano Understanding The Risks And The Reality

Jul 23, 2025 -

Yellowstones Supervolcano Rumors Fears And The Scientific Perspective

Jul 23, 2025

Yellowstones Supervolcano Rumors Fears And The Scientific Perspective

Jul 23, 2025 -

Dahlonega Man Wins 3 Million In Georgia Lottery

Jul 23, 2025

Dahlonega Man Wins 3 Million In Georgia Lottery

Jul 23, 2025 -

Ellen De Generes Uk Relocation A Donald Trump Driven Decision

Jul 23, 2025

Ellen De Generes Uk Relocation A Donald Trump Driven Decision

Jul 23, 2025