Northwestern Energy Group (NWE) Stock: Hold Rating From LADENBURG THALM/SH SH Impacts Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Northwestern Energy Group (NWE) Stock: Hold Rating from Ladenburg Thalmann Impacts Investors

Northwestern Energy Group (NWE) saw its stock price react to a recent rating change from Ladenburg Thalmann, a prominent financial services firm. The firm issued a "Hold" rating for NWE, prompting questions and analysis among investors about the future trajectory of the utility company's stock. This article delves into the details of the rating change, its potential implications, and what investors should consider moving forward.

Ladenburg Thalmann's Rationale for the "Hold" Rating:

Ladenburg Thalmann's decision to maintain a "Hold" rating on Northwestern Energy Group stock wasn't a sudden move. Their analysis likely considered several factors impacting NWE's performance and outlook. While the specific reasoning behind the rating hasn't been publicly detailed in exhaustive fashion, potential influencing factors could include:

- Regulatory environment: The utility sector is heavily regulated, and changes in state or federal regulations can significantly impact profitability. Any perceived uncertainty or upcoming regulatory hurdles could contribute to a "Hold" rating.

- Competition: The energy market is increasingly competitive, with renewable energy sources posing challenges to traditional utilities. Ladenburg Thalmann's assessment may reflect concerns about NWE's ability to compete effectively in this evolving landscape.

- Financial performance: Analysts likely scrutinized NWE's recent financial reports, including earnings, revenue growth, and debt levels. A less-than-stellar performance in any of these areas could justify a cautious "Hold" recommendation.

- Growth prospects: Future growth potential is a key factor in stock ratings. A "Hold" rating might suggest limited near-term growth opportunities for NWE compared to other investment options.

Investor Reactions and Market Impact:

The announcement of the "Hold" rating likely caused some volatility in NWE's stock price. While a "Hold" isn't inherently negative, it often signals a lack of strong bullish sentiment. Investors may interpret this as a signal to either maintain their existing positions or consider alternative investments offering potentially higher returns. It's crucial for investors to conduct their own thorough due diligence before making any investment decisions based on a single analyst rating.

What Should Investors Do?

The Ladenburg Thalmann rating serves as one data point in a larger picture. Investors shouldn't solely base their decisions on this single assessment. Instead, they should consider:

- Diversification: A well-diversified portfolio helps mitigate risk. Over-reliance on any single stock, including NWE, is generally discouraged.

- Long-term strategy: Investors with a long-term horizon might view a "Hold" rating as less impactful than short-term traders. The long-term prospects of Northwestern Energy, considering its position in the energy sector, remain relevant.

- Independent analysis: Conduct thorough research, reviewing financial statements, industry reports, and other analyst opinions before making any buying, selling, or holding decisions regarding NWE stock. Consider consulting a qualified financial advisor.

Conclusion:

The "Hold" rating from Ladenburg Thalmann on Northwestern Energy Group (NWE) stock should be viewed within the context of a wider investment strategy. While the rating may influence some investors, it's vital to conduct thorough research and consider multiple perspectives before making any decisions related to your investment portfolio. Remember, investing always involves risk, and past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Northwestern Energy Group (NWE) Stock: Hold Rating From LADENBURG THALM/SH SH Impacts Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Singer Van Hunt Exploring Halle Berrys Current Partner

Jun 04, 2025

Singer Van Hunt Exploring Halle Berrys Current Partner

Jun 04, 2025 -

Industry Headwinds Force Powin To Confront Significant Financial Challenges

Jun 04, 2025

Industry Headwinds Force Powin To Confront Significant Financial Challenges

Jun 04, 2025 -

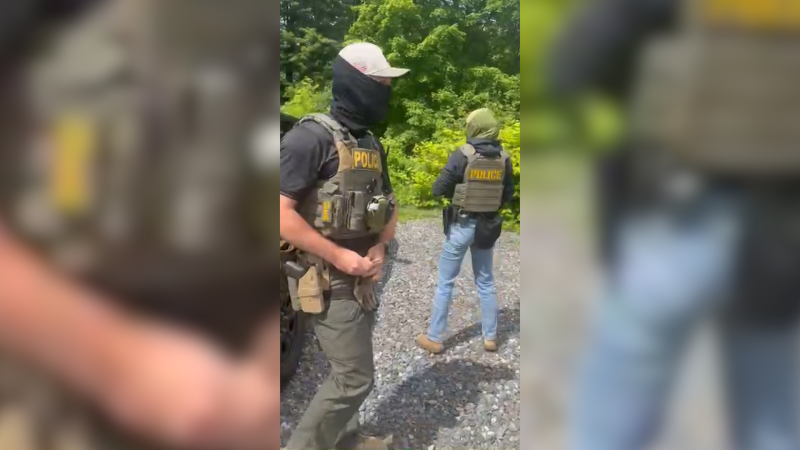

Gardeners Detention Sparks Outrage Business Owners Confront Masked Agents

Jun 04, 2025

Gardeners Detention Sparks Outrage Business Owners Confront Masked Agents

Jun 04, 2025 -

Bikes To The Bails West Indies Cricketers Cycle To Match Amidst Traffic Chaos

Jun 04, 2025

Bikes To The Bails West Indies Cricketers Cycle To Match Amidst Traffic Chaos

Jun 04, 2025 -

Northwestern Energy Nasdaq Nwe Receives Hold Rating From Ladenburg Thalm Sh Sh

Jun 04, 2025

Northwestern Energy Nasdaq Nwe Receives Hold Rating From Ladenburg Thalm Sh Sh

Jun 04, 2025

Latest Posts

-

Wwii Bomb Defusal In Cologne Leads To Large Scale Evacuation

Jun 06, 2025

Wwii Bomb Defusal In Cologne Leads To Large Scale Evacuation

Jun 06, 2025 -

First Look Meghan Markle Unveils Charming Birthday Photos Of Lilibet

Jun 06, 2025

First Look Meghan Markle Unveils Charming Birthday Photos Of Lilibet

Jun 06, 2025 -

Police Probe Following Multiple Deaths After Heart Operations At Nhs Hospital

Jun 06, 2025

Police Probe Following Multiple Deaths After Heart Operations At Nhs Hospital

Jun 06, 2025 -

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025 -

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025