Northwestern Energy (NASDAQ: NWE) - Hold Rating Assigned By Ladenburg Thalmann

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Northwestern Energy (NWE) Receives Hold Rating from Ladenburg Thalmann: What Investors Need to Know

Northwestern Energy (NASDAQ: NWE), a prominent player in the utility sector, recently received a "Hold" rating from Ladenburg Thalmann, prompting investors to re-evaluate their positions. This announcement follows a period of moderate growth and market volatility within the energy industry, making it crucial for investors to understand the implications of this rating and the current outlook for NWE.

Ladenburg Thalmann's Rationale:

While Ladenburg Thalmann hasn't publicly detailed the specific reasoning behind their "Hold" rating for Northwestern Energy, it's likely influenced by several factors prevalent in the current market landscape. These could include:

- Regulatory Uncertainty: The utility sector is heavily regulated, and changes in regulations can significantly impact a company's profitability and investment appeal. Any uncertainty surrounding future regulations could contribute to a more cautious outlook.

- Interest Rate Sensitivity: Utilities often rely on debt financing. Rising interest rates increase borrowing costs, potentially impacting profitability and making investment less attractive. This is a significant factor influencing many analysts' assessments of utility stocks currently.

- Competition and Technological Disruption: The energy landscape is evolving rapidly with the rise of renewable energy sources and increasing competition. Northwestern Energy's ability to adapt and compete in this changing environment will be crucial for future growth.

- Overall Market Conditions: The broader economic climate and investor sentiment play a significant role in stock valuations. A bearish market outlook could lead to a "Hold" recommendation even for fundamentally sound companies.

Northwestern Energy's Recent Performance:

To fully understand the implications of the Ladenburg Thalmann rating, it's essential to examine Northwestern Energy's recent financial performance and operational updates. Investors should review the company's latest earnings reports and SEC filings (available on the ) for a comprehensive picture. Key metrics to consider include:

- Earnings per Share (EPS): Analyzing trends in EPS provides insights into the company's profitability and growth potential.

- Revenue Growth: Consistent revenue growth is indicative of a healthy and expanding business.

- Debt Levels: High levels of debt can be a cause for concern, especially in a rising interest rate environment.

- Capital Expenditures (CAPEX): Investment in infrastructure and upgrades is essential for a utility company, but excessive CAPEX can strain finances.

What this means for Investors:

A "Hold" rating doesn't necessarily signal a negative outlook. It often suggests that analysts believe the stock is fairly valued at its current price and that there's limited upside potential in the short term. However, it's crucial for investors to conduct their own thorough due diligence before making any investment decisions. Consider consulting with a financial advisor to assess your risk tolerance and investment goals.

Looking Ahead:

Northwestern Energy's future performance will depend on several factors, including its ability to navigate regulatory hurdles, manage its debt effectively, and adapt to the evolving energy landscape. Investors should monitor the company's progress in these areas closely. Further updates from the company and additional analyst reports will provide further clarity on the outlook for NWE.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Northwestern Energy (NASDAQ: NWE) - Hold Rating Assigned By Ladenburg Thalmann. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karen Read Trial Update Day 24 Brings Unexpected Twist In Data Analysis

Jun 03, 2025

Karen Read Trial Update Day 24 Brings Unexpected Twist In Data Analysis

Jun 03, 2025 -

The Disposable Vape Ban A Turning Point In Teen Smoking

Jun 03, 2025

The Disposable Vape Ban A Turning Point In Teen Smoking

Jun 03, 2025 -

Cnn Investigation Launched After Gardeners Arrest By Unidentified Agents

Jun 03, 2025

Cnn Investigation Launched After Gardeners Arrest By Unidentified Agents

Jun 03, 2025 -

French Open Eight Us Players Progress To Next Stage

Jun 03, 2025

French Open Eight Us Players Progress To Next Stage

Jun 03, 2025 -

Deconstructing The News Examining The Implications Of Jets To Carry Nuclear Bombs

Jun 03, 2025

Deconstructing The News Examining The Implications Of Jets To Carry Nuclear Bombs

Jun 03, 2025

Latest Posts

-

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025 -

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025 -

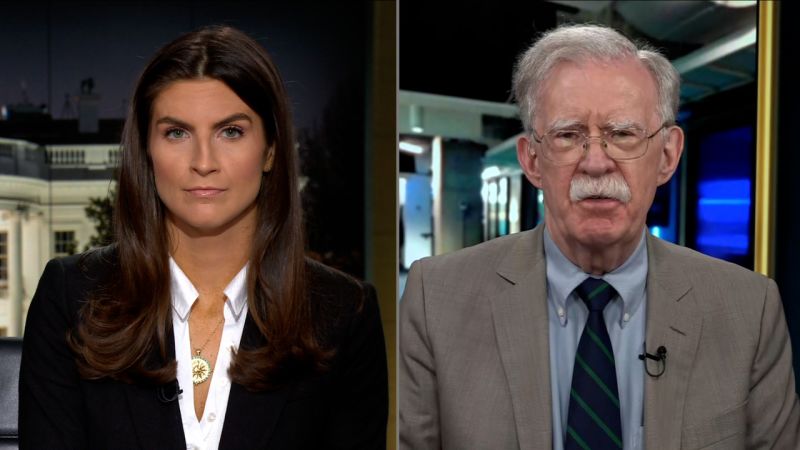

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025 -

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025 -

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025