Northwestern Energy (NASDAQ: NWE) Receives Hold Rating From Ladenburg Thalmann

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Northwestern Energy (NWE) Receives Hold Rating from Ladenburg Thalmann: What Does it Mean for Investors?

Northwestern Energy (NASDAQ: NWE), a prominent player in the utility sector, recently received a "Hold" rating from Ladenburg Thalmann, a respected financial services firm. This announcement has sent ripples through the investment community, prompting questions about the future trajectory of NWE stock. This article delves into the details of the rating, its implications for investors, and provides a comprehensive overview of Northwestern Energy's current market position.

Ladenburg Thalmann's Rationale:

While Ladenburg Thalmann didn't publicly disclose the specific reasoning behind their "Hold" rating, several factors likely contributed to their assessment. These could include:

- Current Market Conditions: The overall energy sector is experiencing significant volatility influenced by factors such as fluctuating fuel prices, regulatory changes, and the ongoing transition to renewable energy sources. These uncertainties can impact the performance of utility companies like Northwestern Energy.

- Growth Prospects: Analysts may be assessing NWE's projected growth rate compared to other companies within the sector. While Northwestern Energy has a stable and reliable revenue stream, its growth potential might be considered moderate compared to some of its competitors.

- Valuation: Ladenburg Thalmann's assessment likely incorporates an analysis of NWE's current market capitalization and its perceived intrinsic value. A "Hold" rating often suggests the stock is fairly valued at its current price, offering limited upside potential in the short term.

What Does a "Hold" Rating Mean for Investors?

A "Hold" rating is generally considered a neutral stance. It neither recommends buying nor selling the stock. For current NWE shareholders, a "Hold" rating suggests maintaining their existing position. For potential investors, it suggests a wait-and-see approach, monitoring the company's performance and developments before considering an investment.

Northwestern Energy: A Company Overview

Northwestern Energy provides electricity and natural gas services across Montana and parts of Idaho and South Dakota. The company boasts a substantial customer base and a well-established infrastructure. However, like other utility companies, it faces challenges relating to:

- Infrastructure Modernization: Maintaining and upgrading aging infrastructure is a significant capital expense for NWE, potentially affecting profitability in the short term.

- Regulatory Scrutiny: Utility companies operate under strict regulatory frameworks, and any changes in regulations could impact NWE's operations and financial performance.

- Renewable Energy Transition: The increasing adoption of renewable energy sources presents both opportunities and challenges. NWE needs to adapt its strategy to accommodate this shift while maintaining a reliable and affordable energy supply for its customers.

Looking Ahead: Opportunities and Challenges for NWE

Despite the "Hold" rating, Northwestern Energy holds several strengths, including a geographically diverse customer base and a history of reliable service. However, investors should closely monitor the following:

- Regulatory developments: Keep an eye on any changes in energy policies at the state and federal levels.

- Investment in renewable energy: NWE's progress in integrating renewable energy sources into its portfolio will be crucial for long-term growth.

- Financial performance: Regularly review NWE's financial reports to assess its performance against industry benchmarks.

Conclusion:

Ladenburg Thalmann's "Hold" rating on Northwestern Energy (NWE) should be considered within the broader context of the energy sector and NWE's specific business dynamics. While not necessarily negative, it suggests a period of cautious observation for investors. Thorough due diligence and a careful assessment of NWE's future prospects are crucial before making any investment decisions. Always consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Northwestern Energy (NASDAQ: NWE) Receives Hold Rating From Ladenburg Thalmann. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Significant Advances In Colorectal Cancer Research On Treatment And Prevention

Jun 03, 2025

Significant Advances In Colorectal Cancer Research On Treatment And Prevention

Jun 03, 2025 -

Tom Daleys Movie Idea Tom Holland As The Lead

Jun 03, 2025

Tom Daleys Movie Idea Tom Holland As The Lead

Jun 03, 2025 -

The Disposable Vape Ban A Look At Its Effectiveness

Jun 03, 2025

The Disposable Vape Ban A Look At Its Effectiveness

Jun 03, 2025 -

Spain Bar Shooting Two Scottish Nationals Killed

Jun 03, 2025

Spain Bar Shooting Two Scottish Nationals Killed

Jun 03, 2025 -

New York Mets Recall Ronny Mauricio Roster Move And Potential Lineup Changes

Jun 03, 2025

New York Mets Recall Ronny Mauricio Roster Move And Potential Lineup Changes

Jun 03, 2025

Latest Posts

-

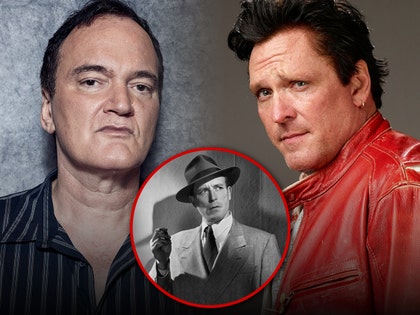

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025