Northwestern Energy (NWE): Analyst Downgrade Prompts Investor Caution

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Northwestern Energy (NWE): Analyst Downgrade Prompts Investor Caution

Northwestern Energy (NWE), a prominent player in the utility sector, is facing increased investor scrutiny following a recent analyst downgrade. The move has sent ripples through the market, prompting questions about the company's future performance and the overall health of the energy sector. Understanding the reasons behind the downgrade is crucial for investors considering NWE stock.

The Analyst Downgrade: What Happened?

[Insert Name of Analyst Firm] recently downgraded its rating on Northwestern Energy (NWE) stock, citing [Specific Reason 1, e.g., concerns about regulatory headwinds] and [Specific Reason 2, e.g., potential impact of evolving renewable energy policies]. The downgrade was accompanied by a [mention change in price target, e.g., lowered price target], further fueling investor apprehension. This action follows a period of [mention recent market trends affecting NWE, e.g., relatively flat performance] for NWE, raising concerns amongst analysts about its future growth trajectory.

Understanding the Concerns:

The analyst's concerns center around several key factors:

-

Regulatory Uncertainty: The utility sector is heavily regulated, and changes in regulatory landscapes can significantly impact profitability. The analyst's report highlighted potential challenges related to [mention specific regulatory issues, e.g., new environmental regulations or rate increase approvals]. Navigating these complexities successfully is critical for NWE's continued success.

-

Renewable Energy Transition: The shift towards renewable energy sources poses both opportunities and challenges for established utilities like NWE. The analyst expressed concern about NWE's [mention specific concerns, e.g., ability to adapt to the changing energy mix and integrate renewable energy sources into its infrastructure]. This transition requires significant investments and strategic planning.

-

Financial Performance: While NWE has historically shown [mention positive aspects, e.g., stable earnings], the analyst expressed concern about [mention specific financial concerns, e.g., potential impact of rising interest rates or increased capital expenditure requirements]. A thorough analysis of NWE's financial statements is essential for investors to assess the validity of these concerns.

Investor Response and Market Implications:

The downgrade has understandably caused some market volatility. NWE's stock price experienced a [mention percentage change] drop following the announcement. However, it's important to note that individual investor responses will vary. Some may choose to sell their holdings, while others may view this as a buying opportunity, anticipating a potential rebound.

What's Next for Northwestern Energy?

NWE's management will likely need to address these concerns directly. This could involve [mention potential company responses, e.g., a revised strategic plan, increased transparency about regulatory interactions, or a detailed communication regarding renewable energy investments]. Investors should closely monitor the company's announcements and investor relations materials for further clarity.

Should You Buy, Sell, or Hold?

This analyst downgrade provides a clear signal that investors should proceed with caution. Before making any investment decisions regarding NWE, thorough due diligence is essential. This includes:

- Reviewing NWE's recent financial reports and SEC filings.

- Analyzing the company's long-term strategic plan.

- Comparing NWE's performance to its competitors in the utility sector.

- Considering the broader macroeconomic factors that may impact the energy sector.

Ultimately, the decision to buy, sell, or hold NWE stock should be based on your own individual investment goals and risk tolerance. Consulting with a qualified financial advisor is always recommended before making significant investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Northwestern Energy (NWE): Analyst Downgrade Prompts Investor Caution. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mamdanis Nyc Mayoral Bid Receives Boost With Key Asian American Endorsement

Jun 03, 2025

Mamdanis Nyc Mayoral Bid Receives Boost With Key Asian American Endorsement

Jun 03, 2025 -

Day 24 Karen Read Trial Expert Witness Questions Crime Scene Data

Jun 03, 2025

Day 24 Karen Read Trial Expert Witness Questions Crime Scene Data

Jun 03, 2025 -

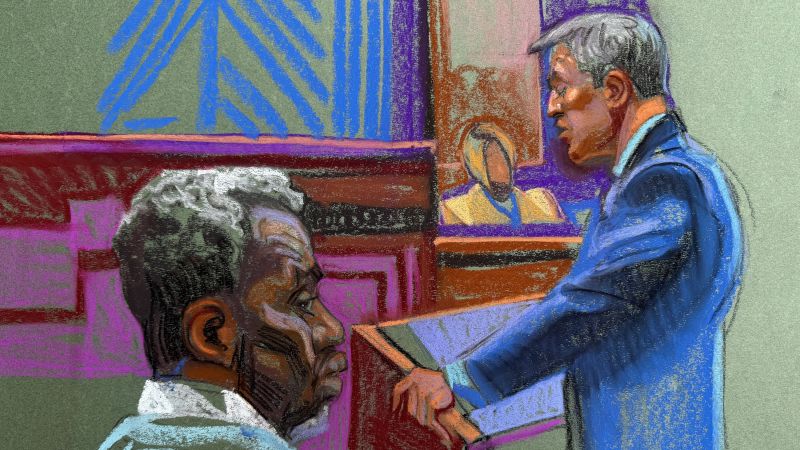

The Sean Combs Trial Legal Proceedings And Future Implications

Jun 03, 2025

The Sean Combs Trial Legal Proceedings And Future Implications

Jun 03, 2025 -

Maximize Your Childs Future The Power Of 529 Savings Plans

Jun 03, 2025

Maximize Your Childs Future The Power Of 529 Savings Plans

Jun 03, 2025 -

Double Murder Of Scottish Tourists Rocks Spanish Resort Town

Jun 03, 2025

Double Murder Of Scottish Tourists Rocks Spanish Resort Town

Jun 03, 2025

Latest Posts

-

Break In Arkansas Killing Case Suspect Captured At Local Barbershop

Aug 02, 2025

Break In Arkansas Killing Case Suspect Captured At Local Barbershop

Aug 02, 2025 -

Only Fans Streamer Targeted In Shocking Crypto Attack Cctv Footage Released

Aug 02, 2025

Only Fans Streamer Targeted In Shocking Crypto Attack Cctv Footage Released

Aug 02, 2025 -

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025 -

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025