NWE Stock: Ladenburg Thalmann Lowers Rating, Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NWE Stock Plunges: Ladenburg Thalmann Downgrade Sparks Investor Concerns

Ladenburg Thalmann's recent downgrade of NWE stock has sent ripples through the investment community, leaving many investors wondering about the implications for their portfolios. The financial services firm lowered its rating on National Fuel Gas Company (NWE), a leading energy company, prompting a significant drop in the stock price. This article delves into the reasons behind the downgrade, its potential impact on investors, and what to expect moving forward.

Why the Downgrade? Understanding Ladenburg Thalmann's Rationale

Ladenburg Thalmann cited several factors contributing to their decision to lower the rating on NWE stock. While the specifics may vary based on their internal analysis, common concerns surrounding energy companies often include:

- Fluctuating Energy Prices: The energy sector is notoriously volatile, with prices subject to global market forces, geopolitical events, and seasonal demand. Any significant downturn in energy prices can directly impact a company's profitability.

- Regulatory Changes: Government regulations play a crucial role in the energy industry. New environmental regulations or changes in energy policy can significantly impact operational costs and future growth prospects for companies like NWE.

- Competition: The energy sector is highly competitive. New technologies and the rise of renewable energy sources are putting pressure on traditional energy companies, forcing them to adapt and innovate to maintain market share.

- Debt Levels: High levels of corporate debt can make a company vulnerable to economic downturns and limit its ability to invest in future growth opportunities.

Implications for NWE Investors: What Should You Do?

The downgrade from Ladenburg Thalmann represents a significant negative signal for NWE investors. However, it's crucial to remember that this is just one analyst's opinion. Before making any rash decisions, investors should:

- Conduct Thorough Due Diligence: Review NWE's latest financial reports, earnings calls, and other publicly available information. Understand the company's current financial health, strategic plans, and risk factors.

- Diversify Your Portfolio: Reducing your exposure to any single stock, including NWE, is a fundamental principle of risk management. A diversified portfolio can help cushion the impact of negative news or unexpected market fluctuations.

- Seek Professional Advice: Consider consulting with a qualified financial advisor. They can provide personalized guidance based on your individual investment goals, risk tolerance, and overall financial situation. They can help you assess the implications of the downgrade within the context of your broader investment strategy.

- Monitor Market Trends: Keep a close eye on NWE's stock price, news related to the company, and overall market conditions. Being informed is key to making sound investment decisions.

Looking Ahead: Future Prospects for NWE

The future performance of NWE stock remains uncertain. While the Ladenburg Thalmann downgrade casts a shadow, the company's long-term prospects will depend on several factors, including its ability to navigate the challenges outlined above, adapt to changing market conditions, and effectively execute its strategic plans. Investors should carefully monitor these developments and make informed decisions based on the latest information.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Keywords: NWE stock, National Fuel Gas Company, Ladenburg Thalmann, stock downgrade, energy sector, investment implications, stock market, financial news, investor concerns, energy prices, regulatory changes, portfolio diversification, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NWE Stock: Ladenburg Thalmann Lowers Rating, Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ross Monaghan Shooting Graphic Video Shown On Spanish Tv Network

Jun 03, 2025

Ross Monaghan Shooting Graphic Video Shown On Spanish Tv Network

Jun 03, 2025 -

New Research Highlights Breakthroughs In Colorectal Cancer Prevention And Treatment

Jun 03, 2025

New Research Highlights Breakthroughs In Colorectal Cancer Prevention And Treatment

Jun 03, 2025 -

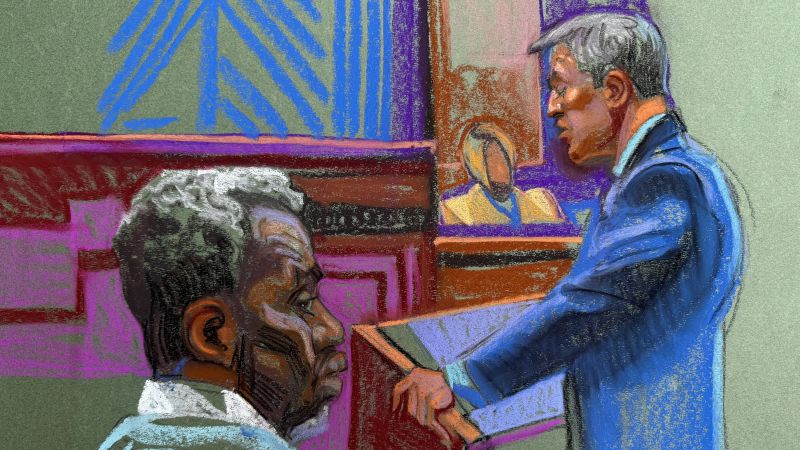

Sean Combs Trial Key Evidence And Witness Testimony

Jun 03, 2025

Sean Combs Trial Key Evidence And Witness Testimony

Jun 03, 2025 -

Is Ronny Mauricio Ready Mets Recall Signals Increased Offensive Support

Jun 03, 2025

Is Ronny Mauricio Ready Mets Recall Signals Increased Offensive Support

Jun 03, 2025 -

Nyc Mayoral Primary A Deep Dive Into Faiza Mamdani And Harry Siegels Campaigns

Jun 03, 2025

Nyc Mayoral Primary A Deep Dive Into Faiza Mamdani And Harry Siegels Campaigns

Jun 03, 2025