NWE Stock: Ladenburg Thalmann's Hold Rating And Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NWE Stock: Ladenburg Thalmann's Hold Rating and Implications for Investors

Ladenburg Thalmann's recent "Hold" rating for NWE stock has sent ripples through the investment community. What does this mean for current and prospective investors in National Western Life Insurance Company? Let's delve into the details and explore the implications.

National Western Life Insurance Company (NWE), a prominent player in the financial services sector, recently received a "Hold" rating from Ladenburg Thalmann, a reputable financial services firm. This assessment has sparked considerable interest and discussion amongst investors, prompting crucial questions about the future trajectory of NWE stock. Understanding the rationale behind this rating and its potential impact is paramount for anyone considering investing in or currently holding NWE shares.

Understanding Ladenburg Thalmann's "Hold" Rating

A "Hold" rating generally signifies that analysts believe the stock's price is fairly valued at its current market level. It's neither a strong buy nor a sell recommendation. Ladenburg Thalmann's decision likely stems from a comprehensive analysis of NWE's financial performance, industry trends, and future growth prospects. While the specific details of their analysis might not be publicly available, several factors could contribute to a "Hold" rating:

- Stable Financial Performance: NWE might be exhibiting consistent, yet not exceptionally high, growth. This steady performance, while positive, might not justify a "Buy" recommendation, given the current market conditions and potential for higher returns elsewhere.

- Market Saturation: The insurance industry can be highly competitive. If Ladenburg Thalmann perceives limited opportunities for significant market share expansion for NWE, a "Hold" rating becomes more plausible.

- Economic Uncertainty: Macroeconomic factors, such as interest rate hikes or inflation, could influence the analyst's outlook, leading to a more conservative "Hold" recommendation rather than a bullish "Buy."

Implications for NWE Investors

The "Hold" rating doesn't necessarily signal negative news. It's crucial to avoid knee-jerk reactions. However, it does provide valuable context for investors to consider:

- Current Holders: Existing investors might choose to maintain their position, awaiting further catalysts for price appreciation. This might involve monitoring NWE's quarterly earnings reports and any strategic initiatives the company undertakes.

- Potential Investors: Those considering investing in NWE should carefully weigh the "Hold" rating against their own risk tolerance and investment goals. Diversification is always key in a robust investment strategy.

- Further Research: It's essential to conduct thorough due diligence before making any investment decisions. This includes reviewing NWE's financial statements, understanding its business model, and comparing its performance against competitors.

Beyond Ladenburg Thalmann: A Broader Perspective

It's vital to remember that a single analyst rating shouldn't be the sole basis for investment decisions. Investors should consider a range of perspectives, including ratings from other reputable firms and independent market analysis. Stay informed about NWE's news and developments through reliable financial news sources.

Looking Ahead: The insurance sector is dynamic, and NWE's future performance will depend on various factors. While Ladenburg Thalmann's "Hold" rating provides valuable insight, investors should continue to monitor the company's progress and adapt their strategies accordingly.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NWE Stock: Ladenburg Thalmann's Hold Rating And Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

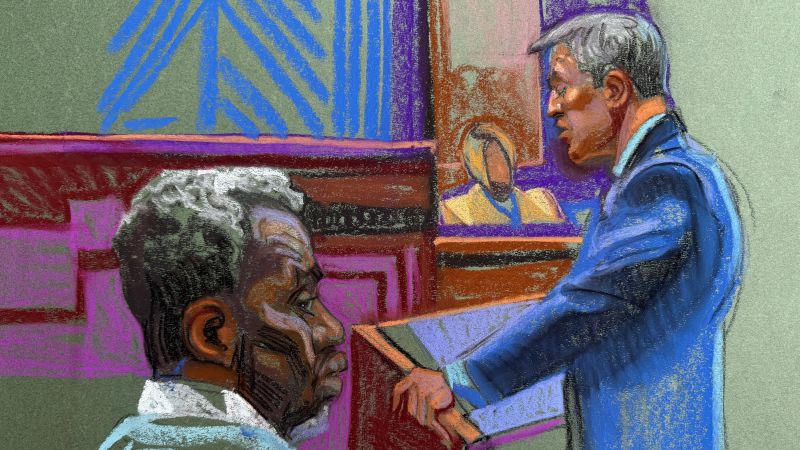

Whats Next For Diddy Following The Latest Court Proceedings

Jun 04, 2025

Whats Next For Diddy Following The Latest Court Proceedings

Jun 04, 2025 -

Jannik Sinner On His Alcaraz Struggle A Roland Garros Showdown Looms

Jun 04, 2025

Jannik Sinner On His Alcaraz Struggle A Roland Garros Showdown Looms

Jun 04, 2025 -

Business Owners Confront Authorities Over Gardeners Detention Cnn Exclusive

Jun 04, 2025

Business Owners Confront Authorities Over Gardeners Detention Cnn Exclusive

Jun 04, 2025 -

Carl Nassibs Journey From Nfl Player To Lgbtq Advocate

Jun 04, 2025

Carl Nassibs Journey From Nfl Player To Lgbtq Advocate

Jun 04, 2025 -

Olympic Diver Tom Daley Offers Support To Closeted Lgbtq Athletes

Jun 04, 2025

Olympic Diver Tom Daley Offers Support To Closeted Lgbtq Athletes

Jun 04, 2025

Latest Posts

-

Winter Fuel Payment Changes Chancellors Announcement And Impact

Jun 06, 2025

Winter Fuel Payment Changes Chancellors Announcement And Impact

Jun 06, 2025 -

Confirmed David Quinn Returns To Rangers As Assistant Coach Under Sullivan

Jun 06, 2025

Confirmed David Quinn Returns To Rangers As Assistant Coach Under Sullivan

Jun 06, 2025 -

North Pacific Ship Fire 22 Crew Members Rescued From Lifeboat

Jun 06, 2025

North Pacific Ship Fire 22 Crew Members Rescued From Lifeboat

Jun 06, 2025 -

Daniel Anjorin Murder Witness Testimony Implicates Marcus Monzo

Jun 06, 2025

Daniel Anjorin Murder Witness Testimony Implicates Marcus Monzo

Jun 06, 2025 -

After Seven Years Paige De Sorbo Exits Bravos Summer House

Jun 06, 2025

After Seven Years Paige De Sorbo Exits Bravos Summer House

Jun 06, 2025