NWE Stock: Ladenburg Thalmann's Hold Rating And Market Reaction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NWE Stock: Ladenburg Thalmann's Hold Rating and Market Reaction – A Deep Dive

Ladenburg Thalmann's recent "Hold" rating for NWE stock has sent ripples through the market. But what does this mean for investors, and how has the market reacted? Let's delve into the details.

The financial services firm, Ladenburg Thalmann, recently issued a hold rating for NorthWestern Energy (NWE), a significant player in the energy sector. This announcement follows a period of relative stability for NWE, but also amidst a backdrop of fluctuating energy prices and increasing regulatory scrutiny within the utility industry. The rating, while not overtly negative, has sparked discussion amongst investors regarding the future trajectory of NWE stock.

Understanding Ladenburg Thalmann's Hold Rating

A "Hold" rating isn't necessarily bad news. It essentially suggests that analysts believe the stock is fairly valued at its current price. It implies a lack of strong catalysts for significant price appreciation or depreciation in the near future. This is different from a "Buy" rating, which suggests the stock is undervalued and poised for growth, or a "Sell" rating, which signals the belief that the stock is overvalued and likely to decline.

Ladenburg Thalmann's reasoning behind the "Hold" rating likely considers various factors, including:

- Earnings Projections: Analysts often base ratings on projected earnings growth. If Ladenburg Thalmann anticipates only modest earnings growth for NWE, a "Hold" rating would be consistent with that assessment.

- Regulatory Landscape: The utility sector faces increasing regulatory pressure regarding environmental concerns and infrastructure modernization. These regulatory uncertainties can impact profitability and influence analyst ratings.

- Competitive Analysis: The competitive landscape within the energy sector is dynamic. Ladenburg Thalmann's analysis likely includes a comparison of NWE's performance against its competitors.

- Economic Outlook: Macroeconomic factors, such as interest rate hikes and inflation, also play a crucial role in shaping analyst opinions on stock performance.

Market Reaction to the Hold Rating

The market's immediate reaction to Ladenburg Thalmann's "Hold" rating was relatively muted. While there might have been minor fluctuations in NWE's stock price immediately following the announcement, the overall impact appeared limited. This suggests that the market might have already partially priced in the factors considered by the analysts.

However, it's crucial to remember that market reactions are complex and can be influenced by a multitude of factors beyond a single analyst rating. News regarding broader market trends, competitor actions, or even unexpected events can significantly impact stock prices.

What This Means for Investors

For current NWE investors, the "Hold" rating might not necessitate immediate action. If their investment strategy aligns with holding a stable, dividend-paying utility stock, the rating may not alter their long-term outlook. However, investors should continue to monitor NWE's performance, paying attention to:

- Earnings Reports: Scrutinize NWE's quarterly and annual earnings reports for signs of growth or decline.

- News and Analyst Updates: Stay informed about any further analyst ratings and news that might impact NWE.

- Diversification: Maintaining a well-diversified portfolio remains a crucial strategy for mitigating risk.

For potential investors, the "Hold" rating might suggest a wait-and-see approach. While not a negative signal, it lacks the enthusiasm of a "Buy" rating. Consider conducting thorough due diligence before investing in NWE or any other stock.

Disclaimer: This article provides general information and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. Stock prices are inherently volatile, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NWE Stock: Ladenburg Thalmann's Hold Rating And Market Reaction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Forgotten Album Grace Potters Latest Musical Offering

Jun 04, 2025

The Forgotten Album Grace Potters Latest Musical Offering

Jun 04, 2025 -

Alexander Bubliks Las Vegas Triumph Sets Up French Open 2025 Quarter Final

Jun 04, 2025

Alexander Bubliks Las Vegas Triumph Sets Up French Open 2025 Quarter Final

Jun 04, 2025 -

Grace Potter Opens The Vault A Look At The Musicians Hidden Gems

Jun 04, 2025

Grace Potter Opens The Vault A Look At The Musicians Hidden Gems

Jun 04, 2025 -

Americans Leaving The Us Disillusionment With Trumps Legacy

Jun 04, 2025

Americans Leaving The Us Disillusionment With Trumps Legacy

Jun 04, 2025 -

The Hidden Lives Of Mormon Wives Swinging Betrayal And Religious Fallout

Jun 04, 2025

The Hidden Lives Of Mormon Wives Swinging Betrayal And Religious Fallout

Jun 04, 2025

Latest Posts

-

Portugal Police Confirm Body Found Belongs To Missing Scot On Stag Do

Jun 06, 2025

Portugal Police Confirm Body Found Belongs To Missing Scot On Stag Do

Jun 06, 2025 -

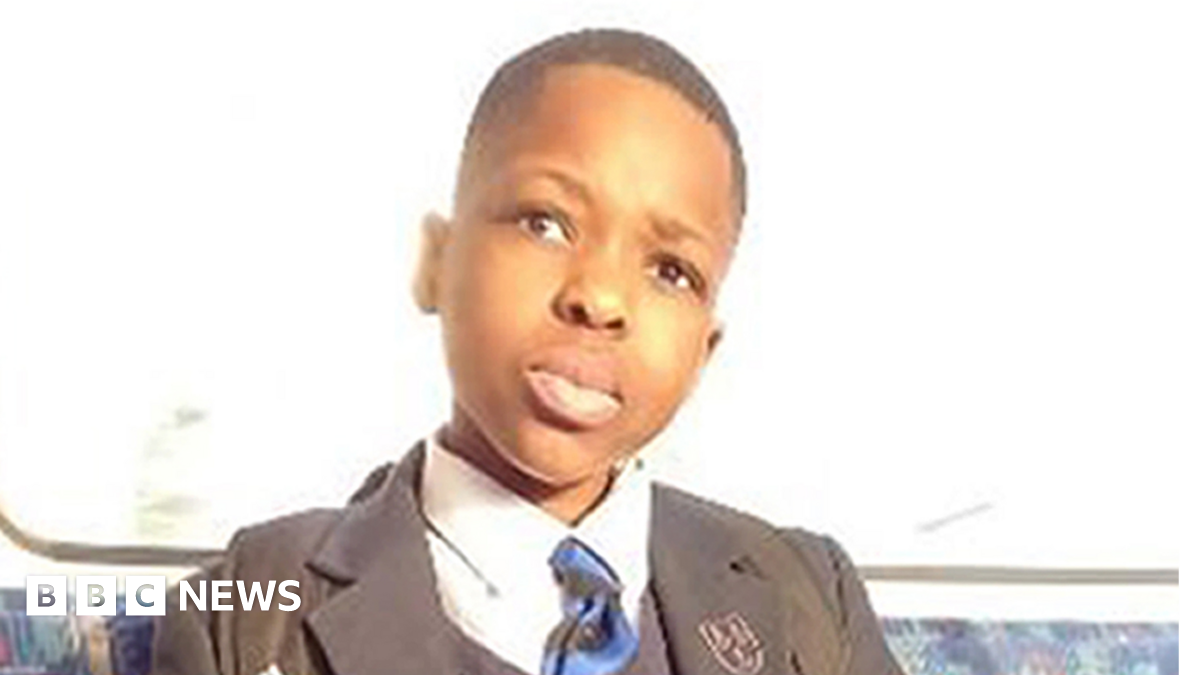

Marcus Monzo Wanted To Kill Daniel Anjorin Court Hearing Details Revealed

Jun 06, 2025

Marcus Monzo Wanted To Kill Daniel Anjorin Court Hearing Details Revealed

Jun 06, 2025 -

Impact Of Supreme Court Decision On Reverse Discrimination Claims And Employment

Jun 06, 2025

Impact Of Supreme Court Decision On Reverse Discrimination Claims And Employment

Jun 06, 2025 -

Multiple Cardiac Surgery Patient Deaths Lead To Police Investigation At Nhs Facility

Jun 06, 2025

Multiple Cardiac Surgery Patient Deaths Lead To Police Investigation At Nhs Facility

Jun 06, 2025 -

Broadcom Avgo Stock Trader Expectations Following Q Quarter Earnings

Jun 06, 2025

Broadcom Avgo Stock Trader Expectations Following Q Quarter Earnings

Jun 06, 2025