NYSE:BAC Update: Birmingham Capital Management Sells Significant Bank Of America Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NYSE:BAC Update: Birmingham Capital Management Offloads Significant Bank of America Stake

Bank of America (BAC) stock experienced a minor ripple today following the news that Birmingham Capital Management, a prominent investment firm, has significantly reduced its holdings in the financial giant. This move, disclosed in a recent SEC filing, has sparked renewed interest in BAC's performance and future prospects. While the exact reasons behind the sale remain unstated, analysts are weighing in on potential implications for investors.

Birmingham Capital Management's Sale: A Closer Look

The SEC filing revealed that Birmingham Capital Management sold a substantial number of Bank of America shares, representing a considerable decrease in their overall portfolio allocation. The precise number of shares sold and the total value of the transaction haven't been publicly disclosed, fueling speculation within the financial community. This lack of transparency has led to some uncertainty among investors already navigating a complex market landscape.

Potential Factors Influencing Birmingham Capital Management's Decision

Several factors could potentially explain Birmingham Capital Management's decision to divest from Bank of America. These include:

- Market Volatility: The current economic climate is characterized by high inflation and interest rate hikes, creating significant uncertainty in the financial markets. This volatility could have prompted the firm to adjust its portfolio for risk mitigation. [Link to a relevant article on market volatility]

- Profit-Taking: Given Bank of America's recent performance, Birmingham Capital Management may have decided to take profits after a period of growth. This is a common strategy among investment firms aiming to maximize returns.

- Strategic Portfolio Rebalancing: The firm might be shifting its investment strategy to focus on other sectors or companies perceived to offer higher growth potential in the current market. This is a normal practice in active portfolio management.

- Internal Factors: It's also possible that internal factors within Birmingham Capital Management influenced the decision, unrelated to Bank of America's performance specifically. These internal reasons are rarely publicly disclosed.

Impact on Bank of America Stock (BAC): A Cautious Outlook

While the sale by Birmingham Capital Management represents a significant transaction, it's crucial to note that it doesn't necessarily reflect a negative outlook on Bank of America's future. The stock price experienced a minor dip following the news, but the overall market reaction has been relatively muted. This suggests that the broader market might not see this as a major indicator of future performance.

Many analysts maintain a positive outlook on BAC, citing the bank's strong earnings reports and robust balance sheet. However, investors should remain vigilant and monitor market developments closely.

What This Means for Investors:

This event highlights the importance of diversification in investment portfolios. While Bank of America remains a significant player in the financial sector, individual investors should always conduct their own thorough due diligence before making any investment decisions. Consider consulting with a financial advisor to create a strategy aligned with your personal risk tolerance and financial goals.

Keywords: NYSE:BAC, Bank of America, Birmingham Capital Management, stock sale, SEC filing, market volatility, investment strategy, portfolio rebalancing, financial news, stock market, investment advice, BAC stock price, economic uncertainty.

Call to Action (Subtle): Stay informed about the latest market trends and company news by regularly checking reputable financial news sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NYSE:BAC Update: Birmingham Capital Management Sells Significant Bank Of America Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sirius Xm Holdings Stock Performance A Deep Dive For Potential Investors

May 27, 2025

Sirius Xm Holdings Stock Performance A Deep Dive For Potential Investors

May 27, 2025 -

Affaire Macron Brigitte Au Vietnam Verite Ou Intox

May 27, 2025

Affaire Macron Brigitte Au Vietnam Verite Ou Intox

May 27, 2025 -

From Distant Shores To Heartbreak A Dc Love Story

May 27, 2025

From Distant Shores To Heartbreak A Dc Love Story

May 27, 2025 -

Kyiv Under Siege Russia Launches Fresh Aerial Assault After Prisoner Release

May 27, 2025

Kyiv Under Siege Russia Launches Fresh Aerial Assault After Prisoner Release

May 27, 2025 -

Affaire Macron Brigitte Au Vietnam Version Officielle Et Dementi De L Elysee

May 27, 2025

Affaire Macron Brigitte Au Vietnam Version Officielle Et Dementi De L Elysee

May 27, 2025

Latest Posts

-

Understanding The Threat The Spread Of The Screwworm Fly

May 28, 2025

Understanding The Threat The Spread Of The Screwworm Fly

May 28, 2025 -

King Charles Iiis Canada Trip A Balancing Act Between Diplomacy And Us Politics

May 28, 2025

King Charles Iiis Canada Trip A Balancing Act Between Diplomacy And Us Politics

May 28, 2025 -

Major Truck Explosion Nearby Homes Suffer Damage Due To Propane Leak

May 28, 2025

Major Truck Explosion Nearby Homes Suffer Damage Due To Propane Leak

May 28, 2025 -

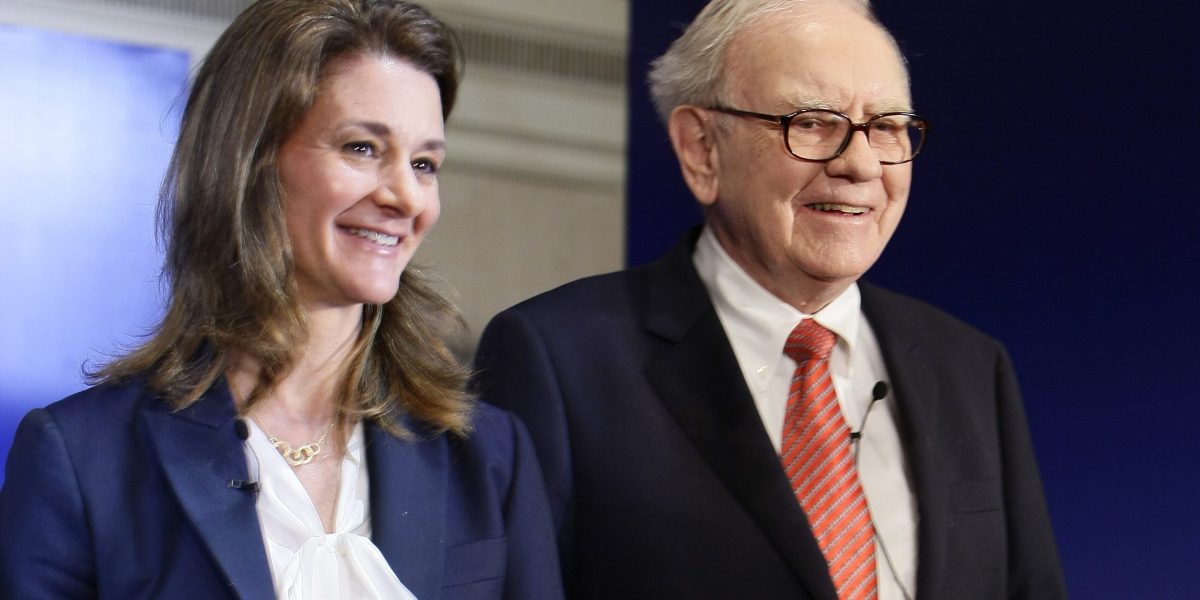

Has The Gates Buffett Era Of Giving Ended Hundreds Of Billionaires Pledge 600 Billion

May 28, 2025

Has The Gates Buffett Era Of Giving Ended Hundreds Of Billionaires Pledge 600 Billion

May 28, 2025 -

Alexandra Daddarios Sheer Lace Dress A Look At The See Through Ensemble

May 28, 2025

Alexandra Daddarios Sheer Lace Dress A Look At The See Through Ensemble

May 28, 2025