NYSE:BAC Update: Birmingham Capital Management's Recent Stock Sale

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NYSE:BAC Update: Birmingham Capital Management Sheds Bank of America Shares – What Does it Mean?

Bank of America (BAC), a financial giant listed on the NYSE, saw a significant shift in its investor landscape recently with Birmingham Capital Management reducing its stake in the company. This move has sparked speculation and raised questions about the future trajectory of BAC stock. This article delves into the details of Birmingham Capital Management's recent sale, analyzes potential implications, and explores what this means for investors.

Birmingham Capital Management's Sale:

Birmingham Capital Management, a prominent investment firm, recently filed a Form 13D with the Securities and Exchange Commission (SEC), revealing a substantial decrease in its Bank of America holdings. While the exact number of shares sold and the reasoning behind the decision remain undisclosed, the move has certainly captured the attention of market analysts and investors alike. This lack of transparency adds to the intrigue surrounding the sale.

Potential Implications and Market Reactions:

The market's reaction to this news has been relatively muted, suggesting that the overall sentiment towards Bank of America remains largely positive. However, the sale does raise several important questions:

- Is this a sign of broader market concerns? Some analysts speculate that Birmingham Capital Management's decision might reflect a broader shift in investor sentiment towards the financial sector, particularly in light of recent economic uncertainties.

- What are Birmingham Capital Management's future plans? The lack of public explanation from Birmingham Capital Management leaves room for speculation. Did they simply rebalance their portfolio, or is this indicative of a more bearish outlook on Bank of America's prospects?

- How will this impact BAC's stock price in the long term? While the immediate impact appears minimal, the long-term effects remain to be seen. Continuous monitoring of trading volume and investor sentiment will be crucial.

Analyzing Bank of America's Current Position:

Despite this recent development, Bank of America continues to be a major player in the financial industry. The bank has demonstrated resilience in the face of economic challenges and continues to report strong earnings. Key factors influencing its performance include:

- Interest rate hikes: The current interest rate environment has positively impacted Bank of America's net interest income.

- Consumer spending: The health of the consumer economy significantly impacts the bank's lending and transaction activities.

- Competition: Intense competition within the financial services sector remains a crucial factor influencing BAC's performance.

What Should Investors Do?

The sale by Birmingham Capital Management does not necessarily signal a negative outlook for Bank of America. However, investors should carefully consider their own risk tolerance and investment strategy before making any decisions. Conducting thorough due diligence, staying informed about market trends, and potentially consulting a financial advisor are all recommended steps.

Conclusion:

Birmingham Capital Management's reduction of its Bank of America holdings warrants attention, but it's crucial to avoid knee-jerk reactions. The move should be considered within the context of the broader market environment and Bank of America's overall financial health. Continued monitoring of BAC's performance and news surrounding the investment firm will be key to understanding the long-term implications of this sale. Remember to always do your own research before making any investment decisions.

Keywords: NYSE:BAC, Bank of America, BAC stock, Birmingham Capital Management, stock sale, SEC filing, Form 13D, investment, financial news, market analysis, investor sentiment, economic uncertainty, interest rates, consumer spending, competition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NYSE:BAC Update: Birmingham Capital Management's Recent Stock Sale. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Social Security Payment Calendar June 2025

May 27, 2025

Official Social Security Payment Calendar June 2025

May 27, 2025 -

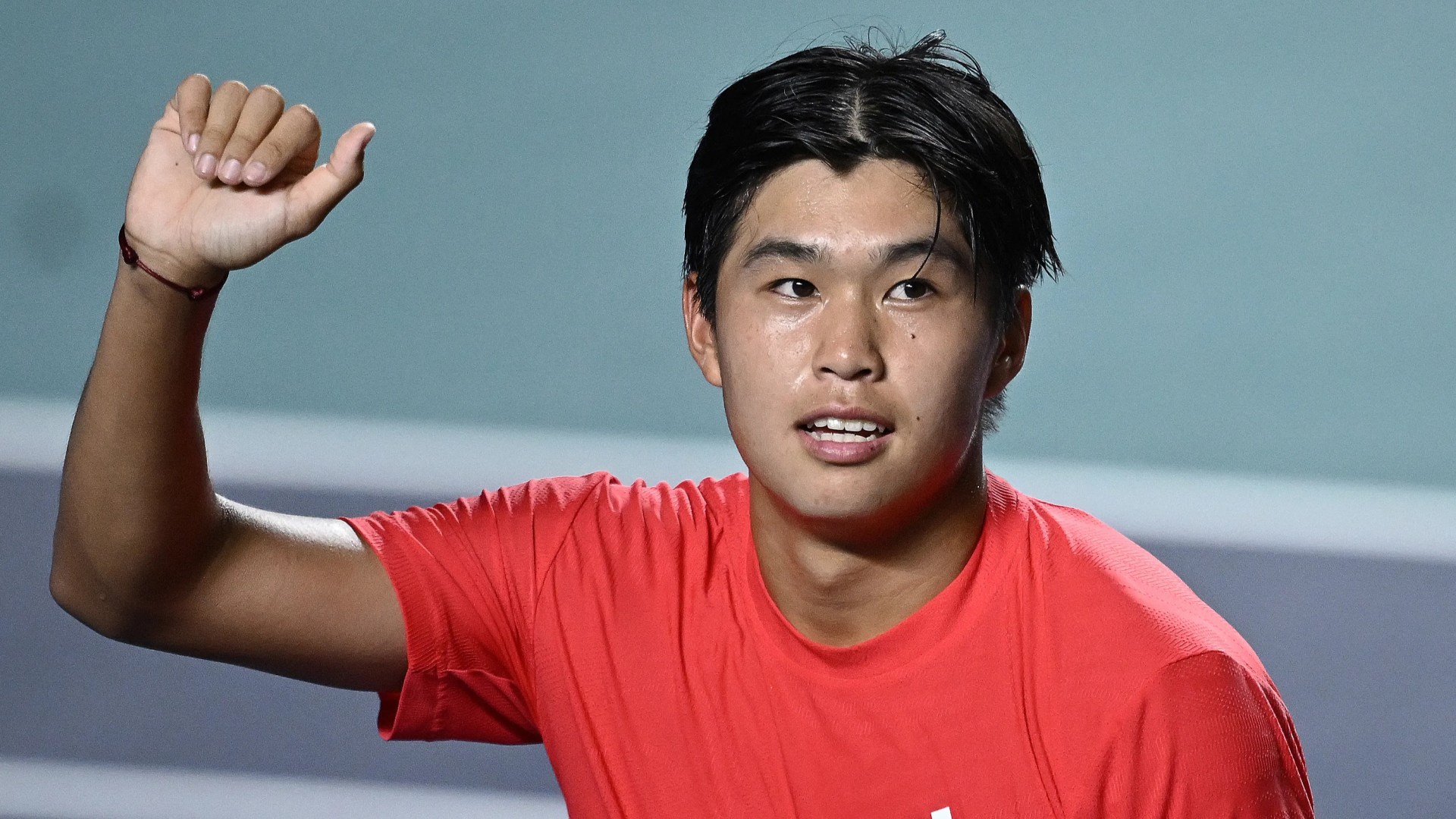

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025

The Unlikely Path A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025 -

73 Arrests Multiple Stabbings Memorial Day Weekend Violence In Coastal Community

May 27, 2025

73 Arrests Multiple Stabbings Memorial Day Weekend Violence In Coastal Community

May 27, 2025 -

Beyond Algorithms Harvards Commencement Speaker Emphasizes The Importance Of Human Connection

May 27, 2025

Beyond Algorithms Harvards Commencement Speaker Emphasizes The Importance Of Human Connection

May 27, 2025 -

Hot Air Balloon Accident In Mexico Leaves Dozen Injured

May 27, 2025

Hot Air Balloon Accident In Mexico Leaves Dozen Injured

May 27, 2025

Latest Posts

-

Henrique Rocha Vitoria Historica Na Estreia Em Roland Garros

May 30, 2025

Henrique Rocha Vitoria Historica Na Estreia Em Roland Garros

May 30, 2025 -

First Odi England Vs West Indies Live Streaming And Highlights

May 30, 2025

First Odi England Vs West Indies Live Streaming And Highlights

May 30, 2025 -

Giants Causeway Visitors Respect The Ancient Stones

May 30, 2025

Giants Causeway Visitors Respect The Ancient Stones

May 30, 2025 -

Us Student Visa Appointments Suspended Expanded Social Media Screening Planned

May 30, 2025

Us Student Visa Appointments Suspended Expanded Social Media Screening Planned

May 30, 2025 -

Remembering Rick Derringer A Celebrated Musicians Legacy

May 30, 2025

Remembering Rick Derringer A Celebrated Musicians Legacy

May 30, 2025