OBR Revises Pension Triple Lock Cost Upwards: Three Times The Original Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OBR Revises Pension Triple Lock Cost Upwards: Three Times the Original Projection

The Office for Budget Responsibility (OBR) has issued a stark warning, revising its cost projection for the UK's triple lock pension system dramatically upwards. The latest figures reveal a cost three times higher than initially forecast, sparking intense debate about the future of this cornerstone of retirement security. This significant upward revision has major implications for government spending and the long-term sustainability of the state pension.

A Triple Lock Under Pressure:

The triple lock, a key manifesto commitment for many governments, guarantees that state pensions increase annually by whichever is highest of: inflation, average earnings growth, or 2.5%. This policy has been lauded for protecting pensioners from the erosion of purchasing power, particularly during periods of high inflation. However, the OBR's revised figures paint a concerning picture.

The Shocking Numbers:

The OBR initially estimated the cost of the triple lock over the next five years at approximately £X billion (replace X with the actual figure if available from a reputable source). However, the revised figure now stands at approximately £3X billion (replace 3X with the actual revised figure if available from a reputable source) – a staggering threefold increase. This massive discrepancy highlights the unforeseen challenges in accurately predicting economic trends and their impact on social security programs.

Why the Dramatic Increase?

Several factors contribute to this dramatic upward revision:

- Unexpected Inflation: The unprecedented surge in inflation in recent years has significantly exceeded initial projections, driving up the cost of the triple lock considerably. The soaring cost of living has had a considerable impact, leading to higher-than-anticipated pension increases.

- Stronger-Than-Expected Wage Growth: While initially beneficial for pensioners, the stronger-than-anticipated growth in average earnings also contributed to the increased cost of the triple lock. This element highlights the complexities of linking pension increases to multiple economic indicators.

- Methodological Refinements: The OBR may have also refined its forecasting methodology, leading to a more accurate—and unfortunately higher—cost projection. Improved data analysis and predictive modelling could account for some of the difference.

Implications for Government Spending and Future Pension Policy:

This significant cost overrun raises serious questions about the long-term affordability of the triple lock. The government will face intense pressure to find ways to manage this increased expenditure without compromising other essential public services. Potential solutions may include:

- Reviewing the Triple Lock Mechanism: Debate is likely to intensify regarding the need for reform to the triple lock's structure, potentially adjusting the weighting of the three factors or introducing a cap on annual increases.

- Exploring Alternative Funding Mechanisms: The government might explore alternative funding mechanisms for pensions, possibly including raising the state pension age or introducing additional voluntary contribution schemes.

- Prioritizing Spending: Difficult choices regarding government spending priorities will need to be made, potentially impacting other crucial areas of public expenditure.

Looking Ahead:

The OBR's revised cost projection for the triple lock serves as a crucial wake-up call. It highlights the importance of accurate economic forecasting and the need for ongoing review and potential reform of key social security programs. The government will need to address this significant challenge responsibly and transparently, engaging in open dialogue with pensioners, stakeholders, and the public. The future of the triple lock and the financial security of millions of UK pensioners hangs in the balance. Further developments will be reported as they emerge.

**(Include a call to action subtly, such as): Stay informed on the latest developments concerning pension policy by subscribing to our newsletter. [link to newsletter signup] ** (Remember to replace "X" with the actual figures from a reliable source such as the OBR report.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OBR Revises Pension Triple Lock Cost Upwards: Three Times The Original Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gary Shteyngarts Precocious Child Narrator A Masterclass In Voice

Jul 10, 2025

Gary Shteyngarts Precocious Child Narrator A Masterclass In Voice

Jul 10, 2025 -

Hollingbourne Police Shooting Leaves Man Seriously Injured

Jul 10, 2025

Hollingbourne Police Shooting Leaves Man Seriously Injured

Jul 10, 2025 -

Wimbledon 2024 Where To Watch The Sinner Vs Shelton Quarterfinal Match

Jul 10, 2025

Wimbledon 2024 Where To Watch The Sinner Vs Shelton Quarterfinal Match

Jul 10, 2025 -

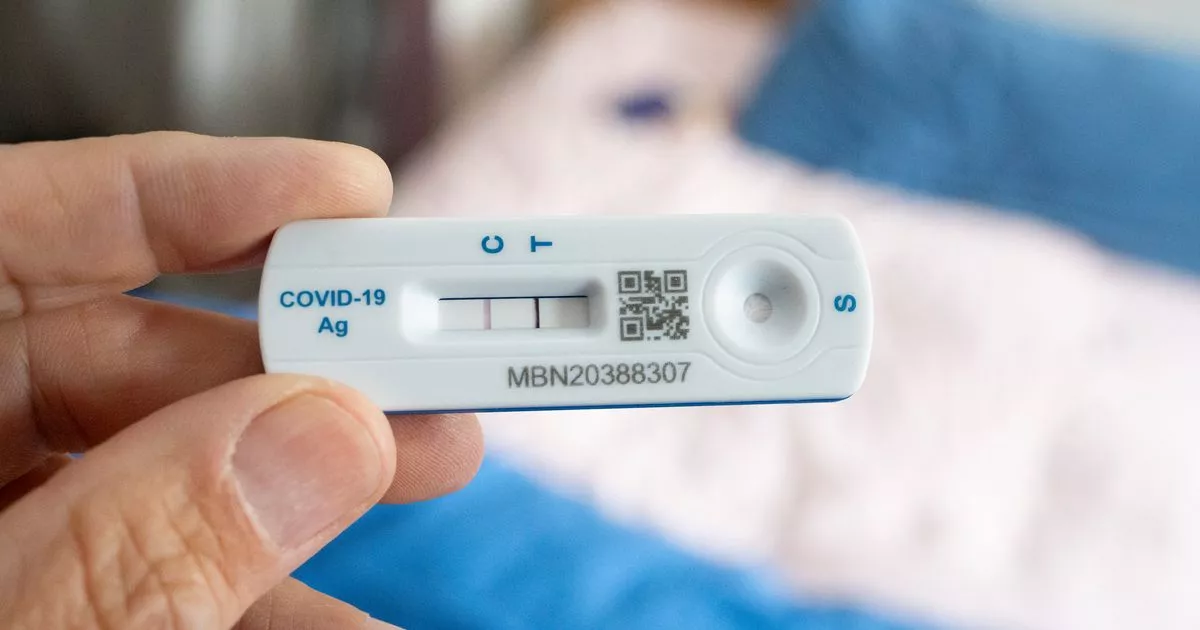

Public Health England Update Stratus Covid Variant Confirmed As Dominant Strain

Jul 10, 2025

Public Health England Update Stratus Covid Variant Confirmed As Dominant Strain

Jul 10, 2025 -

Uk Emergency Alert System Second Nationwide Test In September

Jul 10, 2025

Uk Emergency Alert System Second Nationwide Test In September

Jul 10, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

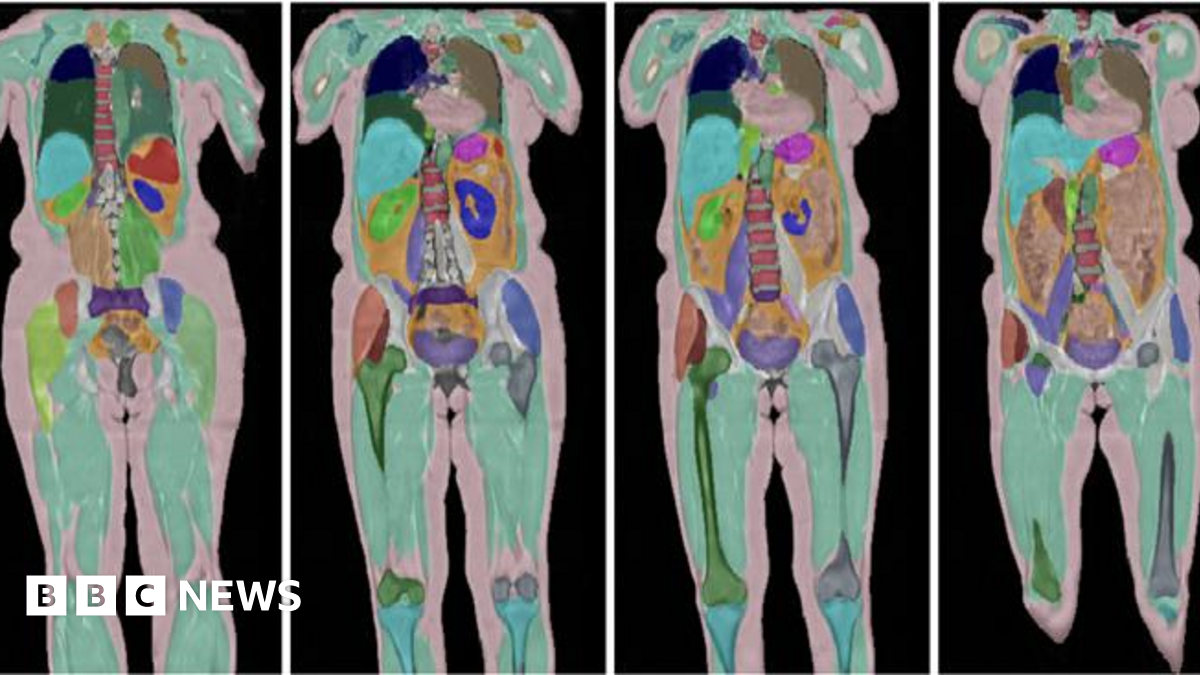

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025