Ohio Parents' Guide To 529 Plans: Maximizing Savings For College

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ohio Parents' Guide to 529 Plans: Maximizing Savings for College

Planning for your child's college education can feel daunting, but one powerful tool often overlooked is the 529 plan. For Ohio families, understanding the nuances of Ohio's 529 plan, the Ohio Tuition Trust Authority (OTTA) program, is crucial for maximizing savings and securing your child's future. This guide will walk you through everything you need to know to navigate the Ohio 529 plan effectively.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically for educational expenses. Contributions grow tax-deferred, meaning you don't pay taxes on the investment earnings until you withdraw them for qualified education expenses. This significant tax advantage makes 529 plans a powerful tool for saving for college, graduate school, or even vocational training. The best part? The earnings are completely tax-free when used for qualified expenses!

The Benefits of the Ohio 529 Plan (OTTA)

Ohio offers its own 529 plan, administered by the Ohio Tuition Trust Authority (OTTA). Choosing the Ohio 529 plan offers several key advantages:

- Potential State Tax Deduction: Ohio residents may be able to deduct their 529 plan contributions from their state income taxes. Check with a tax advisor to confirm your eligibility. This deduction can significantly boost your savings.

- Investment Options: The OTTA plan offers a range of investment options, allowing you to tailor your investment strategy to your risk tolerance and time horizon. From conservative options to more aggressive growth strategies, you can find an investment that aligns with your goals.

- Ease of Use: The online platform is user-friendly, making it easy to manage your account, track your progress, and make contributions.

How to Maximize Your Ohio 529 Plan Savings:

- Start Early: The earlier you start contributing, the more time your investments have to grow. Even small, regular contributions can make a significant difference over time. The power of compounding is your friend!

- Take Advantage of Tax Benefits: Remember to claim your potential state tax deduction. This can reduce your overall tax burden and increase your net savings.

- Consider Employer Matching Programs: Some employers offer matching contributions to 529 plans. Check with your HR department to see if this benefit is available to you.

- Utilize Gift Strategies: Grandparents and other family members can contribute to your child's 529 plan, potentially benefiting from gift tax exclusions. Consult a financial advisor for details.

- Choose the Right Investment Options: Select investments based on your risk tolerance and time horizon. A longer time horizon generally allows for a more aggressive investment strategy.

Qualified Education Expenses:

Remember that 529 plan funds can only be used for qualified education expenses. These include:

- Tuition and fees

- Room and board

- Books and supplies

- Computer equipment and software

Beyond College: While primarily used for college, under certain circumstances, 529 funds can also be used for K-12 tuition expenses (up to $10,000 per year per beneficiary), though this is subject to change and state regulations.

Getting Started with the Ohio 529 Plan:

Visit the Ohio Tuition Trust Authority website () to learn more and open an account. The process is typically straightforward and can be completed online.

Conclusion:

Planning for your child's future education is a significant undertaking. The Ohio 529 plan offers a powerful and tax-advantaged way to save for college and beyond. By understanding the benefits and maximizing your contributions, you can significantly reduce the financial burden of higher education for your family. Don't delay; start saving today and secure your child's educational future! Remember to consult with a financial advisor for personalized advice tailored to your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ohio Parents' Guide To 529 Plans: Maximizing Savings For College. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ronny Mauricios Hot Start Propels Him To Mets Major League Call Up

Jun 03, 2025

Ronny Mauricios Hot Start Propels Him To Mets Major League Call Up

Jun 03, 2025 -

Ncuti Gatwa To Regenerate Doctor Whos Unexpected Twist

Jun 03, 2025

Ncuti Gatwa To Regenerate Doctor Whos Unexpected Twist

Jun 03, 2025 -

The Tiafoe Gasquet Connection Impact On Baptistes Game

Jun 03, 2025

The Tiafoe Gasquet Connection Impact On Baptistes Game

Jun 03, 2025 -

How Religious Beliefs Shape Sexual Attitudes And Relationships In Britain

Jun 03, 2025

How Religious Beliefs Shape Sexual Attitudes And Relationships In Britain

Jun 03, 2025 -

Exploring Buffalo Where Old School Meets Cool

Jun 03, 2025

Exploring Buffalo Where Old School Meets Cool

Jun 03, 2025

Latest Posts

-

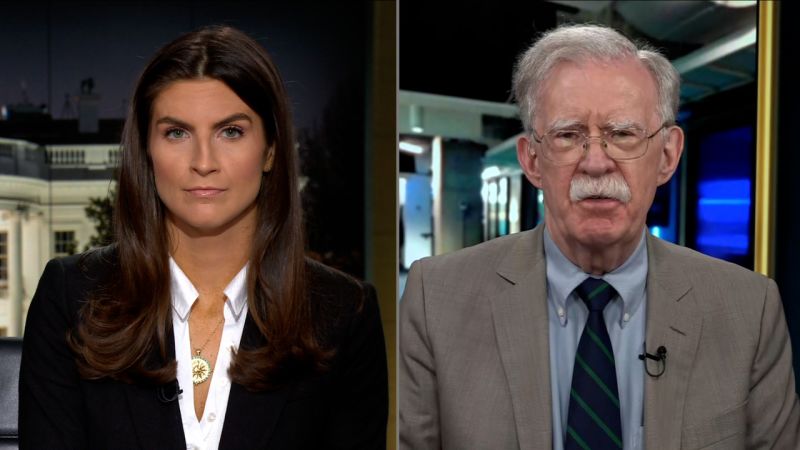

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025 -

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025 -

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025 -

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025 -

Rising Starvation Deaths In Gaza Israeli Forces Kill Aid Worker

Aug 03, 2025

Rising Starvation Deaths In Gaza Israeli Forces Kill Aid Worker

Aug 03, 2025