Ohio Parents Outsmart Rising College Costs With 529 Plan Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ohio Parents Outsmart Rising College Costs with 529 Plan Strategies

The soaring cost of higher education is a major concern for parents across the nation, and Ohio is no exception. Tuition fees, room and board, and other expenses continue to climb, leaving many families scrambling to find affordable solutions. But there's a powerful financial tool that can help Ohio parents navigate this challenge: the 529 college savings plan. This article explores effective 529 plan strategies to help you secure your child's future education.

Understanding Ohio's 529 Plan: The CollegeAdvantage Program

Ohio's 529 plan, known as the CollegeAdvantage Program, offers a tax-advantaged way to save for qualified education expenses. Contributions grow tax-deferred, and withdrawals used for qualified expenses are tax-free at the federal level. This makes it a significantly more efficient savings vehicle than many other investment options. The plan offers various investment options to suit different risk tolerances and time horizons, allowing for customization based on your family's financial goals. [Link to Ohio's CollegeAdvantage Program website]

5 Key Strategies to Maximize Your 529 Plan:

-

Start Early and Save Consistently: The power of compounding is undeniable. Beginning contributions early, even with small amounts, allows your savings to grow exponentially over time. Setting up automatic contributions ensures regular deposits and reduces the temptation to skip payments. Consider it a non-negotiable monthly bill, just like utilities or mortgage payments.

-

Utilize Employer Matching Programs: Some employers offer matching contributions to 529 plans. This is essentially free money! Take advantage of these programs to significantly boost your savings potential. Check with your HR department to see if this benefit is available to you.

-

Consider the Investment Options Carefully: CollegeAdvantage offers a range of investment options, from conservative to aggressive. Your choice should align with your risk tolerance and the timeframe until your child attends college. If your child is still young, a more aggressive portfolio might be appropriate, while a more conservative approach is suitable as college nears. Consult a financial advisor if you need help making the right choice.

-

Take Advantage of Tax Benefits: Remember, contributions aren't deductible at the federal level, but earnings grow tax-deferred, and qualified withdrawals are tax-free. This significantly reduces the overall tax burden compared to other savings methods. Understanding these tax implications is crucial to maximizing your savings.

-

Don't Forget the Ohio Tax Deduction: Ohio offers a state tax deduction for contributions made to the CollegeAdvantage 529 plan. This further enhances the plan's attractiveness and makes saving even more rewarding. Consult a tax professional to learn more about this benefit and how it applies to your specific situation.

Beyond the Basics: Addressing Common Concerns

-

What if my child doesn't go to college? While 529 plans are primarily designed for college expenses, there are provisions for non-qualified withdrawals. However, you'll incur income tax and a 10% penalty on the earnings portion. It’s always best to plan for college, but understanding the alternatives provides peace of mind.

-

Can I change beneficiaries? Yes, you can change the beneficiary to another eligible family member, such as another child or grandchild. This flexibility ensures that the funds aren't wasted if your original beneficiary's plans change.

Conclusion:

Navigating the rising costs of higher education can feel daunting, but with a well-planned strategy and the utilization of the Ohio CollegeAdvantage 529 plan, you can significantly improve your chances of achieving your college savings goals. Start early, save consistently, and take advantage of all available tax benefits. Your future graduate will thank you!

Call to Action: Visit the Ohio CollegeAdvantage website today to learn more and open your 529 account. Don't delay securing your child's future. [Link to Ohio's CollegeAdvantage Program website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ohio Parents Outsmart Rising College Costs With 529 Plan Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lee Jae Myung Poised To Win South Korean Presidency Exit Poll Results

Jun 04, 2025

Lee Jae Myung Poised To Win South Korean Presidency Exit Poll Results

Jun 04, 2025 -

Musetti Alcaraz And Swiatek Win On Day 8 Of The French Open 2025

Jun 04, 2025

Musetti Alcaraz And Swiatek Win On Day 8 Of The French Open 2025

Jun 04, 2025 -

Etna Volcanos Eruption Forces Tourists To Flee Raw Video Footage

Jun 04, 2025

Etna Volcanos Eruption Forces Tourists To Flee Raw Video Footage

Jun 04, 2025 -

Missing Hiker Aziz Ziriat Found Dead In Dolomites Familys Grief

Jun 04, 2025

Missing Hiker Aziz Ziriat Found Dead In Dolomites Familys Grief

Jun 04, 2025 -

Texas Girls Fish Skin Treatment A Success Story For Premature Infant Wound Care

Jun 04, 2025

Texas Girls Fish Skin Treatment A Success Story For Premature Infant Wound Care

Jun 04, 2025

Latest Posts

-

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025 -

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025 -

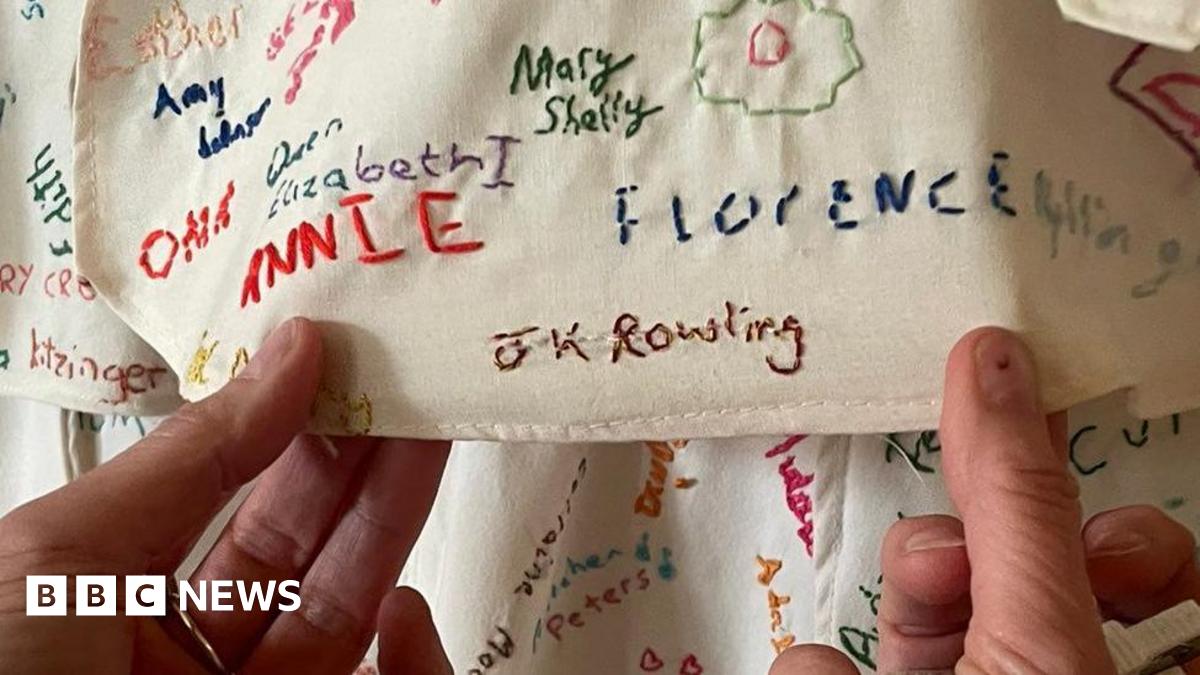

Derbyshire National Trust Property Hides Damaged J K Rowling Related Artwork

Jun 06, 2025

Derbyshire National Trust Property Hides Damaged J K Rowling Related Artwork

Jun 06, 2025 -

Heart Operation Deaths At Nhs Hospital Lead To Major Police Inquiry

Jun 06, 2025

Heart Operation Deaths At Nhs Hospital Lead To Major Police Inquiry

Jun 06, 2025 -

Summer House Star Paige De Sorbo Announces Departure After Seven Years

Jun 06, 2025

Summer House Star Paige De Sorbo Announces Departure After Seven Years

Jun 06, 2025