Ohio's 529 Plan Advantage: Smart Savings Strategies For College

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ohio's 529 Plan Advantage: Smart Savings Strategies for College

Planning for your child's college education can feel daunting, but Ohio's 529 Plan offers a powerful tool to make the dream a reality. With rising tuition costs, securing your child's future requires a strategic approach, and understanding the benefits of Ohio's 529 Plan is a crucial first step. This comprehensive guide explores smart savings strategies using this tax-advantaged plan, helping you navigate the complexities and maximize your contributions.

What is Ohio's 529 Plan?

Ohio's 529 Plan, officially known as the Ohio Tuition Trust Authority (OTTA) 529 Plan, is a college savings plan that offers significant tax advantages. It allows you to invest money tax-free to pay for qualified education expenses, including tuition, fees, room and board, and even books and supplies. This tax-advantaged growth significantly boosts your savings potential compared to traditional investment accounts. Unlike some other states, Ohio's plan doesn't require you to be a resident to contribute or benefit, making it a compelling option for families nationwide.

Key Advantages of Ohio's 529 Plan:

- Tax-Deferred Growth: Earnings grow tax-free, meaning you only pay taxes on the withdrawals used for qualified education expenses.

- Tax-Free Withdrawals: Withdrawals for qualified education expenses are federally tax-free. Ohio also offers its own state tax deduction or credit, depending on the year, further boosting your savings. (Always check the current year's tax regulations for the most up-to-date information).

- Flexibility: You can change beneficiaries if your circumstances change – for example, if your child decides not to go to college, you can transfer the funds to another family member for their education.

- Investment Options: The plan offers a variety of investment options to suit different risk tolerances and time horizons. From conservative options to more aggressive growth strategies, you can tailor your investments to meet your specific goals.

- Affordable Fees: Ohio's 529 Plan boasts relatively low fees compared to other state plans, ensuring more of your money goes towards your child's education.

Smart Savings Strategies:

- Start Early: The earlier you start saving, the more time your investments have to grow. Even small, regular contributions can add up significantly over time, leveraging the power of compounding interest.

- Maximize Contributions: Take advantage of any state tax deductions or credits offered by your state of residence. Many states offer tax benefits for contributions made to 529 plans.

- Diversify Your Investments: Don't put all your eggs in one basket. Spread your investments across different asset classes to manage risk effectively.

- Regularly Review Your Portfolio: Monitor your investment performance and rebalance your portfolio as needed to align with your child's age and educational goals.

- Understand Qualified Education Expenses: Familiarize yourself with the IRS guidelines on qualified education expenses to ensure you are using your withdrawals appropriately and maximizing tax benefits. [Link to IRS guidelines on qualified education expenses]

Beyond the Basics: Additional Considerations

While Ohio's 529 Plan offers numerous benefits, it's important to consider other college funding options, such as scholarships, grants, and federal student loans. A well-rounded approach that combines savings, financial aid, and potential borrowing can significantly reduce the overall financial burden of college. Consulting with a qualified financial advisor can help you develop a personalized college savings strategy that takes into account your individual financial situation.

Conclusion:

Ohio's 529 Plan is a powerful tool for securing your child's future. By understanding its advantages and employing smart savings strategies, you can significantly increase your chances of affording a college education. Start planning today and unlock the full potential of this valuable college savings vehicle. Visit the official Ohio 529 Plan website [Link to Ohio 529 Plan website] for more information and to open an account.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ohio's 529 Plan Advantage: Smart Savings Strategies For College. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Remembering John Brenkus Sports Science Host Dies At 54

Jun 03, 2025

Remembering John Brenkus Sports Science Host Dies At 54

Jun 03, 2025 -

France Psg Win Celebrations End In Tragedy Death Toll Rises To Two

Jun 03, 2025

France Psg Win Celebrations End In Tragedy Death Toll Rises To Two

Jun 03, 2025 -

Roland Garros Le Bandeau De Hailey Baptiste Trop Visible Un Changement Impose

Jun 03, 2025

Roland Garros Le Bandeau De Hailey Baptiste Trop Visible Un Changement Impose

Jun 03, 2025 -

Tom Daley Speaks Out Reaching Out To Closeted Lgbtq Athletes In Sport

Jun 03, 2025

Tom Daley Speaks Out Reaching Out To Closeted Lgbtq Athletes In Sport

Jun 03, 2025 -

Controversy Erupts After Spanish Tv Broadcasts Ross Monaghan Shooting Video

Jun 03, 2025

Controversy Erupts After Spanish Tv Broadcasts Ross Monaghan Shooting Video

Jun 03, 2025

Latest Posts

-

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025 -

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

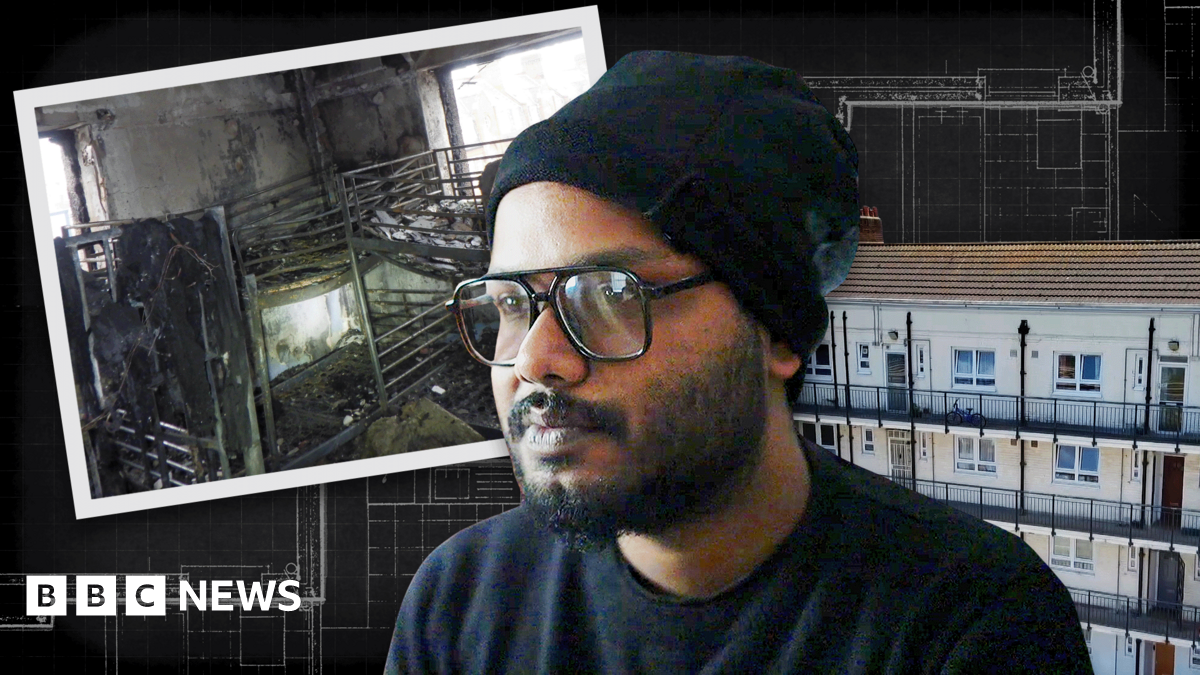

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025 -

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025 -

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025