One In Ten Britons Lack Savings: A Worrying Trend For UK Financial Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One in Ten Britons Lack Savings: A Worrying Trend for UK Financial Stability

Introduction: The UK is facing a concerning financial trend: a staggering one in ten Britons report having absolutely no savings. This alarming statistic reveals a precarious situation for personal finances and raises serious questions about the nation's overall economic stability. This lack of a financial safety net leaves millions vulnerable to unexpected life events and casts a shadow over the future of the UK economy.

The Shocking Reality of Zero Savings: Recent data from [Insert reputable source, e.g., the Office for National Statistics, a reputable financial institution] reveals that approximately 10% of the UK population possesses zero savings. This translates to millions of individuals without a financial buffer to cope with unexpected job losses, illness, or major household repairs. This figure is particularly concerning given the rising cost of living and increasing economic uncertainty.

Factors Contributing to the Savings Gap: Several factors contribute to this worrying trend. The persistent squeeze on household incomes, driven by inflation and stagnant wage growth, is a major culprit. Many Britons are struggling to make ends meet, leaving little to nothing for saving.

- Inflation's Impact: Soaring inflation has eroded the purchasing power of wages, leaving many people with less disposable income at the end of the month.

- Stagnant Wages: Wage growth hasn't kept pace with the rising cost of living, putting further pressure on household budgets.

- Increased Cost of Living: The rising costs of energy, food, and housing are leaving many with little left over for savings.

- Debt Burden: High levels of personal debt, including credit card debt and loans, further restrict the ability to save.

The Implications for the UK Economy: The widespread lack of savings has significant implications for the UK economy. A population unable to absorb financial shocks is more likely to rely on government support during crises, increasing the strain on public finances. Reduced consumer spending, a direct consequence of limited savings, can also dampen economic growth. Furthermore, a lack of savings can hinder investment and long-term economic prosperity.

What Can Be Done? Addressing this issue requires a multi-pronged approach. The government needs to implement policies that support wage growth and alleviate the cost-of-living crisis. This could include measures such as:

- Increased Minimum Wage: Raising the minimum wage to a living wage could significantly improve the financial situation for low-income earners.

- Targeted Financial Support: Providing targeted financial assistance to vulnerable households could help them build up their savings.

- Financial Literacy Programs: Improving financial literacy through nationwide educational programs can empower individuals to manage their finances effectively and build savings habits.

Individual Responsibility: While government intervention is crucial, individual responsibility also plays a vital role. Building a savings habit, even with small amounts, is essential for long-term financial security. Consider using budgeting apps, exploring different savings accounts, and seeking financial advice if needed.

Conclusion: The alarming number of Britons with zero savings highlights a serious vulnerability within the UK's financial landscape. Addressing this requires a concerted effort from both the government and individuals. By implementing supportive policies and fostering responsible financial habits, the UK can work towards a more financially secure future for all its citizens. This is not just about individual well-being; it's about the long-term health and stability of the entire UK economy. Learn more about effective saving strategies by visiting [link to a reputable financial advice website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One In Ten Britons Lack Savings: A Worrying Trend For UK Financial Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Starmers Political Maneuvering Amidst Record Economic Growth And Albania Diplomatic Row

May 17, 2025

Starmers Political Maneuvering Amidst Record Economic Growth And Albania Diplomatic Row

May 17, 2025 -

Thousands Affected Nj Transit Engineer Strike Impacts Millions Of Commuters

May 17, 2025

Thousands Affected Nj Transit Engineer Strike Impacts Millions Of Commuters

May 17, 2025 -

Box Office Success For Friendship Detroit Showing And Specialty Film Previews Announced

May 17, 2025

Box Office Success For Friendship Detroit Showing And Specialty Film Previews Announced

May 17, 2025 -

7 Revealing Statistics Analyzing The Mlb Seasons Second Quarter Performance

May 17, 2025

7 Revealing Statistics Analyzing The Mlb Seasons Second Quarter Performance

May 17, 2025 -

Shohei Ohtanis Historic Night Leads Dodgers To Victory Over Athletics

May 17, 2025

Shohei Ohtanis Historic Night Leads Dodgers To Victory Over Athletics

May 17, 2025

Latest Posts

-

Three Shutouts In A Row Twins 13 Game Winning Streak Dominates The League

May 18, 2025

Three Shutouts In A Row Twins 13 Game Winning Streak Dominates The League

May 18, 2025 -

Urgent Manhunt 11 Inmates Including Murder Suspects Loose After New Orleans Jail Escape

May 18, 2025

Urgent Manhunt 11 Inmates Including Murder Suspects Loose After New Orleans Jail Escape

May 18, 2025 -

Eurovision 2025 Getting To Know The Leading Five Artists

May 18, 2025

Eurovision 2025 Getting To Know The Leading Five Artists

May 18, 2025 -

Get To Know The Stars A Look At The Cast Of Netflixs Kakegurui

May 18, 2025

Get To Know The Stars A Look At The Cast Of Netflixs Kakegurui

May 18, 2025 -

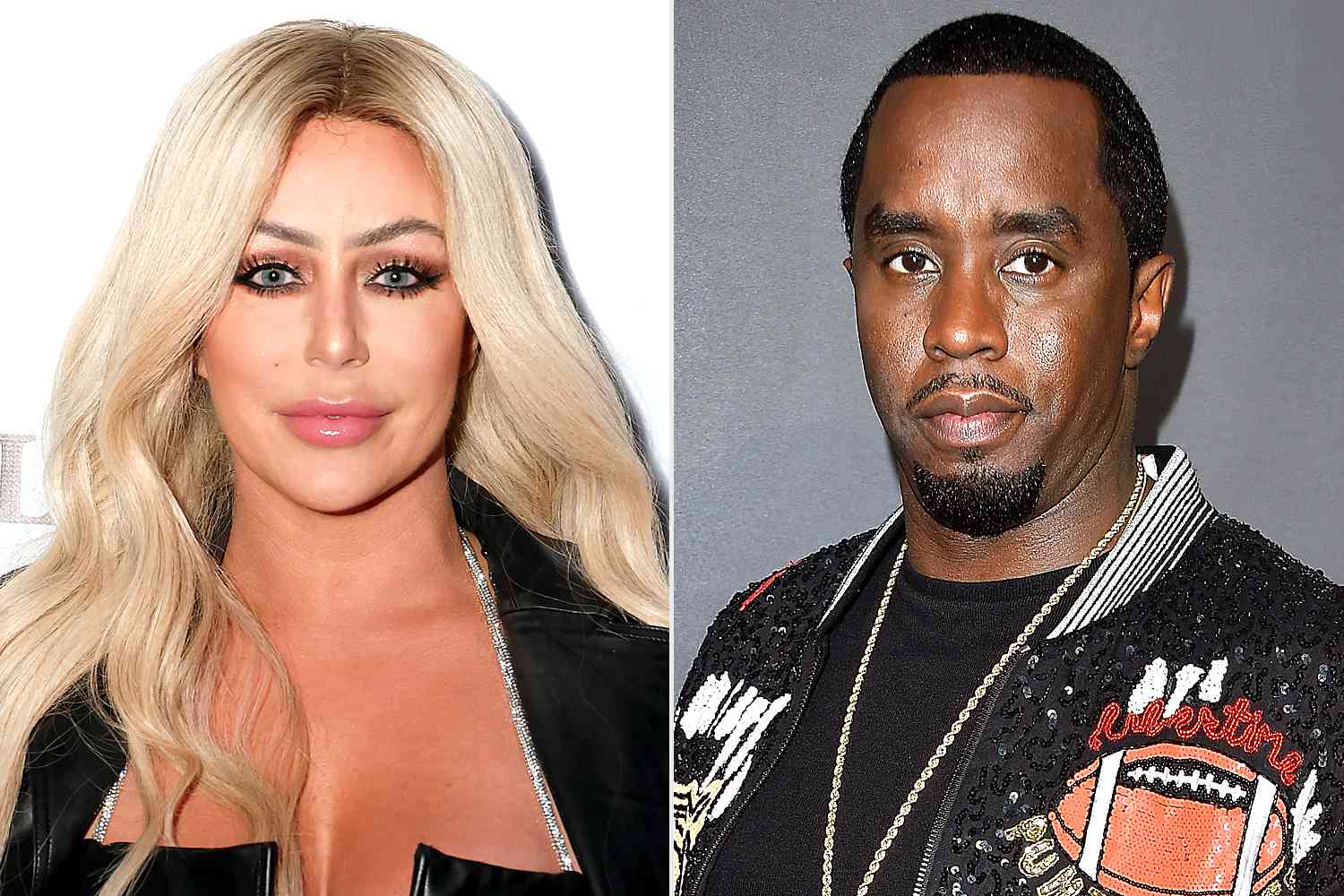

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025

Exclusive Aubrey O Day Will Not Appear As Witness In Diddys Trial

May 18, 2025