One Rate Cut In 2025: Fed's Guidance Impacts U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut in 2025: Fed's Guidance Impacts U.S. Treasury Yields

The Federal Reserve's (Fed) latest projections sent ripples through the financial markets, with its indication of just one interest rate cut anticipated in 2025 significantly impacting U.S. Treasury yields. This cautious outlook, a departure from previous, more optimistic forecasts, reflects the central bank's ongoing battle against stubbornly high inflation and its commitment to a data-dependent approach.

The announcement, delivered following the conclusion of the Fed's September meeting, immediately influenced investor sentiment. The expectation of a slower pace of monetary easing than previously anticipated led to a noticeable increase in Treasury yields across the curve. This signifies that investors are demanding higher returns on their investments in government debt, reflecting a reassessment of future economic prospects.

Understanding the Impact on Treasury Yields

U.S. Treasury yields are inversely related to bond prices. When yields rise, bond prices fall, and vice versa. The Fed's projection of only one rate cut next year suggests a longer period of tighter monetary policy, implying a sustained higher interest rate environment. This, in turn, makes existing Treasury bonds less attractive, pushing yields upwards.

The shift in the Fed's stance is largely attributed to the recent resilience of the U.S. economy, which has defied expectations of a sharp slowdown. Persistent inflation, although showing signs of moderation, remains above the Fed's 2% target. This data has prompted the central bank to prioritize taming inflation, even at the potential cost of slower economic growth.

Market Reaction and Expert Analysis

The market's response to the Fed's guidance was swift and largely in line with expectations. The yield on the benchmark 10-year Treasury note experienced a noticeable jump following the announcement. Analysts across Wall Street have offered varied interpretations, with some emphasizing the Fed's commitment to price stability, while others highlight the risks of overtightening monetary policy and potentially triggering a recession.

Several economists believe the Fed's projection is a conservative estimate, designed to leave room for adjustments depending on incoming economic data. This data-dependent approach underscores the uncertainty surrounding the economic outlook and the Fed's commitment to flexibility in its policy response.

What Does This Mean for Investors?

The revised outlook presents a complex landscape for investors. While higher yields on Treasury bonds can be attractive for income-seeking investors, the potential for further interest rate hikes and a prolonged period of higher rates poses risks. Investors are advised to carefully consider their risk tolerance and investment horizon before making any significant portfolio adjustments.

Looking Ahead: Key Factors to Watch

The coming months will be crucial in shaping the trajectory of U.S. Treasury yields. Investors will be closely monitoring key economic indicators, including inflation data, employment figures, and consumer spending, to assess the accuracy of the Fed's projections. Any significant deviation from the expected path could trigger further volatility in the Treasury market. Furthermore, geopolitical events and global economic conditions will continue to play a significant role in influencing investor sentiment and yield movements.

Conclusion: The Fed's projection of a single rate cut in 2025 marks a significant shift in its monetary policy stance. This has directly influenced U.S. Treasury yields, highlighting the interconnectedness of monetary policy decisions and the bond market. As the economic landscape continues to evolve, investors must remain vigilant and adapt their strategies to navigate the complexities of this evolving environment. Staying informed through reputable financial news sources and consulting with financial advisors is crucial in making well-informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut In 2025: Fed's Guidance Impacts U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Woman Denied Service In Cafe Because Of Facial Difference

May 20, 2025

Woman Denied Service In Cafe Because Of Facial Difference

May 20, 2025 -

Final Clausura 2025 Liga Mx Toluca Vs America Previa Posibles Alineaciones Y Donde Ver

May 20, 2025

Final Clausura 2025 Liga Mx Toluca Vs America Previa Posibles Alineaciones Y Donde Ver

May 20, 2025 -

Beyond The Studio 5 Shows You Ll Love If You Enjoyed It

May 20, 2025

Beyond The Studio 5 Shows You Ll Love If You Enjoyed It

May 20, 2025 -

Jon Jones Claims Ufc Hid Aspinall Injury Details From Fans

May 20, 2025

Jon Jones Claims Ufc Hid Aspinall Injury Details From Fans

May 20, 2025 -

Mlb Betting Predictions Walk Off Wagers And Analysis For White Sox Vs Cubs Red Sox Vs Braves

May 20, 2025

Mlb Betting Predictions Walk Off Wagers And Analysis For White Sox Vs Cubs Red Sox Vs Braves

May 20, 2025

Latest Posts

-

Cnn Reports Final Northern Gaza Hospital Hit By Israeli Strikes

May 20, 2025

Cnn Reports Final Northern Gaza Hospital Hit By Israeli Strikes

May 20, 2025 -

Emotional Resonance Over Action The Last Of Us Enduring Appeal

May 20, 2025

Emotional Resonance Over Action The Last Of Us Enduring Appeal

May 20, 2025 -

Jamie Lee Curtis Talks Lindsay Lohan A Post Freaky Friday Friendship Update

May 20, 2025

Jamie Lee Curtis Talks Lindsay Lohan A Post Freaky Friday Friendship Update

May 20, 2025 -

Former Olympic Champion Speaks Out Against Coachs Abusive Methods

May 20, 2025

Former Olympic Champion Speaks Out Against Coachs Abusive Methods

May 20, 2025 -

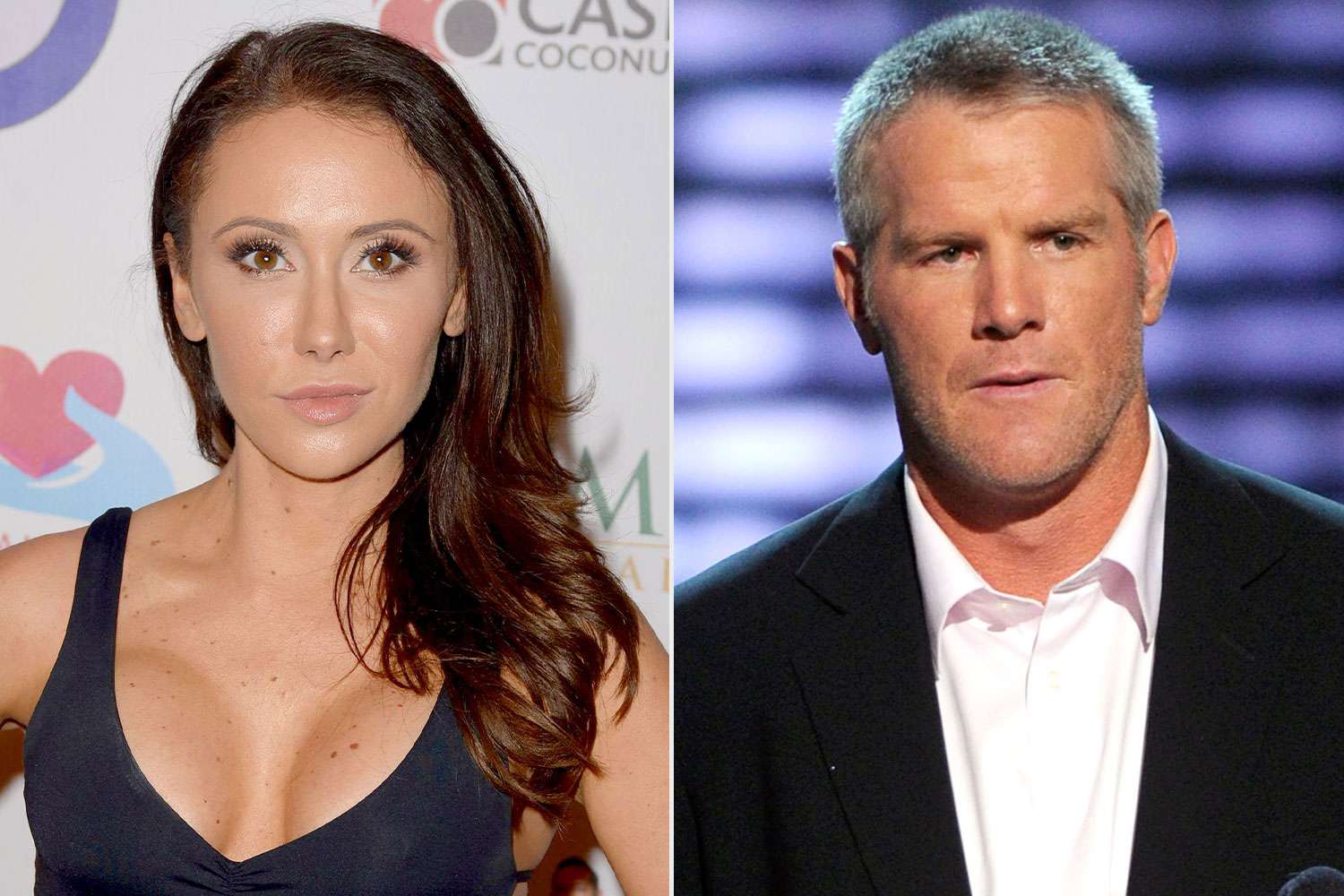

The Brett Favre Scandal Jenn Stergers Account Of Dehumanization

May 20, 2025

The Brett Favre Scandal Jenn Stergers Account Of Dehumanization

May 20, 2025