One Rate Cut Projected: Impact On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut Projected: Impact on US Treasury Yields

The Federal Reserve's potential for a rate cut in 2024 has sent ripples through the financial markets, prompting significant speculation about its impact on US Treasury yields. While the consensus among economists isn't unanimous, the projection of even a single cut has considerable implications for investors and the broader economy. This article delves into the projected rate cut, its potential consequences for US Treasury yields, and what this means for you.

The Fed's Shifting Stance and the Projected Rate Cut

After a period of aggressive interest rate hikes to combat inflation, the Federal Reserve is now signaling a potential shift in its monetary policy. Several economic indicators, including a softening inflation rate and concerns about potential economic slowdown, have led to predictions of at least one interest rate cut in 2024. This shift reflects a delicate balancing act: curbing inflation without triggering a recession. [Link to a reputable source discussing the Fed's recent statements].

Impact on US Treasury Yields: A Deeper Dive

Interest rates and Treasury yields have an inverse relationship. When the Fed cuts interest rates, investors typically anticipate lower returns on government bonds, leading to a decrease in Treasury yields. This is because investors can now earn less from keeping their money in relatively safe havens like Treasury bonds. This decrease, however, is not always immediate or uniform across all maturities.

-

Short-Term Yields: Short-term Treasury yields are expected to be more significantly impacted by a rate cut, potentially dropping more sharply than longer-term yields. This is due to the direct link between short-term rates and the Fed's target rate.

-

Long-Term Yields: Long-term Treasury yields are generally influenced by a broader range of factors, including inflation expectations and economic growth prospects. While a rate cut may exert downward pressure, the impact may be less pronounced compared to short-term yields. The actual effect will depend heavily on market sentiment and investor expectations regarding future economic conditions.

What This Means for Investors

The projected rate cut presents both opportunities and challenges for investors:

-

Bondholders: Existing bondholders may see a decline in the value of their holdings as yields fall. However, lower yields also create opportunities to buy bonds at potentially more attractive prices for future income streams.

-

Stock Investors: A rate cut can be viewed positively by stock investors as it could potentially stimulate economic growth and boost corporate earnings. However, this effect depends on whether the rate cut is effective in achieving its intended outcome without triggering uncontrolled inflation.

-

Savers: Savers might find that the returns on their savings accounts and other interest-bearing instruments decrease. This could prompt a search for alternative investment avenues.

Uncertainty Remains: Factors to Consider

It's crucial to remember that economic forecasts are not guarantees. Several unpredictable factors could influence the actual impact of a rate cut on US Treasury yields:

- Inflation trajectory: Persistent inflation could counter the downward pressure on yields.

- Economic growth: A stronger-than-expected economic recovery could lead to higher yields.

- Geopolitical events: Global events can significantly impact investor sentiment and Treasury yields.

Conclusion: Navigating the Shifting Landscape

The projected rate cut by the Federal Reserve is a significant development with potentially far-reaching consequences for US Treasury yields. Investors and businesses alike need to closely monitor economic indicators and adjust their strategies accordingly. While a rate cut could offer potential benefits, understanding the risks and complexities involved is paramount to successful navigation of this changing economic landscape. Consulting with a financial advisor can provide personalized guidance tailored to your specific investment goals and risk tolerance.

Disclaimer: This article provides general information and should not be considered financial advice. Investment decisions should be made based on your individual circumstances and after consultation with a qualified professional.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut Projected: Impact On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Broken Dreams An Olympic Gold Medalist Exposes The Dark Side Of Elite Sports

May 21, 2025

Broken Dreams An Olympic Gold Medalist Exposes The Dark Side Of Elite Sports

May 21, 2025 -

The Pachyrhinosaurus Die Off New Discoveries From A Canadian Fossil Site

May 21, 2025

The Pachyrhinosaurus Die Off New Discoveries From A Canadian Fossil Site

May 21, 2025 -

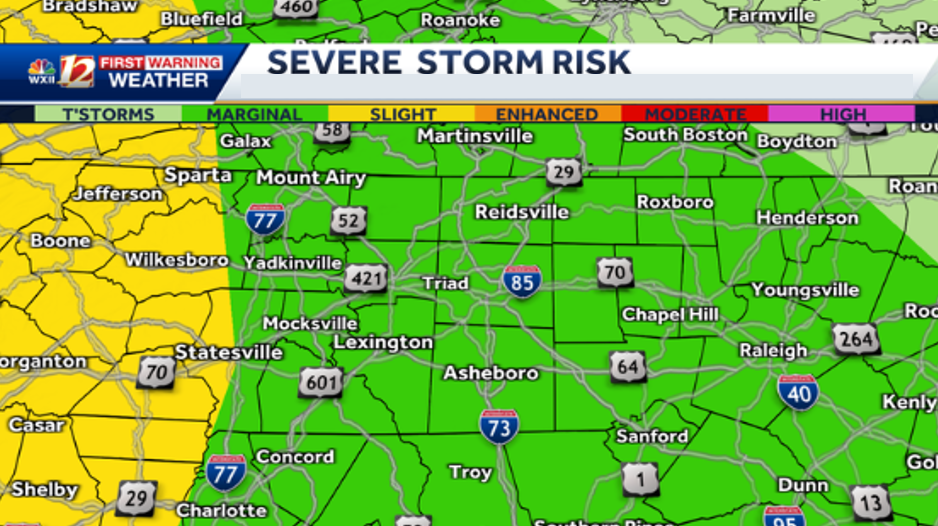

Severe Storm Risk Overnight North Carolina Braces For Heavy Rain

May 21, 2025

Severe Storm Risk Overnight North Carolina Braces For Heavy Rain

May 21, 2025 -

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025 -

Weekly Forecast Rain And Falling Temperatures Predicted

May 21, 2025

Weekly Forecast Rain And Falling Temperatures Predicted

May 21, 2025

Latest Posts

-

Freed Hostage Returns Home Parents Describe Emotional Reunion

May 21, 2025

Freed Hostage Returns Home Parents Describe Emotional Reunion

May 21, 2025 -

Rain Storms And High Winds North Carolina Issues Severe Weather Warning For Tonight

May 21, 2025

Rain Storms And High Winds North Carolina Issues Severe Weather Warning For Tonight

May 21, 2025 -

Drug Smuggling Attempt Foiled Cat Caught Transporting Narcotics In Costa Rica

May 21, 2025

Drug Smuggling Attempt Foiled Cat Caught Transporting Narcotics In Costa Rica

May 21, 2025 -

Ellen De Generes Poignant Tribute Following Family Death

May 21, 2025

Ellen De Generes Poignant Tribute Following Family Death

May 21, 2025 -

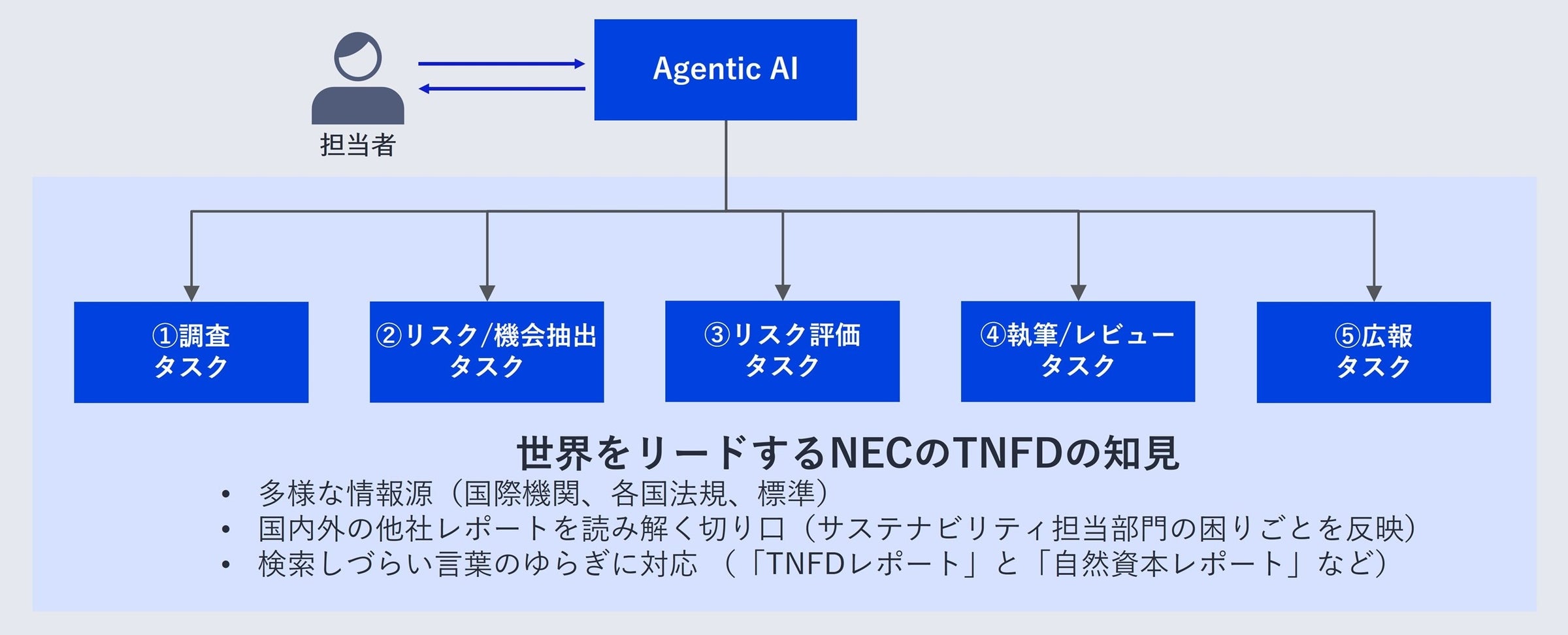

Nec Tnfd Agentic Ai

May 21, 2025

Nec Tnfd Agentic Ai

May 21, 2025