One Rate Cut Projected In 2025: Impact On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One Rate Cut Projected in 2025: How This Impacts US Treasury Yields

The whispers are growing louder: a single interest rate cut is projected by many economists for 2025. This seemingly small shift in the Federal Reserve's (Fed) anticipated policy has significant implications for the US Treasury market, potentially impacting everything from mortgage rates to investor strategies. Understanding these ramifications is crucial for anyone invested in or affected by the US economy.

The Fed's Tightening Cycle and the 2025 Projection

The Federal Reserve has been aggressively raising interest rates throughout 2022 and 2023 in a bid to combat persistent inflation. This tightening cycle has pushed up US Treasury yields, making them more attractive to investors seeking higher returns. However, the projection of a single rate cut in 2025 suggests a belief that inflation will be tamed by then, allowing the Fed to ease its monetary policy.

Impact on US Treasury Yields: A Downward Trend?

This anticipated rate cut is expected to lead to a decline in US Treasury yields. The inverse relationship between interest rates and bond prices means that as interest rates fall, the prices of existing Treasury bonds rise. This rise in price translates to lower yields for investors buying new bonds.

- Reduced Demand: With the prospect of lower rates, the demand for higher-yielding existing Treasury bonds might decrease slightly in the short-term, potentially causing a temporary dip before the actual rate cut.

- Long-Term Implications: However, the long-term impact is likely to be a gradual downward trend in yields as the market anticipates the Fed's shift in policy. This makes longer-term Treasuries potentially more attractive to investors seeking stability and capital preservation.

- Uncertainty Remains: It's crucial to remember that this is a projection, and economic forecasts are inherently uncertain. Unforeseen economic shocks or a resurgence of inflation could easily alter the Fed's plans, potentially impacting Treasury yields in unpredictable ways.

How This Affects Investors

The projected rate cut presents both opportunities and challenges for investors:

- Bond Investors: Existing bondholders could see an increase in the value of their holdings as yields fall. However, new investors might find lower returns on newly issued bonds.

- Mortgage Rates: A rate cut could lead to slightly lower mortgage rates, making homeownership more affordable. However, the impact might be limited depending on other market forces.

- Stock Market: Lower interest rates can generally be positive for the stock market, as borrowing becomes cheaper for companies and investors might shift towards higher-risk assets.

What to Watch For

Keeping a close eye on key economic indicators like inflation, unemployment, and GDP growth is crucial. These factors will heavily influence the Fed's decision-making process and ultimately affect the trajectory of Treasury yields. Furthermore, paying attention to the Fed's communication and any revisions to their projections is essential for informed investment decisions.

Conclusion: Navigating Uncertainty

The projected single rate cut in 2025 introduces a layer of complexity to the US Treasury market. While a downward trend in yields is anticipated, uncertainty remains. Investors and market participants should carefully consider these projections alongside a comprehensive risk assessment and stay informed about evolving economic conditions. Consulting a financial advisor can provide personalized guidance tailored to your specific investment goals and risk tolerance. Remember, this information is for educational purposes only and is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One Rate Cut Projected In 2025: Impact On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Last Of Us A Masterclass In Emotional Storytelling Without Relentless Action

May 20, 2025

The Last Of Us A Masterclass In Emotional Storytelling Without Relentless Action

May 20, 2025 -

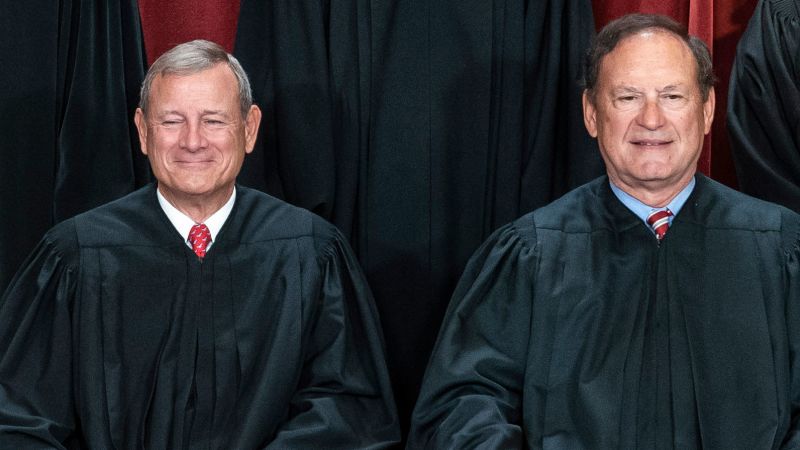

Thirty Years On The Bench Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025

Thirty Years On The Bench Reflecting On Alito And Roberts Supreme Court Careers

May 20, 2025 -

New Peaky Blinders Series Confirmed What We Know About The Big Change

May 20, 2025

New Peaky Blinders Series Confirmed What We Know About The Big Change

May 20, 2025 -

Down To The Wire Eu And Uk Clash Over Final Brexit Deal

May 20, 2025

Down To The Wire Eu And Uk Clash Over Final Brexit Deal

May 20, 2025 -

Snls 50th Season Ends On A High Note Record Breaking Numbers

May 20, 2025

Snls 50th Season Ends On A High Note Record Breaking Numbers

May 20, 2025

Latest Posts

-

Heartbreaking And Brilliant Why The Last Of Uss Pacing Works

May 20, 2025

Heartbreaking And Brilliant Why The Last Of Uss Pacing Works

May 20, 2025 -

Brexit Betrayal Eu And Uk Leaders Face Tense Final Negotiations

May 20, 2025

Brexit Betrayal Eu And Uk Leaders Face Tense Final Negotiations

May 20, 2025 -

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025

Jon Joness Explosive Accusation Ufc Covered Up Aspinalls Injury

May 20, 2025 -

Assessing The Damage St Louis Grapples With Aftermath Of Rare Tornado

May 20, 2025

Assessing The Damage St Louis Grapples With Aftermath Of Rare Tornado

May 20, 2025 -

Childs Pacifier And Thumb Age Appropriate Weaning Strategies For Parents

May 20, 2025

Childs Pacifier And Thumb Age Appropriate Weaning Strategies For Parents

May 20, 2025