One-Year Reprieve Sought For Farm Inheritance Tax

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

One-Year Reprieve Sought for Farm Inheritance Tax: A Crucial Fight for Family Farms

The future of family farms across the nation hangs in the balance as a significant push for a one-year reprieve on inheritance tax is gaining momentum. Farmers and agricultural advocates are lobbying intensely for a temporary suspension, arguing that the current economic climate is crippling their ability to meet the often-substantial tax burdens associated with inheriting farmland. This isn't just about money; it's about preserving a vital part of our national heritage and ensuring food security for generations to come.

The Crushing Weight of Inheritance Tax on Family Farms

Inheritance tax, also known as estate tax, can be particularly devastating for family farms. These businesses often possess significant assets – land, equipment, livestock – which inflate the overall estate value, leading to massive tax liabilities upon the death of the owner. Unlike other businesses, which can be easily liquidated to cover tax obligations, farmland is often the heart of the family operation and difficult to sell quickly without significant financial loss. This leaves heirs facing impossible choices: sell the farm to pay the tax or face crippling debt, potentially forcing them out of business.

Why a One-Year Reprieve is Critical

The current economic downturn, coupled with rising inflation and fluctuating commodity prices, has placed immense pressure on farmers already struggling to maintain profitability. Advocates argue that a one-year moratorium on inheritance tax would provide crucial breathing room, allowing families time to:

- Develop a comprehensive financial plan: This includes exploring options like refinancing, selling non-essential assets, or seeking government assistance programs designed to support family farms.

- Negotiate favorable terms with creditors: A temporary reprieve could alleviate immediate financial stress, enabling farmers to negotiate more favorable repayment schedules.

- Explore alternative inheritance strategies: Families can consult with estate planners to develop strategies that minimize future tax burdens while preserving the long-term viability of the farm.

The Political Landscape and Ongoing Debate

The campaign for a one-year reprieve is facing an uphill battle. While bipartisan support exists for aiding family farmers, disagreements persist on the best approach. Some propose targeted tax relief specifically for agricultural businesses, while others advocate for broader changes to the inheritance tax system.

The debate highlights the complex interplay between economic policy, agricultural sustainability, and family legacy. The ongoing discussion requires careful consideration of the long-term implications for food security and the economic well-being of rural communities.

Looking Ahead: What Happens Next?

The coming months will be crucial in determining the fate of this crucial legislation. Farmers and agricultural organizations are intensifying their lobbying efforts, engaging in grassroots activism, and partnering with lawmakers to build broader support for the one-year reprieve. The outcome will significantly impact the future of family farming and the nation's agricultural landscape.

Call to Action: Stay informed about this critical issue. Contact your local representatives and urge them to support legislation providing a one-year reprieve on inheritance tax for family farms. The future of farming, and the food on our tables, depends on it. Learn more by visiting [link to relevant agricultural advocacy organization].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on One-Year Reprieve Sought For Farm Inheritance Tax. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Slowing Ocean Currents Supercharging Us Sea Level Rise

May 18, 2025

Slowing Ocean Currents Supercharging Us Sea Level Rise

May 18, 2025 -

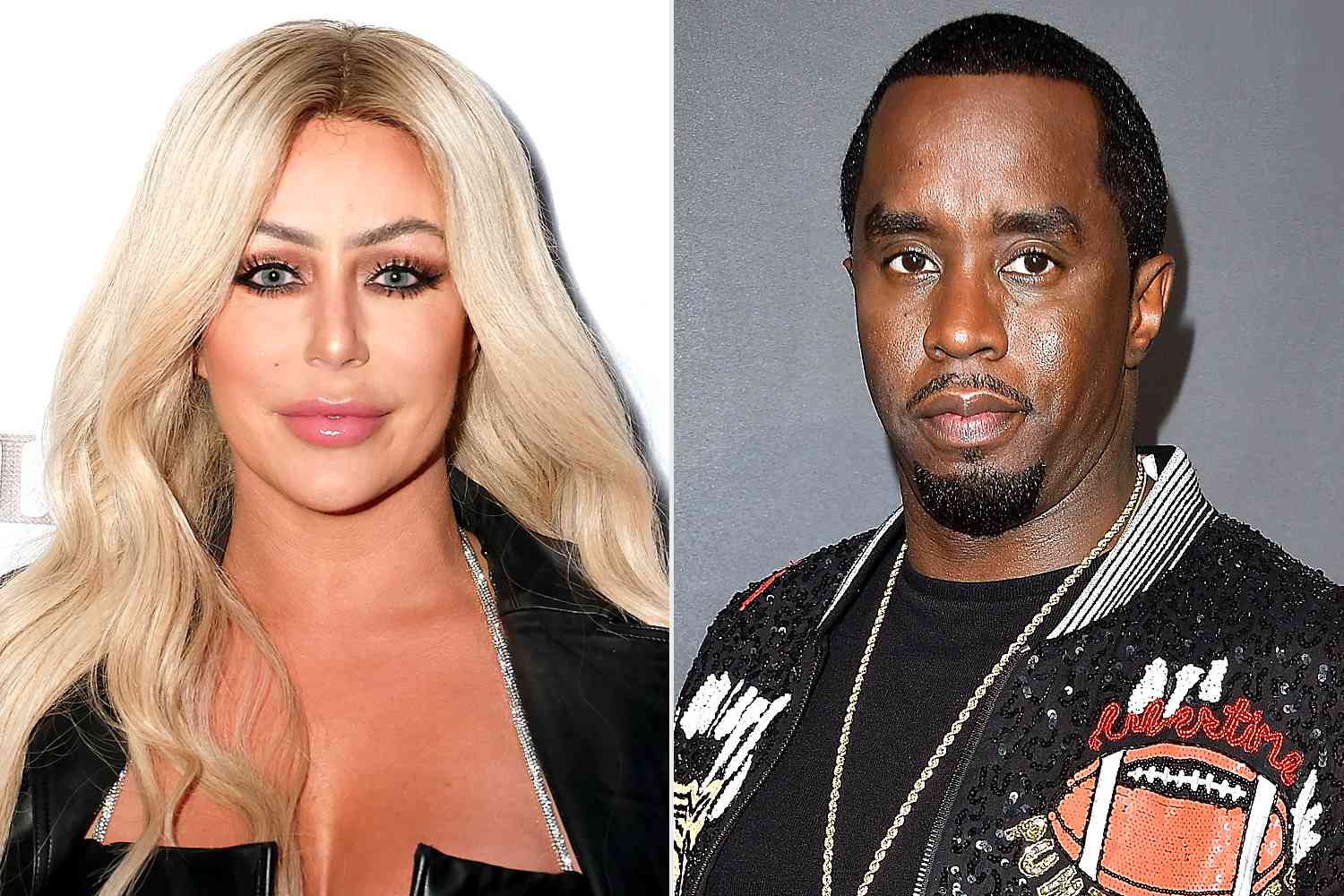

Aubrey O Day Skips Sean Diddy Combs Trial No Subpoena Issued

May 18, 2025

Aubrey O Day Skips Sean Diddy Combs Trial No Subpoena Issued

May 18, 2025 -

Trump Putin Summit Key To Resolving Ukraine Conflict

May 18, 2025

Trump Putin Summit Key To Resolving Ukraine Conflict

May 18, 2025 -

Rediscovering Cannes A Look At Ludicrous Pre Camera Phone Images

May 18, 2025

Rediscovering Cannes A Look At Ludicrous Pre Camera Phone Images

May 18, 2025 -

Key Moments From The Sean Diddy Combs Trial Testimony Continues

May 18, 2025

Key Moments From The Sean Diddy Combs Trial Testimony Continues

May 18, 2025

Latest Posts

-

Cassinos Online Com Slots Brasileiros Ganhe Giros Gratis

May 18, 2025

Cassinos Online Com Slots Brasileiros Ganhe Giros Gratis

May 18, 2025 -

Government Announces Eu Agreement And Winter Fuel Policy Reversal

May 18, 2025

Government Announces Eu Agreement And Winter Fuel Policy Reversal

May 18, 2025 -

The Subway Series Most Hated Mets And Yankees Players

May 18, 2025

The Subway Series Most Hated Mets And Yankees Players

May 18, 2025 -

Exclusive Interview Jeffrey Dean Morgan On Destination X And Future Projects

May 18, 2025

Exclusive Interview Jeffrey Dean Morgan On Destination X And Future Projects

May 18, 2025 -

Diddys Text To Cassie After Hotel Assault The Full Story

May 18, 2025

Diddys Text To Cassie After Hotel Assault The Full Story

May 18, 2025