OpenAI CEO Sam Altman On The Dangers Facing Today's Financial System

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OpenAI CEO Sam Altman Sounds the Alarm on Financial System Dangers

OpenAI's CEO, Sam Altman, a prominent figure in the world of artificial intelligence, recently issued a stark warning about the vulnerabilities plaguing today's financial system. His comments, delivered at a high-profile tech conference and subsequently shared across various media outlets, have sparked widespread debate among economists, technologists, and investors. Altman's concerns aren't about a singular impending crisis, but rather a confluence of interconnected risks that could trigger significant instability.

The Growing Threat of AI-Driven Instability

While Altman is a leading figure in AI development, his warning isn't solely focused on the technology he helps create. Instead, he highlights how the rapid integration of AI into financial markets, while offering potential benefits, also introduces unprecedented risks. He points to the potential for algorithmic trading gone wrong, the increased susceptibility to sophisticated fraud, and the challenges of regulating AI-driven financial decisions. These concerns are amplified by the lack of clear regulatory frameworks designed to address these emerging issues.

- Algorithmic Trading Risks: The reliance on high-frequency trading algorithms, often operating at speeds far exceeding human comprehension, creates the potential for cascading failures and market crashes. A single unforeseen event or bug could trigger a domino effect with far-reaching consequences.

- Sophisticated Fraud & Cyberattacks: AI can be leveraged by malicious actors to create increasingly sophisticated fraud schemes and cyberattacks targeting financial institutions. The speed and complexity of these attacks can overwhelm traditional security measures.

- Regulatory Challenges: The rapidly evolving nature of AI in finance makes it incredibly difficult for regulators to keep pace. The lack of clear guidelines and regulations creates a fertile ground for risk and uncertainty.

Beyond AI: Systemic Risks and Systemic Solutions

Altman’s concerns extend beyond AI's impact. He also emphasizes the inherent fragilities within the existing financial system, citing factors such as:

- High Levels of Debt: Globally elevated debt levels leave many economies vulnerable to economic shocks. A sudden downturn could trigger a cascade of defaults and bankruptcies.

- Geopolitical Instability: Escalating global tensions and geopolitical uncertainty introduce significant volatility into financial markets, exacerbating existing risks.

- Climate Change Impacts: The increasing frequency and severity of climate-related disasters pose substantial financial risks, particularly for insurers and investors in vulnerable sectors.

"We need a coordinated, global approach to mitigate these risks," Altman reportedly stated. He advocated for greater international cooperation and proactive regulatory measures to ensure the stability and resilience of the global financial system. This includes investing in robust cybersecurity infrastructure, fostering greater transparency in algorithmic trading, and developing comprehensive regulatory frameworks specifically tailored to the unique challenges posed by AI in finance.

The Call for Action: Collaboration and Innovation

Altman's warnings serve as a crucial call to action for policymakers, financial institutions, and technology companies alike. Addressing these interconnected risks requires a collaborative and innovative approach, leveraging the power of technology while simultaneously mitigating its potential downsides. The future of the global financial system hinges on proactive measures to navigate these challenges. Further discussion and research are urgently needed to establish effective safeguards and prevent a potential crisis. Failing to act decisively could have severe and lasting consequences. This is not merely a technological issue; it is a systemic one requiring a multi-pronged and globally coordinated response.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OpenAI CEO Sam Altman On The Dangers Facing Today's Financial System. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Artie Burns Acl Injury A Serious Setback For The Dolphins

Jul 24, 2025

Artie Burns Acl Injury A Serious Setback For The Dolphins

Jul 24, 2025 -

The Hunting Wives Netflixs New Series Explores Wealth Power And Murder

Jul 24, 2025

The Hunting Wives Netflixs New Series Explores Wealth Power And Murder

Jul 24, 2025 -

Investigation Uncovers Ex Union Boss Mc Cluskeys Use Of Private Jets Funded By Building Firm

Jul 24, 2025

Investigation Uncovers Ex Union Boss Mc Cluskeys Use Of Private Jets Funded By Building Firm

Jul 24, 2025 -

Bradford Murder Case Life Sentence For Husband Who Killed Wife

Jul 24, 2025

Bradford Murder Case Life Sentence For Husband Who Killed Wife

Jul 24, 2025 -

Ghislaine Maxwell Us Department Of Justice Requests Meeting

Jul 24, 2025

Ghislaine Maxwell Us Department Of Justice Requests Meeting

Jul 24, 2025

Latest Posts

-

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

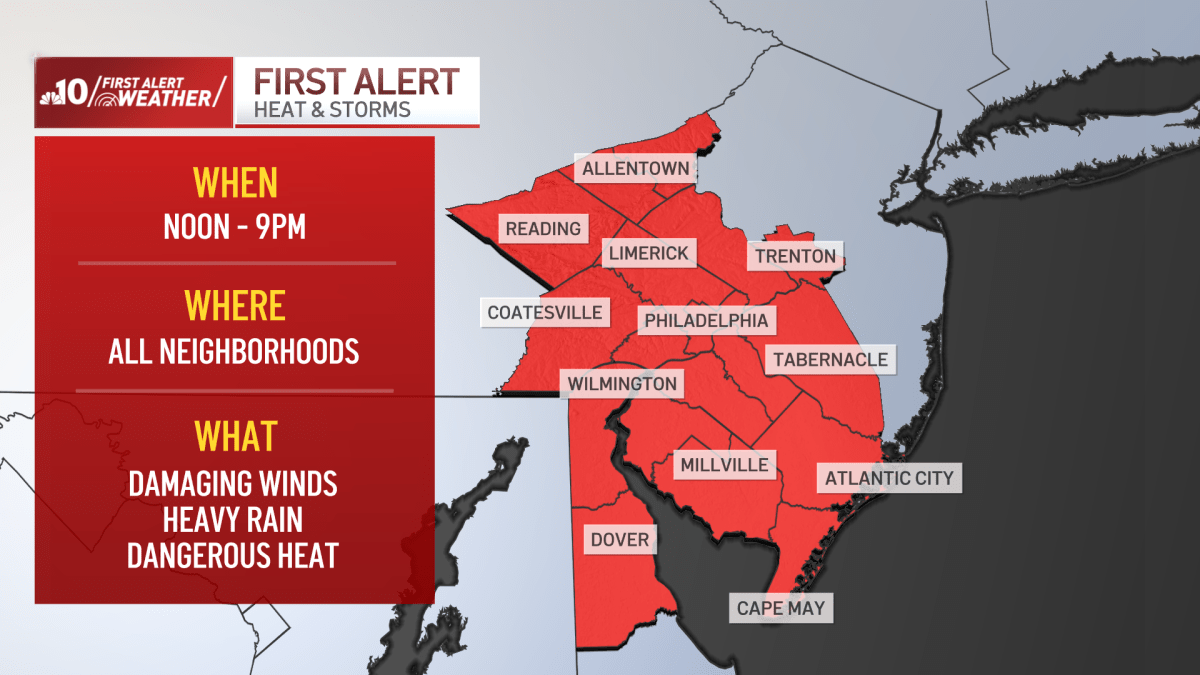

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025 -

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025

Confirmed Anne Burrell Died By Suicide Investigation Concludes

Jul 26, 2025