Options Trading On Broadcom: A Pre-Earnings Analysis And Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Options Trading on Broadcom: A Pre-Earnings Analysis and Strategy

Broadcom (AVGO) is gearing up for its upcoming earnings announcement, presenting a compelling opportunity for options traders. This pre-earnings analysis will explore potential strategies, considering the company's recent performance, market sentiment, and historical volatility. Whether you're a seasoned options trader or just starting out, understanding the risks and rewards involved is crucial before taking a position.

Broadcom's Recent Performance and Future Outlook:

Broadcom, a leading provider of semiconductor and infrastructure software solutions, has experienced significant growth in recent years. However, the current macroeconomic environment, including concerns about inflation and a potential recession, introduces uncertainty. Recent quarterly reports have shown [insert specific recent performance data, e.g., revenue growth, EPS, etc., citing the source]. Analysts' forecasts for the upcoming earnings are varied, with some predicting strong results driven by [mention specific growth drivers, e.g., strong demand for 5G infrastructure, data center solutions, etc.], while others express caution due to [mention potential headwinds, e.g., supply chain disruptions, weakening consumer demand, etc.]. This divergence of opinion creates ideal conditions for options trading strategies.

Analyzing Implied Volatility (IV):

Before implementing any options strategy, understanding implied volatility (IV) is paramount. IV reflects the market's expectation of future price fluctuations. High IV generally means options are more expensive, offering potentially higher profits but also increased risk. Conversely, low IV presents opportunities for lower-cost options but potentially smaller returns. Analyzing AVGO's historical IV around previous earnings announcements can provide valuable insights into expected volatility for the upcoming report. You can use options chain data from your brokerage platform to track IV changes over time.

Potential Options Trading Strategies:

Several strategies can be employed before Broadcom's earnings announcement, each carrying different risk profiles:

-

Long Straddle/Strangle: A straddle (buying a call and put with the same strike price and expiration) or a strangle (buying a call and put with different strike prices) are suitable for traders anticipating significant price movement in either direction. These strategies profit most from large price swings but lose money if the price remains relatively stable.

-

Short Straddle/Strangle: The opposite of the above, this strategy profits from price stability. However, it's extremely risky and can lead to substantial losses if the price moves significantly. This strategy requires a high level of confidence in your price prediction.

-

Bullish/Bearish Call/Put Spreads: These strategies offer defined risk and reward profiles, making them suitable for traders with specific price expectations. A bullish call spread profits if the price rises above a certain level, while a bearish put spread profits if the price falls below a certain level.

Risk Management is Crucial:

Options trading involves significant risk. Before implementing any strategy, it's crucial to:

- Define your risk tolerance: Determine the maximum amount you're willing to lose.

- Set stop-loss orders: Protect yourself from catastrophic losses.

- Diversify your portfolio: Don't put all your eggs in one basket.

- Thoroughly research the underlying asset: Understand the company's fundamentals and the factors that could impact its price.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Options trading involves substantial risk, and you could lose more than your initial investment. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about market trends and Broadcom's performance by following reputable financial news sources. Careful planning and risk management are key to successful options trading. What are your thoughts on Broadcom's upcoming earnings? Share your strategies and insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Options Trading On Broadcom: A Pre-Earnings Analysis And Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Derbyshire National Trust Site Covers Up Vandalized J K Rowling Artwork

Jun 06, 2025

Derbyshire National Trust Site Covers Up Vandalized J K Rowling Artwork

Jun 06, 2025 -

New Black Panther Marvel Faces Backlash After Shocking Announcement

Jun 06, 2025

New Black Panther Marvel Faces Backlash After Shocking Announcement

Jun 06, 2025 -

Supreme Court Weighs In On Reverse Discrimination Case Woman Prevails

Jun 06, 2025

Supreme Court Weighs In On Reverse Discrimination Case Woman Prevails

Jun 06, 2025 -

Update Body Recovered In Search For Missing Man From Scottish Stag Party In Portugal

Jun 06, 2025

Update Body Recovered In Search For Missing Man From Scottish Stag Party In Portugal

Jun 06, 2025 -

Reverse Discrimination Suits Easier After Supreme Court Sides With Plaintiff

Jun 06, 2025

Reverse Discrimination Suits Easier After Supreme Court Sides With Plaintiff

Jun 06, 2025

Latest Posts

-

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025 -

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025 -

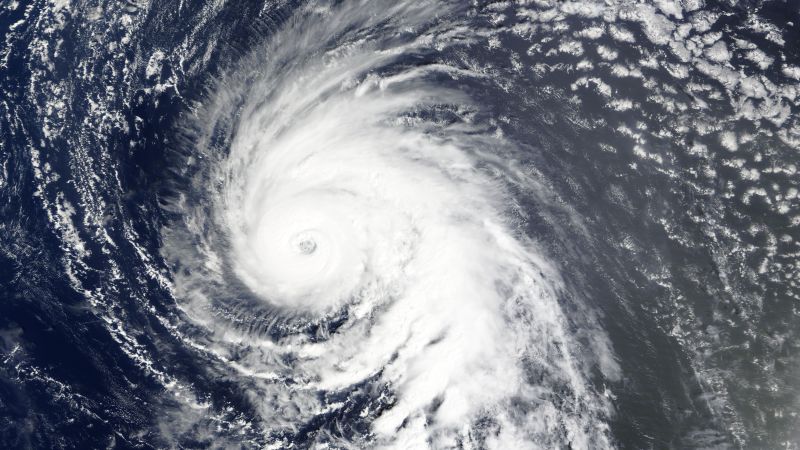

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025 -

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025