Over $5 Billion Invested In Bitcoin ETFs: Fueling Market Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Fueling Market Growth?

The cryptocurrency market is buzzing with excitement as investments in Bitcoin exchange-traded funds (ETFs) surpass the staggering $5 billion mark. This monumental influx of capital begs the question: is this a significant catalyst for sustained market growth, or merely a temporary surge? Let's delve into the implications of this investment boom and explore its potential impact on the future of Bitcoin.

The Rise of Bitcoin ETFs:

The recent surge in Bitcoin ETF investments signifies a growing institutional acceptance of cryptocurrencies as a viable asset class. Previously, many institutional investors were hesitant due to regulatory uncertainty and the perceived volatility of the market. However, the approval of several Bitcoin ETFs in major markets like the US has dramatically shifted the landscape. This increased accessibility has opened the doors for a wider range of investors, from pension funds to individual retail investors, to gain exposure to Bitcoin without directly holding the cryptocurrency.

Factors Driving Investment:

Several factors contribute to this substantial investment in Bitcoin ETFs:

- Regulatory Clarity: The approval of regulated Bitcoin ETFs in key markets provides a level of comfort and legitimacy that previously wasn't available. This reduces regulatory risk and encourages larger-scale investments.

- Inflation Hedge: With persistent inflationary pressures globally, Bitcoin is increasingly viewed as a potential hedge against inflation, driving demand from investors seeking to preserve their capital.

- Institutional Adoption: The growing adoption of Bitcoin by institutional investors, including large asset management firms, signals a shift in market sentiment and adds credibility to the asset.

- Technological Advancements: Continued development within the Bitcoin ecosystem, such as the Lightning Network for faster and cheaper transactions, further enhances its appeal.

Fueling Market Growth – But With Caveats:

While the $5 billion invested in Bitcoin ETFs undeniably represents a significant boost to the market, it's crucial to consider the potential downsides.

- Volatility Remains: Bitcoin's inherent volatility remains a key concern. While ETFs offer a degree of diversification, they are still subject to the price fluctuations of the underlying asset.

- Market Manipulation: Concerns about market manipulation persist, particularly in the context of smaller, less regulated exchanges. While regulated ETFs mitigate this risk to some extent, complete elimination is unlikely.

- Regulatory Uncertainty (Long-term): While recent approvals have been positive, regulatory landscapes can change rapidly. Future regulatory hurdles could impact the growth trajectory of Bitcoin ETFs.

The Future of Bitcoin ETFs and Market Growth:

The massive investment in Bitcoin ETFs is undoubtedly a significant development, potentially signaling a new era of mainstream adoption for cryptocurrencies. However, predicting the long-term impact requires a nuanced approach. While it's likely to contribute to sustained market growth, the inherent volatility and lingering regulatory uncertainties should be carefully considered.

What this means for investors:

This surge in investment underlines the importance of thorough research and risk management. While Bitcoin ETFs offer a relatively accessible entry point, investors should understand the risks involved before committing capital. Diversification within a broader portfolio is crucial to mitigate the volatility associated with Bitcoin.

Conclusion:

The over $5 billion invested in Bitcoin ETFs represents a pivotal moment in the cryptocurrency market. It's a powerful testament to growing institutional acceptance and potentially a significant catalyst for future growth. However, investors must remain aware of the inherent risks and proceed with caution, relying on sound financial advice and thorough due diligence. The long-term impact remains to be seen, but the current trend is undeniably positive. Stay informed and stay tuned for further developments in this rapidly evolving market. Learn more about investing in Bitcoin ETFs by [linking to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Fueling Market Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Ww 1 Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Now Streaming

May 20, 2025

New Ww 1 Epic Featuring Daniel Craig Cillian Murphy And Tom Hardy Now Streaming

May 20, 2025 -

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025 -

Toledo Mud Hens Secure Victory Against Rail Riders Game Recap

May 20, 2025

Toledo Mud Hens Secure Victory Against Rail Riders Game Recap

May 20, 2025 -

Deadline Looms Brexit Talks Reach Critical Point With Claims Of Broken Promises

May 20, 2025

Deadline Looms Brexit Talks Reach Critical Point With Claims Of Broken Promises

May 20, 2025 -

Ethereum Investment Surge 200 Million Inflow Post Pectra Upgrade

May 20, 2025

Ethereum Investment Surge 200 Million Inflow Post Pectra Upgrade

May 20, 2025

Latest Posts

-

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025

The Unexpected Friendship Jamie Lee Curtis And Lindsay Lohans Close Bond

May 20, 2025 -

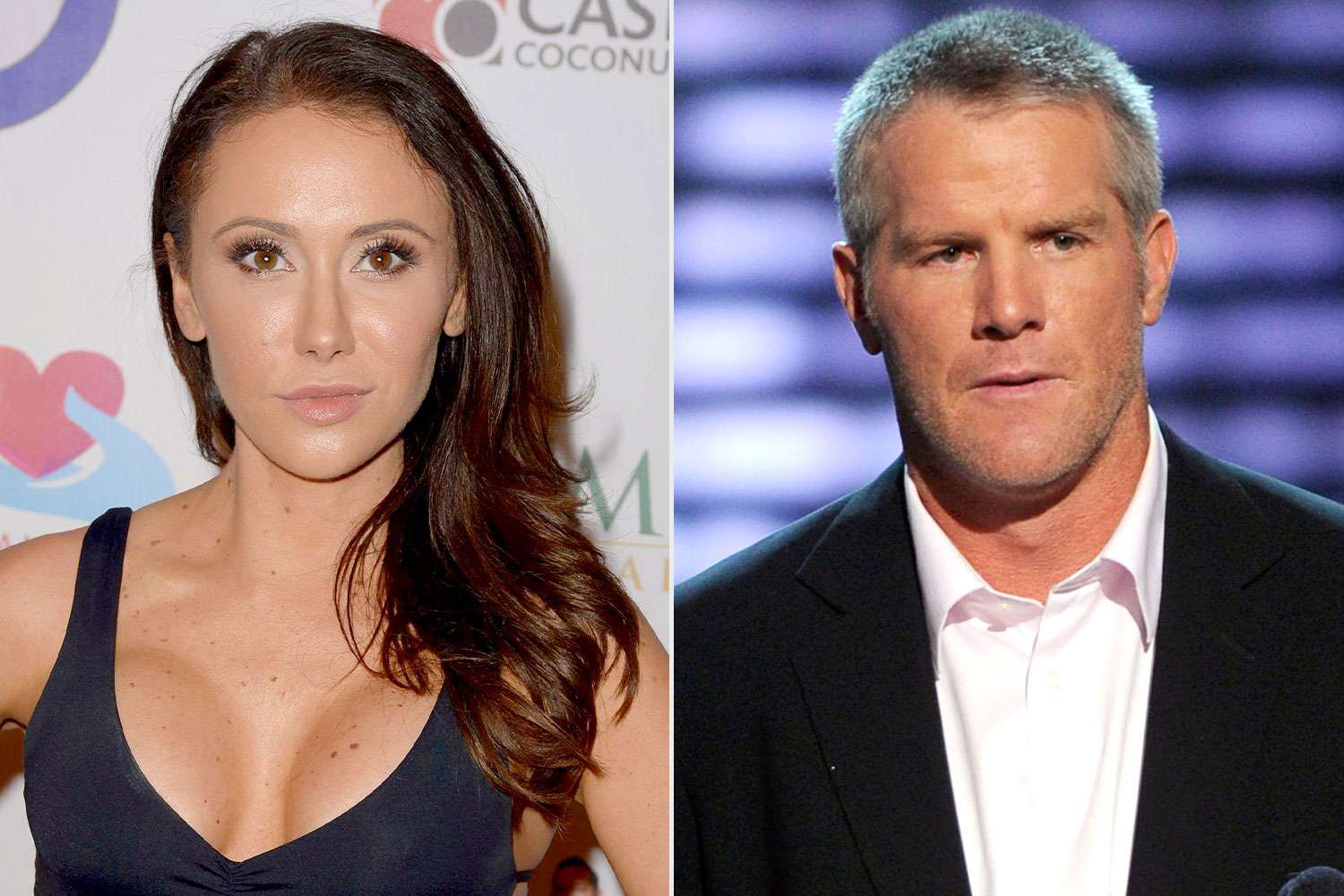

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025 -

Urgent Security Breach Legal Aid Firm Suffers Data Loss Including Criminal Records

May 20, 2025

Urgent Security Breach Legal Aid Firm Suffers Data Loss Including Criminal Records

May 20, 2025 -

Tragic Railroad Accident Two Adults Killed Children Injured And Missing

May 20, 2025

Tragic Railroad Accident Two Adults Killed Children Injured And Missing

May 20, 2025 -

May 15th Helldivers 2 Master Of Ceremony Warbonds Go Live

May 20, 2025

May 15th Helldivers 2 Master Of Ceremony Warbonds Go Live

May 20, 2025