Over $5 Billion Pours Into Bitcoin ETFs: Analyzing The Recent Investment Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Pours into Bitcoin ETFs: Analyzing the Recent Investment Boom

The cryptocurrency market is buzzing. A recent surge in investment has seen over $5 billion flood into Bitcoin exchange-traded funds (ETFs), marking a significant milestone for Bitcoin's mainstream adoption and institutional acceptance. This unprecedented influx raises several key questions: What's driving this investment boom? What does it mean for the future of Bitcoin? And are there potential risks investors should be aware of?

This article delves into the recent surge in Bitcoin ETF investment, analyzing the contributing factors and exploring the implications for the cryptocurrency market.

H2: The Catalyst for the Bitcoin ETF Boom:

Several factors have converged to fuel this remarkable investment surge in Bitcoin ETFs. These include:

-

SEC Approval: The pivotal moment came with the SEC's approval of the first spot Bitcoin ETFs. This regulatory green light signaled a significant shift in the perception of Bitcoin, legitimizing it in the eyes of many institutional investors who were previously hesitant due to regulatory uncertainty. This approval opened the floodgates for investment.

-

Institutional Adoption: Large institutional investors, such as pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a hedge against inflation and a store of value. Bitcoin ETFs offer a more regulated and accessible entry point for these institutions compared to directly purchasing Bitcoin.

-

Growing Investor Confidence: Despite market volatility, growing investor confidence in Bitcoin's long-term potential is a key driver. Many see Bitcoin as a decentralized alternative to traditional financial systems, and the increasing adoption of blockchain technology further reinforces this view. The perceived scarcity of Bitcoin, with a limited supply of 21 million coins, also contributes to its appeal as a potential store of value.

-

Ease of Access and Regulation: Bitcoin ETFs offer a streamlined and regulated pathway for investors to gain exposure to Bitcoin. Unlike directly buying and holding Bitcoin, which involves navigating the complexities of cryptocurrency exchanges and wallets, ETFs provide a familiar and regulated investment vehicle accessible through standard brokerage accounts.

H2: Implications for the Future of Bitcoin:

The massive influx of capital into Bitcoin ETFs has significant implications for the future of Bitcoin:

-

Increased Price Volatility: While the increased institutional investment brings stability in the long term, it may initially lead to increased price volatility in the short term, as large trades impact the market.

-

Mainstream Adoption: The success of Bitcoin ETFs is accelerating Bitcoin's journey towards mainstream adoption. This increased accessibility is making Bitcoin more appealing to a wider range of investors, further solidifying its position as a significant asset class.

-

Further Innovation: The success of Bitcoin ETFs will likely encourage further innovation in the cryptocurrency space, leading to the development of new and improved investment products. We can expect to see more sophisticated and diverse ETF offerings in the future.

H2: Potential Risks and Considerations:

While the current investment boom is exciting, investors should remain aware of the inherent risks involved in cryptocurrency investments:

-

Market Volatility: The cryptocurrency market is inherently volatile. Bitcoin's price can fluctuate significantly in short periods, potentially leading to substantial losses for investors.

-

Regulatory Uncertainty: Although the SEC's approval is a positive step, regulatory landscapes can change, and future regulations could impact the Bitcoin ETF market.

-

Security Risks: While ETFs offer a more secure investment route than directly holding Bitcoin, security breaches in the underlying infrastructure remain a possibility.

H2: Conclusion:

The over $5 billion poured into Bitcoin ETFs represents a watershed moment for the cryptocurrency market. This surge in investment signifies growing institutional acceptance, mainstream adoption, and a strengthening belief in Bitcoin's long-term potential. While risks remain, this significant investment influx points towards a potentially bright future for Bitcoin and the broader cryptocurrency landscape. Investors should always conduct thorough research and consider their risk tolerance before investing in any cryptocurrency-related asset. For further insights into cryptocurrency investment, consider exploring resources such as [link to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Pours Into Bitcoin ETFs: Analyzing The Recent Investment Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Feline Drug Runner Cat Apprehended In Costa Rican Prison Smuggling Operation

May 21, 2025

Feline Drug Runner Cat Apprehended In Costa Rican Prison Smuggling Operation

May 21, 2025 -

What Is Femicide And Why Are Incidents Increasing A Critical Analysis

May 21, 2025

What Is Femicide And Why Are Incidents Increasing A Critical Analysis

May 21, 2025 -

Bbc Faces Backlash After Linekers Potential Exit

May 21, 2025

Bbc Faces Backlash After Linekers Potential Exit

May 21, 2025 -

Report Reveals Lufthansa Flights 10 Minute Pilotless Operation After Co Pilot Faint

May 21, 2025

Report Reveals Lufthansa Flights 10 Minute Pilotless Operation After Co Pilot Faint

May 21, 2025 -

Water Vole Conservation The Surprising Role Of Glitter In Wales Ecosystems

May 21, 2025

Water Vole Conservation The Surprising Role Of Glitter In Wales Ecosystems

May 21, 2025

Latest Posts

-

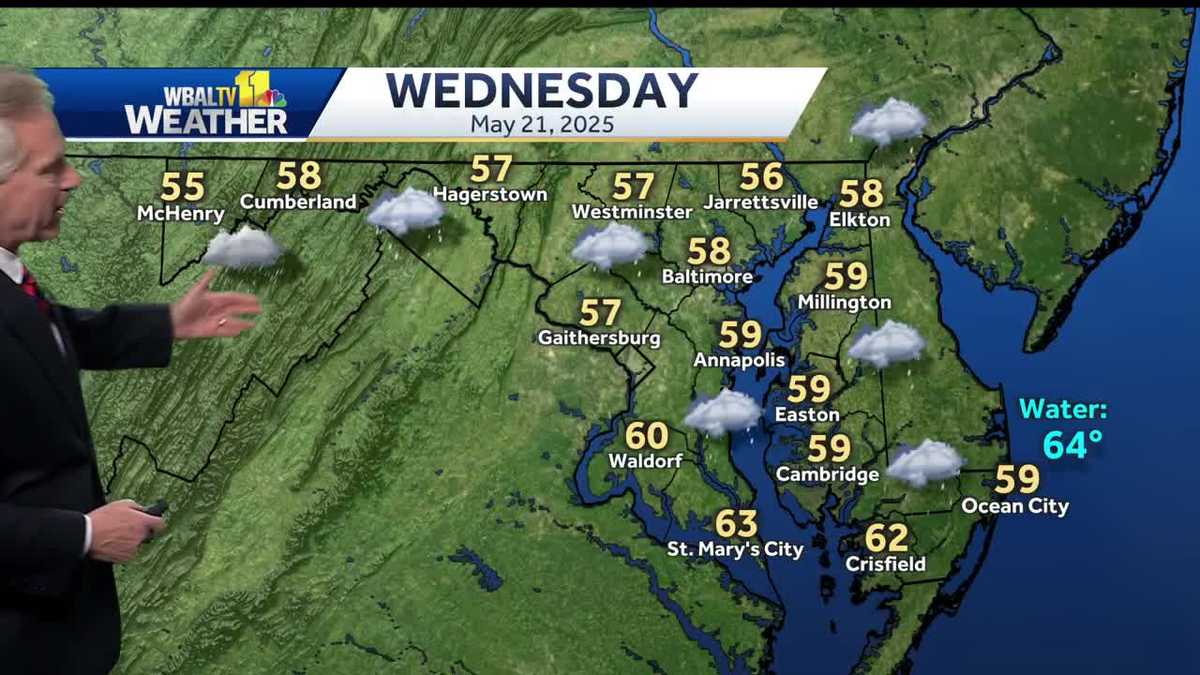

Rain And Chilly Temperatures Sweep Across Region Wednesday

May 21, 2025

Rain And Chilly Temperatures Sweep Across Region Wednesday

May 21, 2025 -

Irreplaceable Ellen De Generes Emotional Tribute Following Family Death

May 21, 2025

Irreplaceable Ellen De Generes Emotional Tribute Following Family Death

May 21, 2025 -

Dork Politicians Tim Dillons Candid Cnn Interview Sparks Debate

May 21, 2025

Dork Politicians Tim Dillons Candid Cnn Interview Sparks Debate

May 21, 2025 -

Abandoned Chicks Delaware Shelter Seeks Help After Usps Delivery Disaster

May 21, 2025

Abandoned Chicks Delaware Shelter Seeks Help After Usps Delivery Disaster

May 21, 2025 -

Outrage As New Law Impacts Paedophiles Parental Rights Family Speaks Out

May 21, 2025

Outrage As New Law Impacts Paedophiles Parental Rights Family Speaks Out

May 21, 2025