Palantir Stock Continues Decline: Six-Day Losing Streak And Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palantir Stock Continues Decline: Six-Day Losing Streak Sparks Market Analysis

Palantir Technologies (PLTR) stock has experienced a significant downturn, plunging for a sixth consecutive day. This prolonged slide has sent ripples through the market, prompting analysts to dissect the contributing factors and predict the future trajectory of this data analytics giant. The question on everyone's mind: is this a temporary setback, or a sign of deeper underlying issues?

The stock's recent performance has been undeniably bleak. The six-day losing streak represents a substantial drop, eroding investor confidence and raising concerns about the company's long-term prospects. Understanding the reasons behind this decline requires a closer look at several key areas.

Factors Contributing to Palantir's Stock Decline

Several intertwined factors are likely contributing to Palantir's current woes. These include:

-

Broader Market Sentiment: The current economic climate is characterized by uncertainty, with rising interest rates and inflation impacting investor behavior across various sectors. Palantir, as a growth stock, is particularly vulnerable to these macroeconomic headwinds. Many investors are shifting towards more defensive positions, impacting growth stocks like PLTR.

-

Concerns about Government Contracts: A significant portion of Palantir's revenue stems from government contracts. Changes in government spending priorities or delays in contract awards can significantly impact the company's financial performance. Any perceived weakening in this area immediately affects investor confidence.

-

Competition in the Data Analytics Sector: The data analytics market is highly competitive. Palantir faces stiff competition from established players and agile newcomers, leading to pricing pressures and a fight for market share. This competitive landscape puts pressure on margins and growth projections.

-

Profitability Concerns: While Palantir is making strides in revenue generation, achieving consistent profitability remains a challenge. Investors are closely scrutinizing the company's path to profitability, and any perceived setbacks in this area can trigger sell-offs.

Market Analysis and Future Outlook

Analysts are divided on Palantir's future trajectory. Some remain optimistic, highlighting the company's innovative technology and substantial government contracts pipeline. They point to the long-term growth potential in the data analytics sector and Palantir's unique position within it. These analysts believe the recent decline presents a buying opportunity for long-term investors.

Others are more cautious, emphasizing the persistent challenges outlined above. They highlight the competitive landscape, profitability concerns, and the sensitivity of Palantir's stock to broader market fluctuations. These analysts suggest that investors should remain watchful and consider the risks before investing in PLTR.

What to Watch For

Investors should keep a close eye on the following key indicators:

- Government contract announcements: Significant new contract wins could significantly boost investor sentiment.

- Quarterly earnings reports: These reports will provide crucial insights into the company's financial performance and future outlook.

- Overall market conditions: Macroeconomic factors will continue to influence Palantir's stock price.

Ultimately, Palantir's future depends on its ability to navigate the challenges it faces while capitalizing on its strengths. The recent decline underscores the inherent volatility of growth stocks and the importance of conducting thorough due diligence before investing. This situation warrants continuous monitoring and careful consideration by investors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and you should consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Palantir Stock Continues Decline: Six-Day Losing Streak And Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Aew Dynamite Recap Mjfs Big Night And Athenas Powerful Statement August 20 2025

Aug 22, 2025

Aew Dynamite Recap Mjfs Big Night And Athenas Powerful Statement August 20 2025

Aug 22, 2025 -

Controversy Erupts Sanex Shower Gel Advertisement Banned Over Racial Stereotype Claims

Aug 22, 2025

Controversy Erupts Sanex Shower Gel Advertisement Banned Over Racial Stereotype Claims

Aug 22, 2025 -

87 Year Old Country Music Icon Postpones Grand Ole Opry Performance

Aug 22, 2025

87 Year Old Country Music Icon Postpones Grand Ole Opry Performance

Aug 22, 2025 -

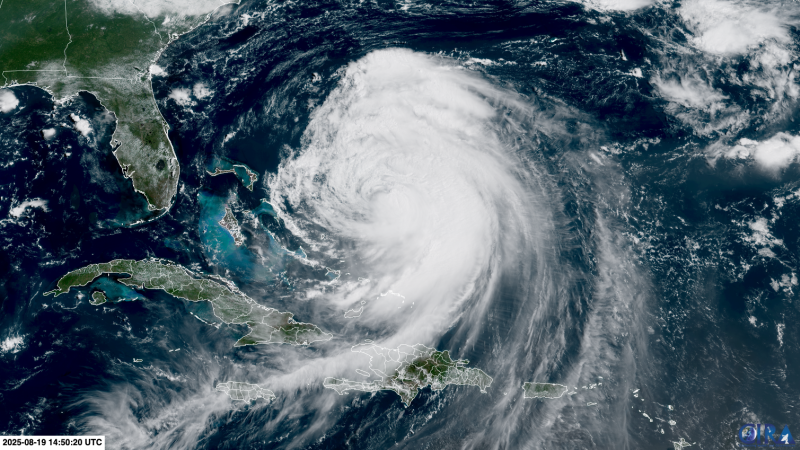

Hurricane Erin Dangerous Surf And The Threat Of A New Storm

Aug 22, 2025

Hurricane Erin Dangerous Surf And The Threat Of A New Storm

Aug 22, 2025 -

Urgent Plea Family Seeks Return Of Children Taken By Fugitive In New Zealand

Aug 22, 2025

Urgent Plea Family Seeks Return Of Children Taken By Fugitive In New Zealand

Aug 22, 2025

Latest Posts

-

Decoding The 2025 Gcse 9 1 Grade Boundaries

Aug 22, 2025

Decoding The 2025 Gcse 9 1 Grade Boundaries

Aug 22, 2025 -

Taifa Stars Ticket Controversy Tanzania Denies Kenyan Fan Blockade Claims

Aug 22, 2025

Taifa Stars Ticket Controversy Tanzania Denies Kenyan Fan Blockade Claims

Aug 22, 2025 -

The Recent Increase In St Georges And Union Jack Flags A Comprehensive Look

Aug 22, 2025

The Recent Increase In St Georges And Union Jack Flags A Comprehensive Look

Aug 22, 2025 -

Ukraine Conflict Chinas Cautious Observation Of Peace Initiatives

Aug 22, 2025

Ukraine Conflict Chinas Cautious Observation Of Peace Initiatives

Aug 22, 2025 -

Cowboy Builder Scam How One Contractor Defrauded Customers And Escaped Punishment

Aug 22, 2025

Cowboy Builder Scam How One Contractor Defrauded Customers And Escaped Punishment

Aug 22, 2025