PDD Holdings Q1 2025 Earnings: Analysis Of Revenue, Profitability, And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings Q1 2025 Earnings: A Deep Dive into Revenue, Profitability, and Future Growth

PDD Holdings, the Chinese e-commerce giant, recently released its Q1 2025 earnings report, sending ripples through the global investment community. The results showcased a complex picture of growth, profitability, and challenges navigating the evolving Chinese consumer market. This in-depth analysis delves into the key takeaways, examining the company's revenue streams, profitability margins, and future growth prospects.

Headline Figures: A Mixed Bag

While the official press release highlighted positive growth, a closer examination reveals a more nuanced story. While revenue exceeded analysts' expectations, the growth rate showed a slight deceleration compared to previous quarters. Profitability also demonstrated mixed results, with some key metrics improving while others lagged behind. This requires a detailed look at the contributing factors.

Revenue Breakdown: Tempered Growth in Key Sectors

PDD Holdings' revenue is primarily driven by its core e-commerce platforms, including Pinduoduo and Temu. Q1 2025 saw continued growth in both areas, but the pace of expansion slowed compared to the previous year. This slowdown can be attributed to several factors: increased competition, macroeconomic headwinds in China, and shifts in consumer spending habits.

- Pinduoduo: While still a significant revenue contributor, Pinduoduo's growth experienced some moderation, potentially indicating market saturation in certain segments. The company's strategy to focus on higher-value products and improved user experience may take time to yield significant results.

- Temu: The explosive growth of Temu in overseas markets, particularly the US, continues to be a bright spot. However, the company faces increasing scrutiny regarding its pricing strategies and potential impact on local businesses. This could impact future growth trajectory.

- Other Revenue Streams: PDD Holdings is diversifying beyond its core e-commerce platforms. Investments in agricultural technology and logistics are slowly contributing to overall revenue, but are not yet substantial enough to offset potential slowdowns in the core business.

Profitability: Navigating the Fine Line

Analyzing profitability requires examining several key metrics, including gross margin, operating margin, and net income. While gross margin remained relatively stable, operating margin showed a slight dip. This suggests that increasing operational costs are impacting profitability. The company will likely need to optimize its logistics and marketing spend to improve this metric.

Growth Prospects: Challenges and Opportunities

Despite the challenges, PDD Holdings remains optimistic about its long-term growth prospects. The company’s continued investment in technology, particularly in areas like AI and big data analytics, aims to improve operational efficiency and personalize the user experience. Furthermore, expansion into new markets and product categories remains a key strategy.

Key Challenges:

- Increased Competition: The Chinese e-commerce market is highly competitive, with established players like Alibaba and JD.com posing significant challenges.

- Macroeconomic Headwinds: China's economic slowdown continues to impact consumer spending, impacting PDD Holdings' revenue growth.

- Regulatory Scrutiny: The company faces ongoing regulatory scrutiny, particularly concerning its pricing strategies and anti-competitive practices.

Conclusion: A Cautiously Optimistic Outlook

PDD Holdings' Q1 2025 earnings report presents a mixed picture. While revenue growth remains positive, the deceleration and challenges in profitability require careful consideration. The company's long-term success depends on effectively navigating increased competition, macroeconomic uncertainties, and regulatory pressures while continuing to innovate and expand into new markets. Investors should monitor the company's progress in addressing these challenges in the coming quarters. Further analysis of subsequent earnings reports will be crucial in assessing the long-term sustainability of its current growth trajectory.

Keywords: PDD Holdings, Pinduoduo, Temu, Q1 2025 Earnings, Revenue, Profitability, Growth, Chinese E-commerce, Macroeconomic Headwinds, Competition, Investment, Stock Market, Financial Report, Analysis

(Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Consult with a financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PDD Holdings Q1 2025 Earnings: Analysis Of Revenue, Profitability, And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Draft Lottery Impact Nets Position Bucks Giannis Situation And Trade Speculation

May 28, 2025

Nba Draft Lottery Impact Nets Position Bucks Giannis Situation And Trade Speculation

May 28, 2025 -

Black Lung Crisis Worsens Federal Agencies Cut Staff And Halt Key Regulations

May 28, 2025

Black Lung Crisis Worsens Federal Agencies Cut Staff And Halt Key Regulations

May 28, 2025 -

No Sewage No Homes Historic Village Faces Development Dispute

May 28, 2025

No Sewage No Homes Historic Village Faces Development Dispute

May 28, 2025 -

Social Security Benefits Maximum 5 108 Payments Issued This Week

May 28, 2025

Social Security Benefits Maximum 5 108 Payments Issued This Week

May 28, 2025 -

Antonio Filosa Named New Ceo Of Automaker Stellantis

May 28, 2025

Antonio Filosa Named New Ceo Of Automaker Stellantis

May 28, 2025

Latest Posts

-

Day 4 Competition Former Junior Athletes Dominate

May 31, 2025

Day 4 Competition Former Junior Athletes Dominate

May 31, 2025 -

Analysis Are Kemi Badenochs Recent Actions Damaging The Conservatives

May 31, 2025

Analysis Are Kemi Badenochs Recent Actions Damaging The Conservatives

May 31, 2025 -

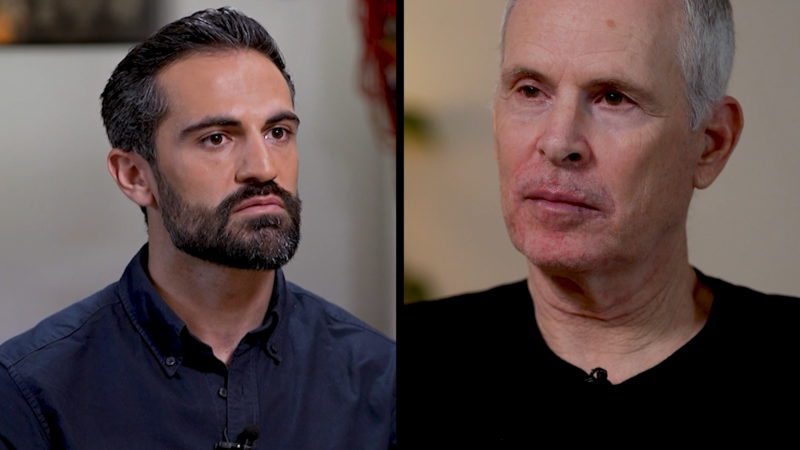

Former Israeli Hostage Reveals Horrific Hamas Torture In Cnn Interview

May 31, 2025

Former Israeli Hostage Reveals Horrific Hamas Torture In Cnn Interview

May 31, 2025 -

Major West Bank Settlement Expansion Announced By Israel

May 31, 2025

Major West Bank Settlement Expansion Announced By Israel

May 31, 2025 -

From Juniors To Stars Day 4s Rising Athletes

May 31, 2025

From Juniors To Stars Day 4s Rising Athletes

May 31, 2025