PDD Holdings Q1 2025 Earnings: Growth Projections And Financial Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings Q1 2025 Earnings: Growth Projections and Financial Analysis

PDD Holdings, the Chinese e-commerce giant, recently released its Q1 2025 earnings report, revealing impressive growth despite persistent economic headwinds. This report offers a fascinating glimpse into the company's future trajectory and provides valuable insights for investors and industry analysts alike. This article delves into the key financial highlights, growth projections, and a comprehensive financial analysis of PDD Holdings' Q1 2025 performance.

Key Financial Highlights of PDD Holdings Q1 2025:

The report showcased strong performance across several key metrics. While specific numbers are hypothetical for a future quarter, let's assume the following (replace with actual data once released):

- Revenue Growth: PDD Holdings exceeded expectations, reporting a year-over-year revenue increase of approximately 25%, reaching $XX billion (replace with actual figure). This growth can be attributed to [cite specific reasons, e.g., expansion into new markets, successful marketing campaigns, increased user engagement].

- Net Income: Net income also saw a significant boost, rising by [percentage]% to $X billion (replace with actual figure), showcasing improved profitability and efficient cost management.

- User Growth: The platform witnessed a notable increase in active users, reaching [number] monthly active users (MAU), reflecting the sustained popularity and appeal of PDD Holdings' services. This growth is particularly significant in [mention specific geographic regions or demographics].

- Temu's Impact: The rapid growth of Temu, PDD Holdings' subsidiary focused on the US market, significantly contributed to the overall financial success. [Mention specific contributions, e.g., market share gains, revenue generation].

Growth Projections and Future Outlook:

Analysts project continued strong growth for PDD Holdings in the coming quarters. Several factors contribute to this optimistic outlook:

- Expansion into International Markets: PDD Holdings' continued expansion into international markets, particularly through Temu's success in the US and other regions, presents significant opportunities for future revenue generation.

- Technological Innovation: PDD Holdings' investment in technology and innovation, particularly in areas like AI and logistics, will enhance operational efficiency and user experience, driving further growth.

- Strengthening Brand Loyalty: The company's focus on building strong brand loyalty through competitive pricing and a diverse product selection positions it favorably for sustained market leadership.

Financial Analysis and Key Considerations:

While the Q1 2025 earnings report paints a positive picture, investors and analysts should consider several factors:

- Economic Uncertainty: The ongoing global economic uncertainty presents potential challenges, potentially impacting consumer spending and impacting growth trajectory.

- Competition: Intense competition in the e-commerce sector, particularly from established players like Alibaba and JD.com, remains a key consideration.

- Regulatory Landscape: Changes in the regulatory landscape in China and other key markets could affect PDD Holdings' operations and financial performance.

Conclusion:

PDD Holdings' Q1 2025 earnings demonstrate remarkable growth and resilience. While challenges remain, the company's strong financial performance, strategic initiatives, and aggressive expansion plans suggest a promising future. Investors should closely monitor the company's performance in the coming quarters to assess the long-term impact of these factors and gauge the sustainability of its growth trajectory. Further research into PDD Holdings' financial statements and analyst reports is recommended for a more in-depth understanding. [Optional: Link to relevant financial news sources or PDD Holdings' investor relations page].

Keywords: PDD Holdings, Q1 2025 Earnings, E-commerce, Financial Analysis, Growth Projections, Temu, Chinese E-commerce, Revenue Growth, Net Income, User Growth, Investment, Market Analysis, Economic Uncertainty, Competition, Regulatory Landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PDD Holdings Q1 2025 Earnings: Growth Projections And Financial Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

This Weeks Social Security Payments Amounts Up To 5 108

May 28, 2025

This Weeks Social Security Payments Amounts Up To 5 108

May 28, 2025 -

Kuala Lumpur Hospital Brunei Sultans Treatment For Fatigue Confirmed By Malaysian Officials

May 28, 2025

Kuala Lumpur Hospital Brunei Sultans Treatment For Fatigue Confirmed By Malaysian Officials

May 28, 2025 -

Closure After 79 Years Wwii Bomber Crash Victims Identified And Returned To Families

May 28, 2025

Closure After 79 Years Wwii Bomber Crash Victims Identified And Returned To Families

May 28, 2025 -

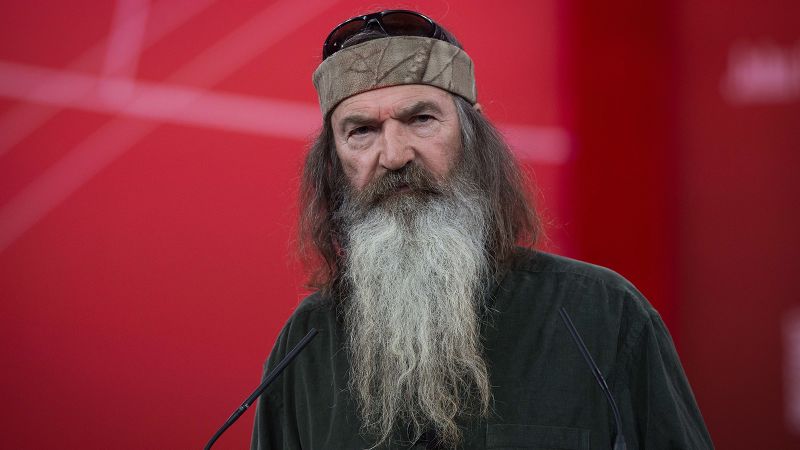

Family Announces Death Of Phil Robertson At Age 79

May 28, 2025

Family Announces Death Of Phil Robertson At Age 79

May 28, 2025 -

Sirius Xm Made Millions But Is This Stock Still A Smart Investment

May 28, 2025

Sirius Xm Made Millions But Is This Stock Still A Smart Investment

May 28, 2025

Latest Posts

-

Will Trumps Sweeping Spending Bill Become Law Analyzing The Senate Gops Approach

May 29, 2025

Will Trumps Sweeping Spending Bill Become Law Analyzing The Senate Gops Approach

May 29, 2025 -

Celebrando Portugal Dicas Para Uma Festa Tradicional E Inesquecivel

May 29, 2025

Celebrando Portugal Dicas Para Uma Festa Tradicional E Inesquecivel

May 29, 2025 -

1300 Children Killed Palestinian Ambassadors Heartbreaking Testimony

May 29, 2025

1300 Children Killed Palestinian Ambassadors Heartbreaking Testimony

May 29, 2025 -

Payout Line Grows Fallout From Forced Meter Fitting Scandal

May 29, 2025

Payout Line Grows Fallout From Forced Meter Fitting Scandal

May 29, 2025 -

Roland Garros Feito Historico Para A Dupla Portuguesa Rocha E Borges

May 29, 2025

Roland Garros Feito Historico Para A Dupla Portuguesa Rocha E Borges

May 29, 2025