PDD Holdings Q1 2025 Earnings: Investors Await Key Performance Indicators

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings Q1 2025 Earnings: Investors Await Key Performance Indicators

Investors are on the edge of their seats as they anticipate the release of PDD Holdings' Q1 2025 earnings report. The Chinese e-commerce giant, known for its popular Pinduoduo platform, is expected to unveil key performance indicators (KPIs) that will offer valuable insights into the company's growth trajectory and overall health within a dynamic and evolving market. The report, scheduled for [Insert Release Date Here], will be scrutinized by analysts and investors alike, impacting PDD Holdings' stock price and influencing market sentiment towards the broader Chinese tech sector.

Key Performance Indicators to Watch

Several crucial KPIs will be under intense scrutiny. These include:

-

Revenue Growth: Analysts will be closely examining PDD Holdings' revenue growth rate compared to the same period last year and the previous quarter. Any significant deviation from expectations could trigger significant market reactions. Sustained strong revenue growth will be crucial to demonstrate the company's continued dominance in the competitive Chinese e-commerce landscape.

-

User Growth and Engagement: The number of active users and their engagement levels (average order value, frequency of purchases) are vital indicators of platform health. A decline in either metric could signal potential challenges in attracting and retaining customers. Increased user engagement, particularly among younger demographics, will be a positive sign for future growth.

-

Marketing and Advertising Spend: PDD Holdings' marketing and advertising expenses will be closely analyzed. While effective marketing is crucial for growth, excessive spending can negatively impact profitability. Investors will look for a balance between robust marketing campaigns and efficient resource allocation.

-

Gross Merchandise Value (GMV): GMV, a measure of the total value of goods sold through the platform, is a crucial indicator of PDD Holdings' overall market share and the strength of its ecosystem. Strong GMV growth will reassure investors about the platform's continued appeal to both buyers and sellers.

-

Profitability Metrics: Investors are eager to see improvements in profitability metrics such as net income and operating margins. PDD Holdings' ability to navigate the competitive market while maintaining or improving profitability will be a key factor influencing investor sentiment.

Navigating a Challenging Market

PDD Holdings operates in a challenging environment marked by intense competition, economic uncertainties, and evolving regulatory landscapes in China. The Q1 2025 earnings report will provide crucial information on how effectively the company is navigating these headwinds. The company's strategic initiatives, including expansion into new markets and diversification of its business model, will also be under the microscope.

Analyst Expectations and Market Outlook

[Insert Analyst Predictions and Market Sentiment Here – cite reputable sources like Bloomberg, Reuters, etc.]. The overall market sentiment surrounding Chinese tech stocks will also play a role in influencing the reaction to PDD Holdings' earnings.

What to Expect After the Release

The release of PDD Holdings' Q1 2025 earnings report will undoubtedly cause significant market volatility. Investors should be prepared for potential price swings and carefully consider their investment strategies based on the revealed information. Further analysis of the report by financial experts will be crucial in understanding the long-term implications for the company and the broader Chinese e-commerce sector. Stay tuned to reputable financial news sources for in-depth coverage and expert commentary following the release.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and it's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PDD Holdings Q1 2025 Earnings: Investors Await Key Performance Indicators. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Explore The Sounds Of Dark Wave Sirius Xm Playlist Featuring Slicing Up Eyeballs

May 27, 2025

Explore The Sounds Of Dark Wave Sirius Xm Playlist Featuring Slicing Up Eyeballs

May 27, 2025 -

Lacrosse Championship Game Maryland Battles Cornell For National Title

May 27, 2025

Lacrosse Championship Game Maryland Battles Cornell For National Title

May 27, 2025 -

The Growing Influence Of Russian Orthodox Churches On Young Men In America

May 27, 2025

The Growing Influence Of Russian Orthodox Churches On Young Men In America

May 27, 2025 -

Rumeur De Gifle Au Vietnam L Entourage De Macron Evoque Une Chamaillerie

May 27, 2025

Rumeur De Gifle Au Vietnam L Entourage De Macron Evoque Une Chamaillerie

May 27, 2025 -

Hunger In Gaza Bbc Story Reveals Blockades Devastating Effects

May 27, 2025

Hunger In Gaza Bbc Story Reveals Blockades Devastating Effects

May 27, 2025

Latest Posts

-

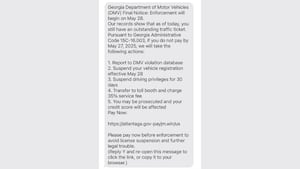

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025