PDD Holdings Q1 2025 Earnings Preview: Growth Prospects And Challenges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings Q1 2025 Earnings Preview: Growth Prospects and Challenges

Pinduoduo's (PDD) upcoming Q1 2025 earnings report is highly anticipated, as investors grapple with the company's evolving growth trajectory and the persistent challenges facing the Chinese e-commerce sector. The release will offer crucial insights into PDD's performance amidst a complex economic landscape, impacting not only the company itself but also broader market sentiment towards Chinese tech stocks. This preview delves into the key factors influencing PDD's prospects and the potential surprises awaiting investors.

Growth Drivers: Beyond the Bargains

While PDD initially gained traction with its value-oriented approach, the company is actively diversifying its revenue streams. This strategic shift is crucial to sustained growth. Key areas to watch include:

-

Temu's Global Expansion: The meteoric rise of Temu, PDD's ultra-low-cost e-commerce platform targeting international markets, is a significant growth driver. Investors will keenly observe its performance in key regions and its impact on overall revenue. Success in the US market, in particular, will be closely scrutinized.

-

Higher-Value Goods and Services: PDD's efforts to move beyond strictly low-priced goods and penetrate higher-value segments will be a key focus. This strategy involves improving its platform's user experience and expanding its product offerings.

-

Agricultural Products and Supply Chain: PDD's focus on agricultural products and improvements in its supply chain are expected to contribute to profitability and resilience. This vertical integration strategy offers a competitive edge and less reliance on external factors.

Challenges Ahead: Navigating a Complex Market

Despite promising growth drivers, PDD faces significant headwinds:

-

Macroeconomic Uncertainty: The ongoing economic slowdown in China, coupled with global inflation, poses a considerable challenge. Consumer spending patterns and overall market demand are uncertain factors impacting PDD's performance.

-

Increased Competition: The Chinese e-commerce market remains fiercely competitive, with established players like Alibaba and JD.com constantly innovating and vying for market share. PDD must maintain its competitive edge to sustain growth.

-

Regulatory Landscape: The evolving regulatory environment in China continues to be a factor. Understanding the impact of any new regulations on PDD's operations will be critical for investors.

Key Metrics to Watch:

Investors should pay close attention to the following key metrics in PDD's Q1 2025 earnings report:

- Revenue Growth: The overall revenue growth will be a primary indicator of PDD's performance. A strong revenue increase, particularly driven by Temu's success, would signal positive momentum.

- Average Revenue Per User (ARPU): Tracking ARPU provides insights into the effectiveness of PDD's strategy to move beyond its value-focused model and capture higher-spending customers.

- Operating Margin: Monitoring operating margin will indicate PDD's ability to manage costs effectively and improve profitability.

- Temu's Performance Metrics: Specific data on Temu’s user acquisition, revenue, and market penetration will offer invaluable insights into its future potential.

Conclusion:

PDD Holdings' Q1 2025 earnings report is poised to provide crucial insights into its future trajectory. While the company’s diversification strategies offer promising growth prospects, macroeconomic uncertainty and intense competition present significant challenges. Careful analysis of the key metrics mentioned above will be essential for investors to assess PDD's current standing and forecast its long-term prospects. Stay tuned for further updates following the official earnings release.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PDD Holdings Q1 2025 Earnings Preview: Growth Prospects And Challenges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sirius Xm Holdings Stock Performance Has Its Growth Potential Peaked

May 28, 2025

Sirius Xm Holdings Stock Performance Has Its Growth Potential Peaked

May 28, 2025 -

Serious Concerns Raised Leaked Recording Questions Handling Of Abortion Arrest

May 28, 2025

Serious Concerns Raised Leaked Recording Questions Handling Of Abortion Arrest

May 28, 2025 -

Jerusalem Flashpoint As Ultra Nationalist Jewish March Ignites Tensions

May 28, 2025

Jerusalem Flashpoint As Ultra Nationalist Jewish March Ignites Tensions

May 28, 2025 -

The Doc Rivers Factor Will He Convince Giannis To Stay In Milwaukee

May 28, 2025

The Doc Rivers Factor Will He Convince Giannis To Stay In Milwaukee

May 28, 2025 -

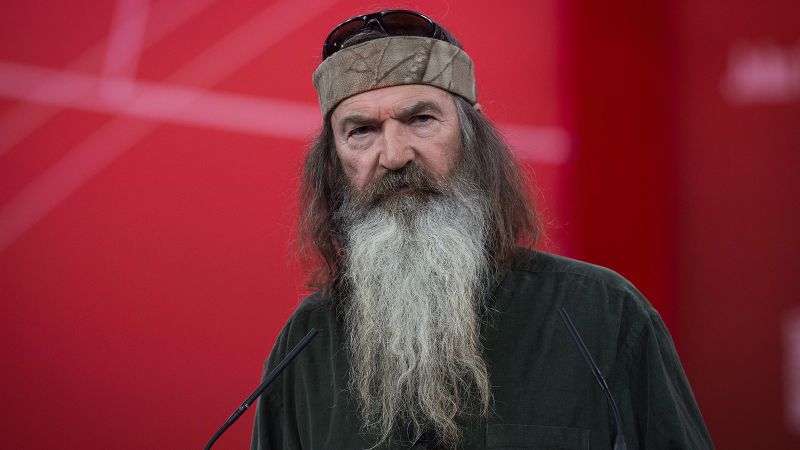

79 Year Old Phil Robertson Of Duck Dynasty Dies Tributes Pour In

May 28, 2025

79 Year Old Phil Robertson Of Duck Dynasty Dies Tributes Pour In

May 28, 2025

Latest Posts

-

Growing Tensions At Nih Staff Walkout Highlights Concerns Over Research Funding

May 29, 2025

Growing Tensions At Nih Staff Walkout Highlights Concerns Over Research Funding

May 29, 2025 -

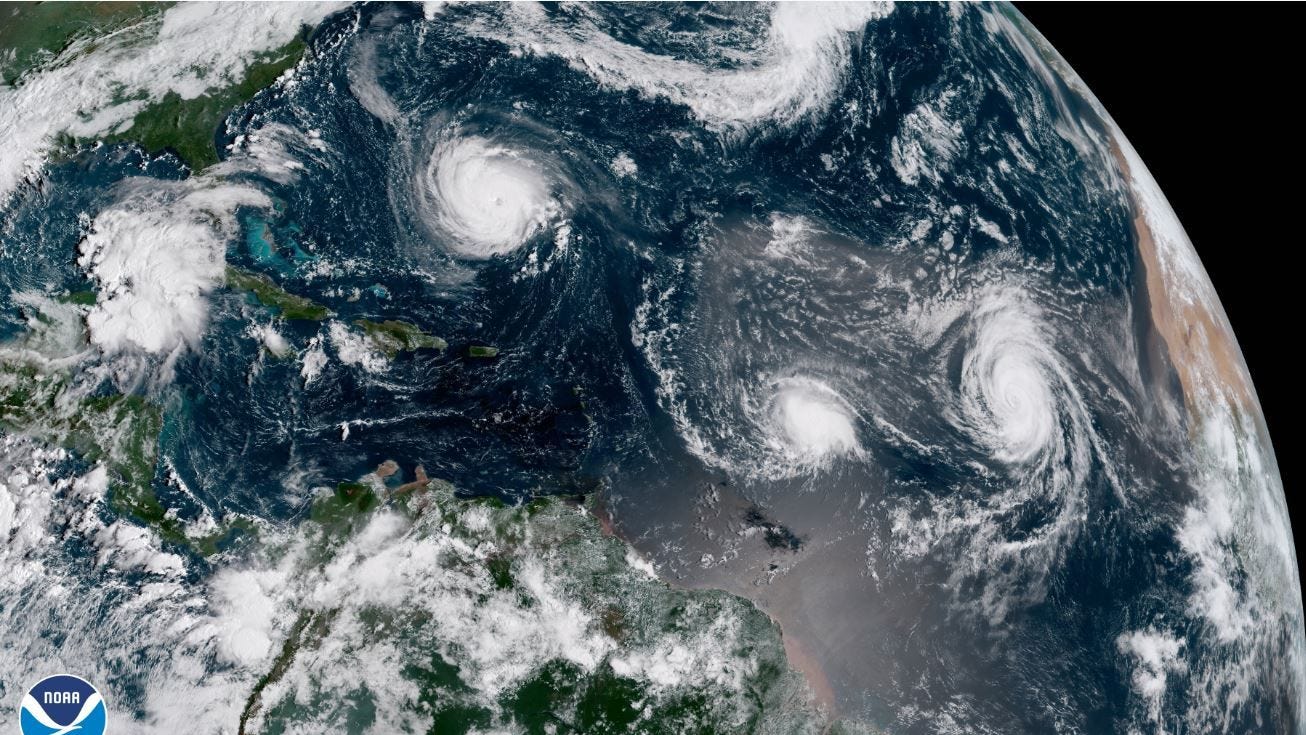

Hurricane Season 2025 Preparedness Predictions And Prevention

May 29, 2025

Hurricane Season 2025 Preparedness Predictions And Prevention

May 29, 2025 -

The Unexpected Social Media Star Shepmates Journey From Lumber To Likes

May 29, 2025

The Unexpected Social Media Star Shepmates Journey From Lumber To Likes

May 29, 2025 -

Getting To Know Antonio Filosa The New Face Of Stellantis Leadership

May 29, 2025

Getting To Know Antonio Filosa The New Face Of Stellantis Leadership

May 29, 2025 -

See Through Style Alexandra Daddarios Daring Lace Gown

May 29, 2025

See Through Style Alexandra Daddarios Daring Lace Gown

May 29, 2025