PDD Holdings' Q1 2025 Financial Report: Analyzing Revenue, Profitability, And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings' Q1 2025 Financial Report: A Deep Dive into Revenue, Profitability, and Growth

PDD Holdings, the Chinese e-commerce giant behind Pinduoduo, recently released its Q1 2025 financial report, revealing strong performance across key metrics despite persistent economic headwinds in China. This report offers valuable insights into the company's continued growth trajectory and its strategic maneuvering within a competitive market. Let's delve into the key highlights and analyze the implications for investors and the broader e-commerce landscape.

Headline-Grabbing Revenue Growth:

PDD Holdings reported a significant year-over-year increase in revenue for Q1 2025, exceeding analysts' expectations. This robust growth can be attributed to several factors, including:

- Expansion of user base: PDD Holdings continues to attract new users, particularly in lower-tier cities, leveraging its value-for-money proposition and engaging social commerce features.

- Diversification of product offerings: The company's expansion beyond its core agricultural products and into broader categories like apparel, electronics, and home goods has fueled revenue diversification and growth.

- Strengthened supply chain: Investments in logistics and supply chain optimization have resulted in improved efficiency and faster delivery times, enhancing the customer experience and driving sales.

Profitability Remains a Key Focus:

While revenue growth is impressive, PDD Holdings' focus on profitability is equally noteworthy. The company demonstrated improved operating margins in Q1 2025, indicating successful cost management and operational efficiency improvements. This is a crucial aspect for long-term sustainability and investor confidence. Further analysis shows that:

- Marketing expenditure optimization: PDD Holdings has shown a more targeted and efficient approach to marketing, maximizing return on investment (ROI).

- Technological advancements: Investments in technology and data analytics contribute to better inventory management, personalized recommendations, and reduced operational costs.

Growth Strategies for the Future:

PDD Holdings' Q1 2025 report underscores its commitment to long-term growth through several strategic initiatives:

- International expansion: The company is actively exploring opportunities for expansion into international markets, seeking to replicate its success in China on a global scale. This presents both significant opportunities and challenges.

- Technological innovation: Continued investment in AI, big data, and other technologies will be critical for enhancing the customer experience, personalizing recommendations, and improving operational efficiency.

- Strengthening partnerships: Collaborations with key suppliers and strategic partners are crucial for maintaining a competitive advantage and expanding product offerings.

Challenges and Considerations:

Despite the positive results, PDD Holdings faces several challenges:

- Intense competition: The Chinese e-commerce market remains fiercely competitive, with established players like Alibaba and JD.com vying for market share.

- Regulatory environment: Navigating the evolving regulatory landscape in China remains a critical factor influencing the company's operations and growth prospects.

- Macroeconomic factors: Economic fluctuations in China and globally can impact consumer spending and affect PDD Holdings' performance.

Conclusion:

PDD Holdings' Q1 2025 financial report paints a picture of a company demonstrating strong revenue growth, improved profitability, and a clear strategic vision for the future. While challenges remain, the company's ability to adapt to a dynamic market and leverage its strengths positions it favorably for continued success. Investors will be keenly watching PDD Holdings' progress in executing its strategic initiatives and navigating the complexities of the Chinese e-commerce landscape. Further analysis of the full report is recommended for a comprehensive understanding.

Keywords: PDD Holdings, Pinduoduo, Q1 2025 Financial Report, Revenue Growth, Profitability, E-commerce, China, Financial Analysis, Investment, Growth Strategy, Market Share, Competitive Landscape, Technological Innovation, Supply Chain, International Expansion.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PDD Holdings' Q1 2025 Financial Report: Analyzing Revenue, Profitability, And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Global Warming Could A Flesh Eating Fungus Be The Next Pandemic

May 27, 2025

Global Warming Could A Flesh Eating Fungus Be The Next Pandemic

May 27, 2025 -

No More I Os 18 4 1 Downgrades Apples Signature Cut Off Explained

May 27, 2025

No More I Os 18 4 1 Downgrades Apples Signature Cut Off Explained

May 27, 2025 -

Pdd Holdings Q1 2025 Earnings A Deep Dive Into The E Commerce Leaders Performance

May 27, 2025

Pdd Holdings Q1 2025 Earnings A Deep Dive Into The E Commerce Leaders Performance

May 27, 2025 -

Russia Unleashes Largest Overnight Air Campaign Against Ukraine

May 27, 2025

Russia Unleashes Largest Overnight Air Campaign Against Ukraine

May 27, 2025 -

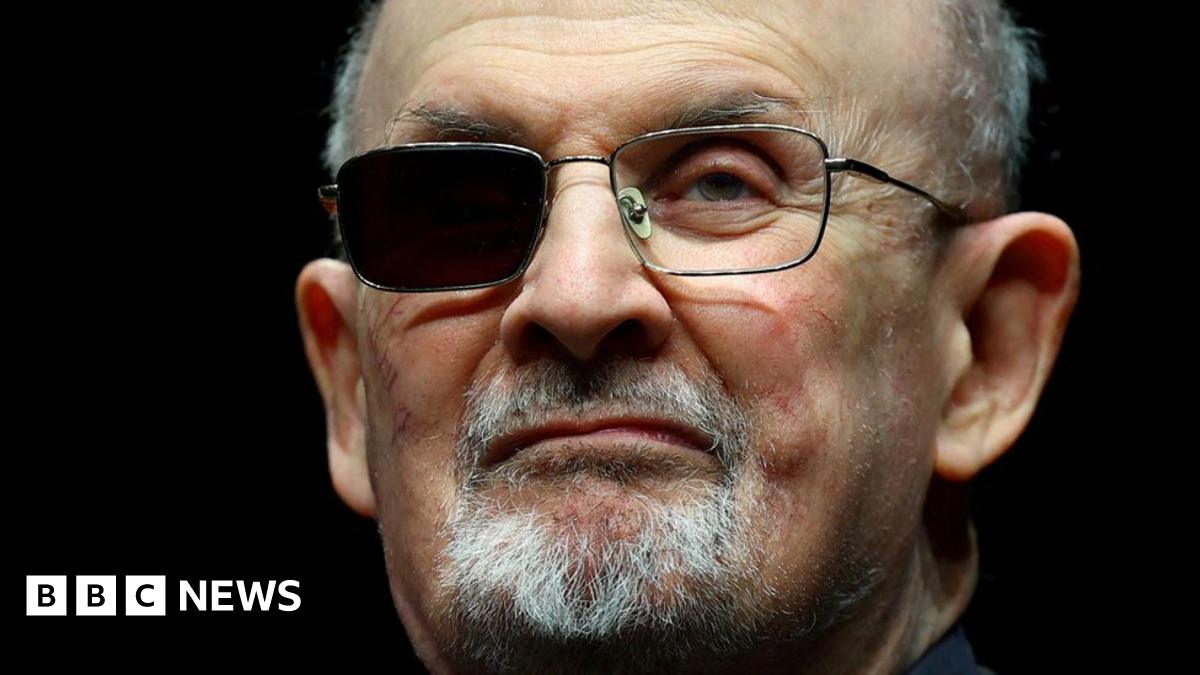

Sir Salman Rushdie Pleased By Attackers Imprisonment

May 27, 2025

Sir Salman Rushdie Pleased By Attackers Imprisonment

May 27, 2025

Latest Posts

-

French Open Day 5 Mens Singles Match Predictions And Analysis

May 30, 2025

French Open Day 5 Mens Singles Match Predictions And Analysis

May 30, 2025 -

A1 Northumberland Road Project Failure Impact On Abandoned Properties

May 30, 2025

A1 Northumberland Road Project Failure Impact On Abandoned Properties

May 30, 2025 -

Trumps Pardon A Reality Tv Couples Escape From Bank Fraud And Tax Convictions

May 30, 2025

Trumps Pardon A Reality Tv Couples Escape From Bank Fraud And Tax Convictions

May 30, 2025 -

Birds On Delta Flight Cause In Flight Commotion Passenger Video Goes Viral

May 30, 2025

Birds On Delta Flight Cause In Flight Commotion Passenger Video Goes Viral

May 30, 2025 -

French Media Withdraws Macrons Marital Focused Campaign Spot

May 30, 2025

French Media Withdraws Macrons Marital Focused Campaign Spot

May 30, 2025