Pension Triple Lock Cost: OBR Triples Initial Estimate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pension Triple Lock Cost: OBR Triples Initial Estimate – A Shock to the System?

The Office for Budget Responsibility (OBR) has dramatically revised its estimate for the cost of the triple lock on state pensions, tripling its initial prediction. This unexpected surge has sent shockwaves through Westminster and sparked a renewed debate about the long-term sustainability of the UK's pension system. The implications are far-reaching, impacting both current pensioners and future generations.

The OBR's initial forecast significantly underestimated the true cost of upholding the triple lock, a policy that guarantees annual state pension increases based on the highest of earnings growth, inflation, or 2.5%. This latest revision paints a stark picture of the escalating financial burden. The government now faces the difficult task of managing this increased expenditure while navigating other pressing economic challenges.

The Scale of the Problem: A Tripling of Costs

The OBR’s initial estimate, released earlier this year, was already substantial. However, the new figures represent a threefold increase, highlighting the unexpected volatility of the factors influencing pension payments. This significant upward revision necessitates a thorough reassessment of the government's fiscal planning and raises serious questions about the affordability of the triple lock in the years to come. The precise figures remain subject to ongoing analysis and will likely be detailed further in upcoming government reports.

Understanding the Triple Lock Mechanism

The triple lock, introduced in 2011, is a cornerstone of the UK's pension system. It aims to protect pensioners from the erosion of their income due to inflation and stagnant wage growth. However, its inherent reliance on fluctuating economic indicators makes it inherently unpredictable and potentially costly. The current economic climate, characterized by high inflation and fluctuating earnings, has exacerbated this inherent risk.

- Earnings Growth: One of the three factors determining the annual pension increase. High earnings growth translates to higher pension increases.

- Inflation: Measured by the Consumer Prices Index (CPI), this is another key factor driving pension uplifts. High inflation leads to larger pension increases.

- 2.5% Minimum Increase: This guaranteed minimum increase acts as a safety net, ensuring pensioners receive at least a 2.5% rise annually, even if earnings growth and inflation are lower.

Political Ramifications and Future Outlook

The OBR's revised estimate is likely to reignite the debate surrounding the future of the triple lock. Opposition parties are already calling for greater transparency and a thorough review of the policy's long-term viability. The government faces the challenging task of balancing the needs of current pensioners with the fiscal constraints of managing public spending. Potential solutions range from reforming the triple lock mechanism to exploring alternative approaches to ensuring adequate retirement incomes.

Long-Term Sustainability Concerns

The substantial increase in the projected cost of the triple lock raises serious concerns about the long-term sustainability of the UK's pension system. Experts are increasingly calling for a comprehensive review of the system, exploring options such as raising the state pension age or increasing national insurance contributions. These are complex and potentially controversial measures, but they may be necessary to ensure the system's viability in the face of increasing costs.

What Happens Next?

The government is expected to respond to the OBR's revised estimates in the coming weeks. Expect further debate and analysis as the implications of this significant cost increase are fully explored. Keeping abreast of official government announcements and independent economic analyses will be crucial in understanding the full impact of this development. This evolving situation requires close monitoring by all stakeholders, including pensioners, taxpayers, and policymakers.

Call to Action: Stay informed about the ongoing developments regarding the triple lock and the future of the UK's pension system by regularly checking reputable news sources and government websites.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pension Triple Lock Cost: OBR Triples Initial Estimate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stage Four Victory For Pogacar Tour De France 2025 Results

Jul 10, 2025

Stage Four Victory For Pogacar Tour De France 2025 Results

Jul 10, 2025 -

Obrs Updated Figures Pension Triple Locks Escalating Cost

Jul 10, 2025

Obrs Updated Figures Pension Triple Locks Escalating Cost

Jul 10, 2025 -

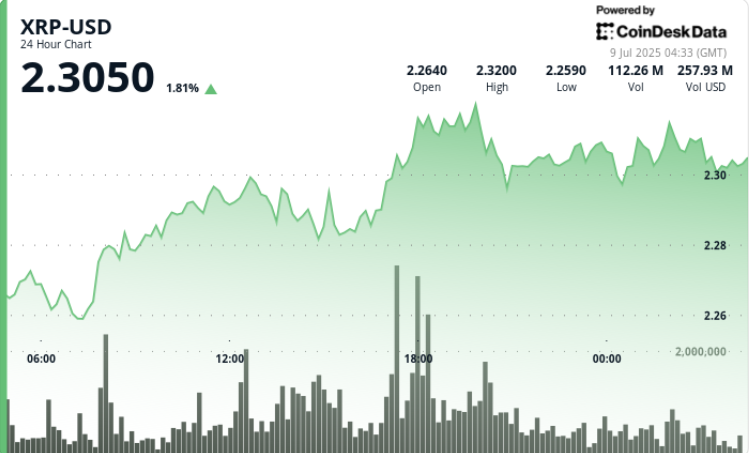

Ripples Banking Charter Fuels Xrp Rally Price Breaks 2 28 On High Volume

Jul 10, 2025

Ripples Banking Charter Fuels Xrp Rally Price Breaks 2 28 On High Volume

Jul 10, 2025 -

Man Seriously Injured In Police Involved Shooting In Hollingbourne Kent

Jul 10, 2025

Man Seriously Injured In Police Involved Shooting In Hollingbourne Kent

Jul 10, 2025 -

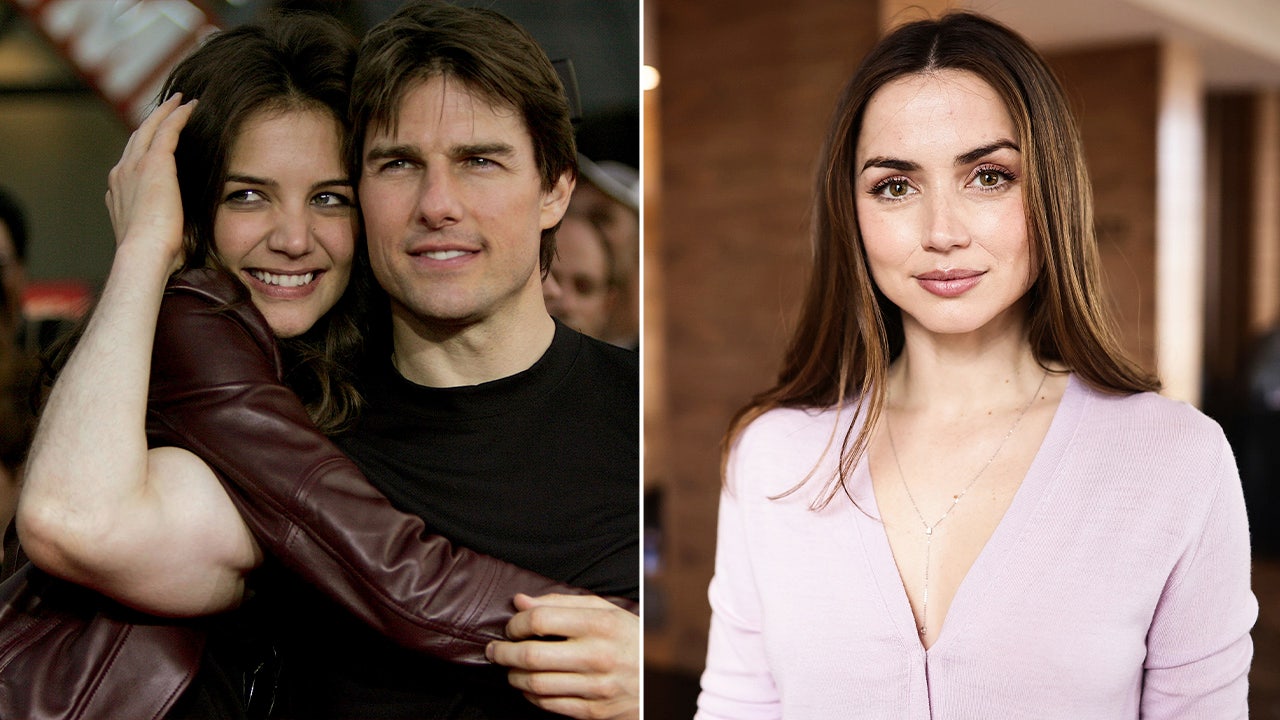

Tom Cruise And Ana De Armas Katie Holmess Subtle Sign Of Acceptance

Jul 10, 2025

Tom Cruise And Ana De Armas Katie Holmess Subtle Sign Of Acceptance

Jul 10, 2025

Latest Posts

-

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025 -

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025