Perpetual Equity's NTA: A Detailed Report And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Perpetual Equity's NTA: A Detailed Report and Analysis

Perpetual Equity, a name often whispered in investment circles, has recently seen its Net Tangible Asset (NTA) value become a key focus of discussion. Understanding NTA is crucial for investors looking to gauge the underlying value of a company, and Perpetual Equity's recent figures warrant a closer look. This detailed report offers an in-depth analysis of Perpetual Equity's NTA, exploring its implications for current and prospective investors.

What is Net Tangible Asset (NTA)?

Before diving into Perpetual Equity's specific NTA, let's define the term. NTA represents the net asset value of a company, calculated by subtracting liabilities from assets. This calculation focuses on tangible assets, excluding intangible assets like goodwill or brand value. A higher NTA generally suggests a company is fundamentally sound and possesses significant underlying value. For investors, NTA per share is often compared to the market price per share to identify potential undervaluation or overvaluation. [Link to a reputable source explaining NTA calculation].

Perpetual Equity's Recent NTA Performance:

(This section requires specific data about Perpetual Equity's NTA. Replace the bracketed information with actual figures and dates obtained from reliable financial sources like the company's financial reports, reputable financial news outlets, or SEC filings.)

Perpetual Equity's NTA per share as of [Date] was reported at [Amount]. This represents a [Percentage] change compared to [Previous Date]'s NTA of [Amount]. This change can be attributed to several factors, including [List key factors influencing NTA change, e.g., changes in asset values, acquisitions, disposals, or debt levels].

Analyzing the Factors Influencing Perpetual Equity's NTA:

Several key factors contribute to the fluctuations observed in Perpetual Equity's NTA. These include:

- Market conditions: The overall market performance significantly impacts the valuation of assets held by Perpetual Equity. A bullish market generally leads to higher NTA, while a bearish market can have the opposite effect.

- Investment strategy: Perpetual Equity's investment approach directly influences its asset composition and thus its NTA. Changes in this strategy, such as a shift towards higher-risk or lower-risk investments, can significantly affect NTA.

- Debt levels: High debt levels can reduce a company's NTA, while lower debt generally increases it. Perpetual Equity's debt-to-equity ratio should be considered when evaluating its NTA.

- Acquisitions and disposals: Acquisitions of companies or assets can increase NTA, while disposals can decrease it. Recent acquisitions or disposals by Perpetual Equity should be examined for their impact on the NTA.

Implications for Investors:

The current NTA per share of Perpetual Equity, when compared to its market price, offers insights into its potential valuation. [Insert analysis here comparing NTA to market price. Is it undervalued or overvalued? What are the implications for investors? This requires specific data and should be supported by sound financial analysis].

Investors should consider the long-term growth prospects of Perpetual Equity, alongside the NTA, before making any investment decisions. A strong NTA is a positive sign, but it's not the sole indicator of future performance.

Conclusion:

Perpetual Equity's NTA provides a valuable metric for evaluating its underlying asset value. However, a thorough analysis requires consideration of multiple factors beyond just the NTA figure. Investors should perform their own due diligence and consult with financial professionals before making investment decisions. Remember to stay updated on Perpetual Equity's financial reports and market analysis to make informed choices.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Perpetual Equity's NTA: A Detailed Report And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rapper 4 Xtras July 4th Fireworks Accident Hand Injuries Reported

Jul 07, 2025

Rapper 4 Xtras July 4th Fireworks Accident Hand Injuries Reported

Jul 07, 2025 -

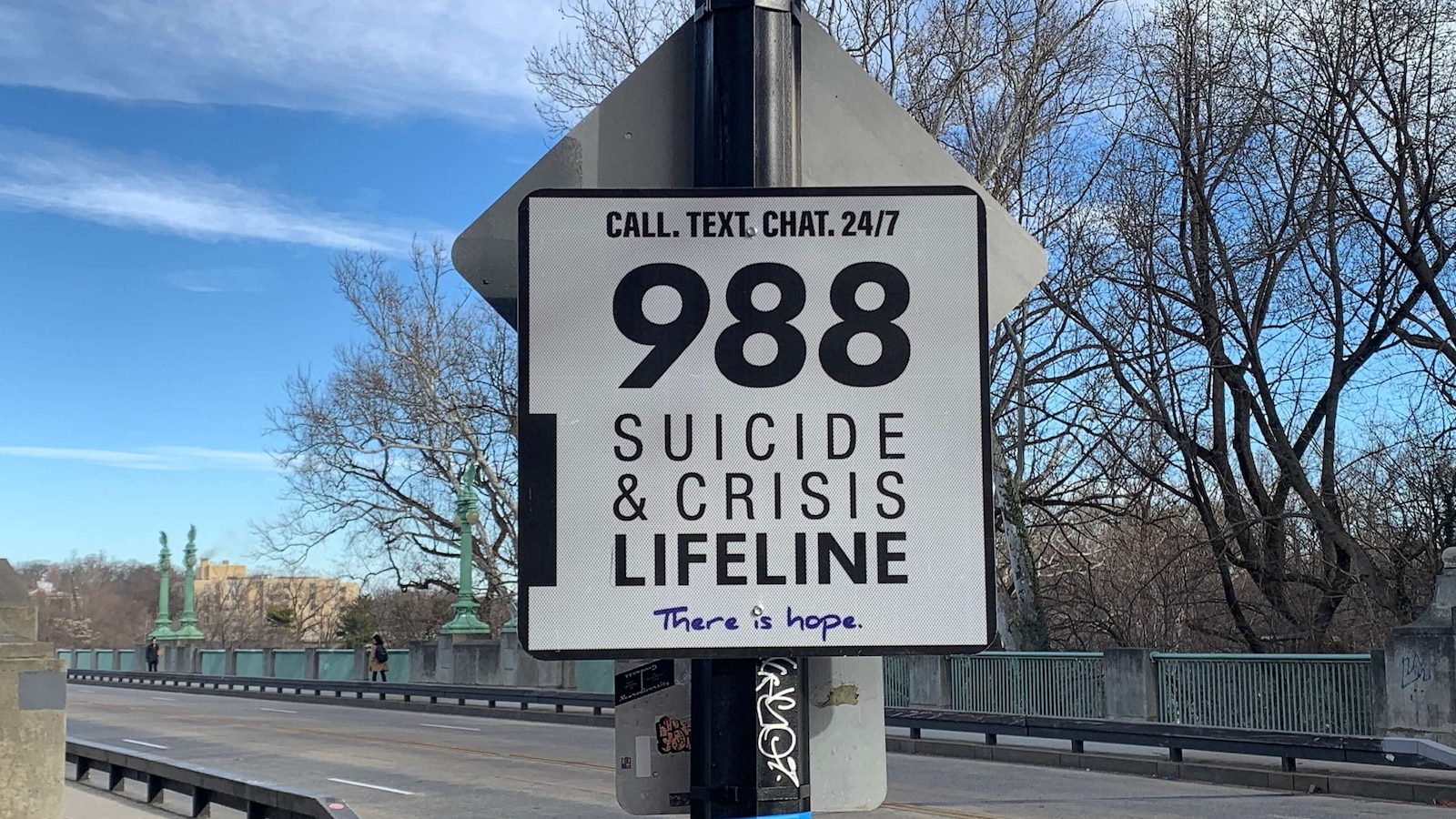

Analysis The 988 Lifelines Growth And The Discontinued Lgbtq Youth Option

Jul 07, 2025

Analysis The 988 Lifelines Growth And The Discontinued Lgbtq Youth Option

Jul 07, 2025 -

Discover Whitefish Montana A Foodie And Nature Lovers Paradise

Jul 07, 2025

Discover Whitefish Montana A Foodie And Nature Lovers Paradise

Jul 07, 2025 -

Gory Details Emerge No Jumpers 4xtras Hand Severely Injured In Firework Incident

Jul 07, 2025

Gory Details Emerge No Jumpers 4xtras Hand Severely Injured In Firework Incident

Jul 07, 2025 -

Emergencia Por Inundaciones En Texas Informacion Actualizada Busquedas Y Rescates

Jul 07, 2025

Emergencia Por Inundaciones En Texas Informacion Actualizada Busquedas Y Rescates

Jul 07, 2025

Latest Posts

-

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025

The Superman Lex Luthor Relationship A Deep Dive Into Their Complicated Bond

Jul 07, 2025 -

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025

Dogecoins Future Examining The Factors Behind Potential Price Increases

Jul 07, 2025 -

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025

Yemen Ports Hit In Israeli Military Operation Galaxy Leader Ship Involved

Jul 07, 2025 -

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025

Tragedy Strikes Poynton Police Discover Bodies Of Two Teenagers

Jul 07, 2025 -

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025

Severe Tick Season Increased Risk And Essential Prevention Strategies

Jul 07, 2025