Planning For College? Unlock The Benefits Of A 529 Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Planning for College? Unlock the Benefits of a 529 Plan

The soaring cost of higher education is a significant concern for families across the nation. Tuition fees, room and board, books, and other expenses can quickly add up, creating financial pressure for even the most well-off households. But there's a powerful tool designed to help families navigate this challenge and secure their children's future: the 529 Plan. This article will explore the significant advantages of 529 plans and guide you through the process of maximizing their benefits.

What is a 529 Plan?

A 529 Plan is a tax-advantaged savings plan designed specifically to pay for qualified education expenses. These plans are sponsored by states, state agencies, or educational institutions, and offer significant tax benefits for those saving for college or other eligible educational pursuits. The money grows tax-deferred, meaning you won't pay taxes on the investment earnings until you withdraw them for qualified expenses.

Key Benefits of a 529 Plan:

-

Tax-Deferred Growth: Perhaps the most compelling advantage is the tax-deferred growth. Your investments grow without being taxed annually, allowing for greater accumulation over time. This contrasts sharply with taxable investment accounts where you pay taxes on gains each year.

-

Tax-Free Withdrawals for Qualified Expenses: When you withdraw funds for qualified education expenses, the withdrawals are generally tax-free at the federal level. This makes a substantial difference in the overall cost of college. Qualified expenses include tuition, fees, room and board, books, supplies, and even some computer equipment. Check your specific plan for details on what qualifies.

-

Flexibility: Many 529 plans offer a range of investment options, allowing you to tailor your portfolio to your risk tolerance and investment timeline. You can choose from age-based options that adjust their risk profile over time, or select specific funds based on your preferences.

-

Gift Tax Advantages: You can contribute a significant amount to a 529 plan upfront and take advantage of gift tax rules. This allows you to contribute more than the annual gift tax exclusion without incurring gift taxes. Consult with a tax advisor for specific details.

-

Beneficiary Changes: If your child's educational plans change, you can often change the beneficiary to another family member, providing flexibility for unforeseen circumstances.

Choosing the Right 529 Plan:

Selecting the appropriate 529 plan involves considering several factors:

- Investment Options: Compare the investment options offered by different plans, paying attention to fees and expense ratios. Lower fees translate to greater returns.

- State Tax Deductions: Some states offer state income tax deductions or credits for contributions made to their own state's 529 plan. This can significantly boost your savings.

- Plan Fees: Pay close attention to the fees associated with the plan, as high fees can eat into your returns.

Getting Started with a 529 Plan:

Opening a 529 plan is relatively straightforward. You can typically do so online through the plan's website or through a financial advisor. Be sure to thoroughly understand the plan's terms and conditions before investing.

Beyond College: While primarily used for college, some 529 plans now allow withdrawals for K-12 tuition expenses, apprenticeships, and even student loan repayments (with certain limitations). Check your plan's specific rules.

Conclusion:

A 529 plan is a powerful tool for families saving for higher education. By understanding the benefits and carefully selecting a plan that aligns with your financial goals and risk tolerance, you can significantly reduce the financial burden of college and secure your child's future. Start planning early and reap the rewards of tax-advantaged savings. Consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Planning For College? Unlock The Benefits Of A 529 Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Daley Opens Up Family Identity And The Power Of Unconditional Love

Jun 04, 2025

Tom Daley Opens Up Family Identity And The Power Of Unconditional Love

Jun 04, 2025 -

Tom Daleys Support Network Helping Closeted Queer Athletes Come Out

Jun 04, 2025

Tom Daleys Support Network Helping Closeted Queer Athletes Come Out

Jun 04, 2025 -

Binge Watching Bonanza Netflix Series Keeps Viewers Hooked

Jun 04, 2025

Binge Watching Bonanza Netflix Series Keeps Viewers Hooked

Jun 04, 2025 -

Hiker Aziz Ziriat Found Dead In Dolomites Familys Heartbreak

Jun 04, 2025

Hiker Aziz Ziriat Found Dead In Dolomites Familys Heartbreak

Jun 04, 2025 -

This Underrated Netflix Comedy Is Taking Over Heres Why

Jun 04, 2025

This Underrated Netflix Comedy Is Taking Over Heres Why

Jun 04, 2025

Latest Posts

-

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025 -

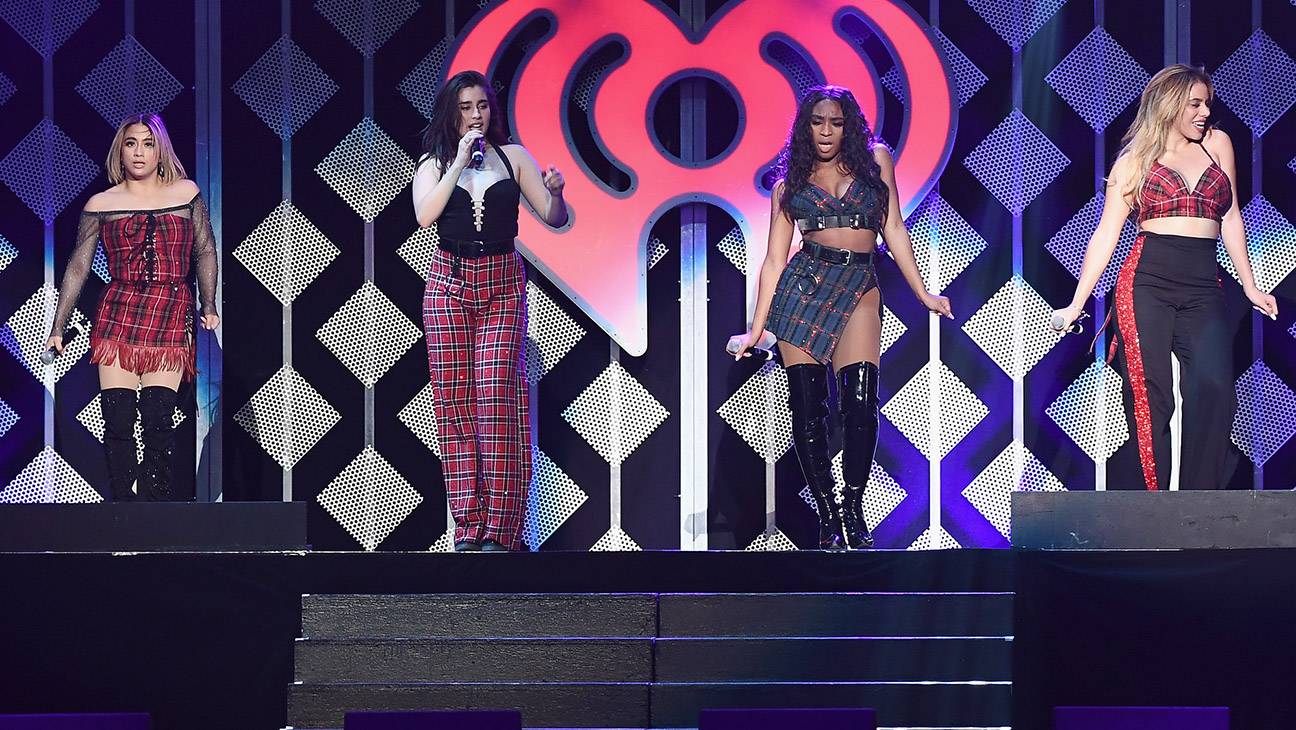

Fifth Harmonys Future Reunion Talks After Camila Cabellos Departure

Jun 06, 2025

Fifth Harmonys Future Reunion Talks After Camila Cabellos Departure

Jun 06, 2025 -

Stars Playoff Failure Leads To De Boers Dismissal

Jun 06, 2025

Stars Playoff Failure Leads To De Boers Dismissal

Jun 06, 2025 -

Goggins Emotional Reason For Unfollowing Aimee Lou Wood On Instagram

Jun 06, 2025

Goggins Emotional Reason For Unfollowing Aimee Lou Wood On Instagram

Jun 06, 2025 -

The Case For Police Dog Pensions Recognizing Canine Service And Sacrifice

Jun 06, 2025

The Case For Police Dog Pensions Recognizing Canine Service And Sacrifice

Jun 06, 2025