Post-Earnings: Broadcom (AVGO) Stock Price Predictions From Traders

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Earnings: Broadcom (AVGO) Stock Price Predictions from Traders – A Rollercoaster Ahead?

Broadcom (AVGO) recently released its earnings report, sending ripples through the tech sector and leaving investors wondering: what's next for the semiconductor giant? The results were a mixed bag, sparking a flurry of predictions and analyses from seasoned traders. This article dives deep into the post-earnings landscape, examining the current sentiment and exploring the range of AVGO stock price predictions circulating amongst market experts.

Earnings Report Recap: A Closer Look at the Numbers

Broadcom's Q3 2023 earnings report revealed a complex picture. While revenue beat expectations, driven largely by strong demand in its infrastructure software segment, profit margins fell short. This divergence between top and bottom-line performance has fueled much of the uncertainty surrounding the stock's future trajectory. Key factors influencing trader sentiment include:

- Strong Infrastructure Software Performance: This sector proved to be a bright spot, showcasing Broadcom's success in the rapidly growing cloud computing market.

- Lower-Than-Expected Profit Margins: This shortfall has raised concerns about the company's ability to maintain profitability amidst rising costs and potential economic headwinds.

- Guidance for Q4 2023: Broadcom's outlook for the next quarter is crucial, providing key insights into future performance and influencing investor confidence. Analysts are closely scrutinizing this guidance for any signs of potential growth or further challenges.

Diverse Predictions: A Spectrum of Opinions

The market's reaction to the earnings report has been far from uniform, leading to a wide array of stock price predictions. Some analysts remain bullish, citing the company's strong position in key growth markets and the potential for long-term gains. Others are more cautious, pointing to the margin squeeze and potential economic slowdown as factors that could limit future growth.

Bullish Predictions:

Several prominent financial institutions have maintained a "buy" rating on AVGO stock, predicting continued growth driven by the expansion of its software business and strong demand for its chips in the data center market. These predictions often cite a price target significantly higher than the current market price.

Bearish Predictions:

Conversely, some traders express concerns about the company's ability to navigate the current macroeconomic environment. They emphasize the potential for further margin compression and the risks associated with slowing demand in certain sectors. These bearish predictions suggest a more cautious approach, potentially advocating for holding or even selling AVGO shares.

Neutral Stance:

Many analysts adopt a more neutral stance, acknowledging both the positive and negative aspects of the earnings report. They emphasize the need for further clarity regarding the company's future strategic direction and the overall economic climate before making definitive predictions.

What to Watch For:

Investors should closely monitor the following factors in the coming weeks and months:

- Updated Guidance: Any revisions to Broadcom's Q4 2023 outlook will be closely scrutinized by the market.

- Macroeconomic Conditions: The overall economic environment will play a significant role in determining the company's future performance.

- Competition: Intense competition in the semiconductor industry could impact Broadcom's market share and profitability.

Conclusion: Navigating the Uncertainty

The post-earnings landscape for Broadcom (AVGO) is characterized by uncertainty. While the company's strong performance in certain sectors is encouraging, concerns remain regarding profitability and the impact of macroeconomic factors. Traders should carefully weigh the diverse predictions available, conduct thorough due diligence, and consider their own risk tolerance before making any investment decisions. Remember to consult with a financial advisor for personalized advice. The road ahead for AVGO remains potentially volatile, offering both significant opportunities and risks for investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Earnings: Broadcom (AVGO) Stock Price Predictions From Traders. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eighteen Years Later Where Does The Madeleine Mc Cann Search Stand

Jun 05, 2025

Eighteen Years Later Where Does The Madeleine Mc Cann Search Stand

Jun 05, 2025 -

Fbi Announces Arrest In New York In California Fertility Clinic Explosion Case

Jun 05, 2025

Fbi Announces Arrest In New York In California Fertility Clinic Explosion Case

Jun 05, 2025 -

Instability In The Netherlands Coalition Collapse Following Wilders Exit

Jun 05, 2025

Instability In The Netherlands Coalition Collapse Following Wilders Exit

Jun 05, 2025 -

Jessie Js Cancer Diagnosis A Story Of Strength And Resilience

Jun 05, 2025

Jessie Js Cancer Diagnosis A Story Of Strength And Resilience

Jun 05, 2025 -

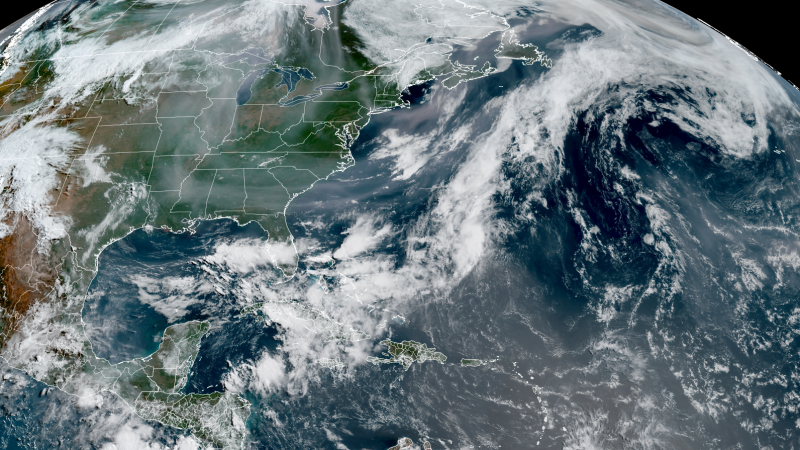

Weather Forecast Collision Course For Canadian Wildfire Smoke And African Dust Plume

Jun 05, 2025

Weather Forecast Collision Course For Canadian Wildfire Smoke And African Dust Plume

Jun 05, 2025

Latest Posts

-

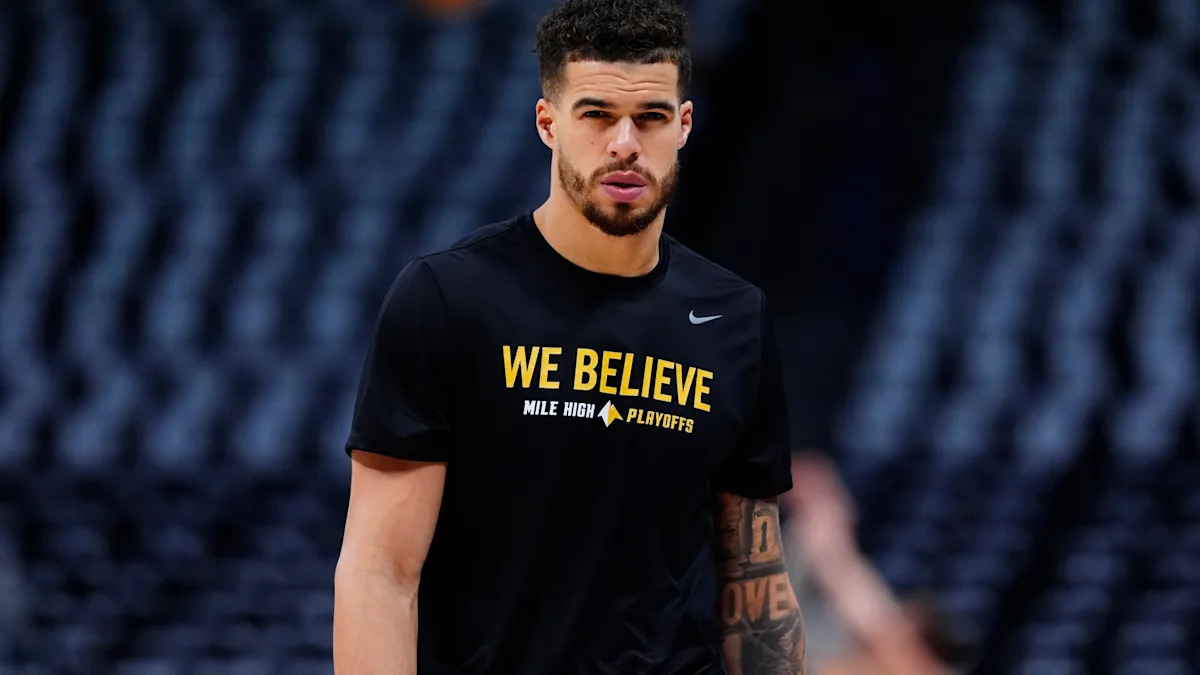

Michael Porter Jr S Sobering Assessment The Devastating Effects Of Sports Gambling

Aug 17, 2025

Michael Porter Jr S Sobering Assessment The Devastating Effects Of Sports Gambling

Aug 17, 2025 -

Austin Butlers Unexpected Bartending Gig After Movie Screening

Aug 17, 2025

Austin Butlers Unexpected Bartending Gig After Movie Screening

Aug 17, 2025 -

Dei Programs Safeguarded Judge Blocks Trump Administrations Restrictions

Aug 17, 2025

Dei Programs Safeguarded Judge Blocks Trump Administrations Restrictions

Aug 17, 2025 -

Curbing Risky Wagers Nba Union Collaborate On Prop Bet Reforms

Aug 17, 2025

Curbing Risky Wagers Nba Union Collaborate On Prop Bet Reforms

Aug 17, 2025 -

Major Bomb Disposal Project Clears Way For Wooler Playground Reopening

Aug 17, 2025

Major Bomb Disposal Project Clears Way For Wooler Playground Reopening

Aug 17, 2025