Post-Shanghai Upgrade: Investors Pour $200 Million Into Ethereum

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Shanghai Upgrade: Investors Pour $200 Million into Ethereum, Signaling Strong Confidence

The Ethereum network recently underwent its highly anticipated Shanghai upgrade, and the market's response has been overwhelmingly positive. Data reveals a significant influx of capital, with investors pouring over $200 million into Ethereum in the days following the upgrade. This surge underscores growing confidence in the network's future and its potential for continued growth. The upgrade, a landmark event for the second-largest cryptocurrency, unlocked staked ETH, a move many analysts believe has removed a significant barrier to entry and boosted market sentiment.

What was the Shanghai Upgrade?

The Shanghai upgrade, also known as the "Shapella" upgrade, was a crucial development for Ethereum. It introduced the ability for users to withdraw their staked ETH, a feature previously unavailable. This unlocked millions of ETH that had been locked up since the Beacon Chain launch in 2020, significantly impacting the overall ETH supply and liquidity. Prior to Shapella, staked ETH was essentially illiquid, limiting its usability and potentially hindering market participation.

This long-awaited feature addressed a major concern among investors, who were previously hesitant to stake their ETH due to the lengthy lock-up period. The upgrade effectively mitigated this risk, encouraging further participation in Ethereum's proof-of-stake (PoS) consensus mechanism.

The Impact of Unlocking Staked ETH

The ability to withdraw staked ETH has had a profound impact on the market. The $200 million investment surge is a clear indication of renewed investor confidence. This influx of capital is likely driven by several factors:

- Increased Liquidity: The unlocking of staked ETH has increased the overall liquidity of the cryptocurrency, making it easier to buy, sell, and trade.

- Reduced Risk: The previous lock-up period presented a significant risk to investors. The Shanghai upgrade alleviated this risk, making staking a more attractive proposition.

- Positive Market Sentiment: The successful execution of the upgrade has boosted market sentiment, signaling the maturity and stability of the Ethereum network.

What Does This Mean for the Future of Ethereum?

The significant investment following the Shanghai upgrade is a strong signal of the continued growth potential of Ethereum. This positive market reaction suggests that the upgrade has successfully addressed key concerns and has paved the way for further adoption and development. Experts believe this could lead to:

- Increased Decentralization: With more individuals able to participate in staking, the network becomes more decentralized and resistant to censorship.

- Enhanced Scalability: The improved liquidity could facilitate the development of more scalable solutions on the Ethereum network.

- Further Innovation: The successful upgrade is likely to encourage further innovation and development within the Ethereum ecosystem.

While the $200 million investment is significant, it's important to remember that cryptocurrency markets remain volatile. However, the positive market response to the Shanghai upgrade indicates a strong foundation for Ethereum's continued growth and dominance in the decentralized finance (DeFi) space. This upgrade marks a pivotal moment in Ethereum's history, potentially setting the stage for broader adoption and further technological advancements. It will be interesting to observe the long-term effects of this momentous upgrade on the cryptocurrency market as a whole. Stay tuned for further updates and analysis.

Call to Action: Want to stay informed about the latest developments in the Ethereum ecosystem? [Link to relevant blog/news site].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Shanghai Upgrade: Investors Pour $200 Million Into Ethereum. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Otra Vez La Explosiva Interpretacion De Yahir Y Victor Garcia En Juego De Voces 2025

May 20, 2025

Otra Vez La Explosiva Interpretacion De Yahir Y Victor Garcia En Juego De Voces 2025

May 20, 2025 -

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Invested

May 20, 2025

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Invested

May 20, 2025 -

Elite Swimmer Speaks Out The Devastating Impact Of Coaching Abuse And Weight Criticism

May 20, 2025

Elite Swimmer Speaks Out The Devastating Impact Of Coaching Abuse And Weight Criticism

May 20, 2025 -

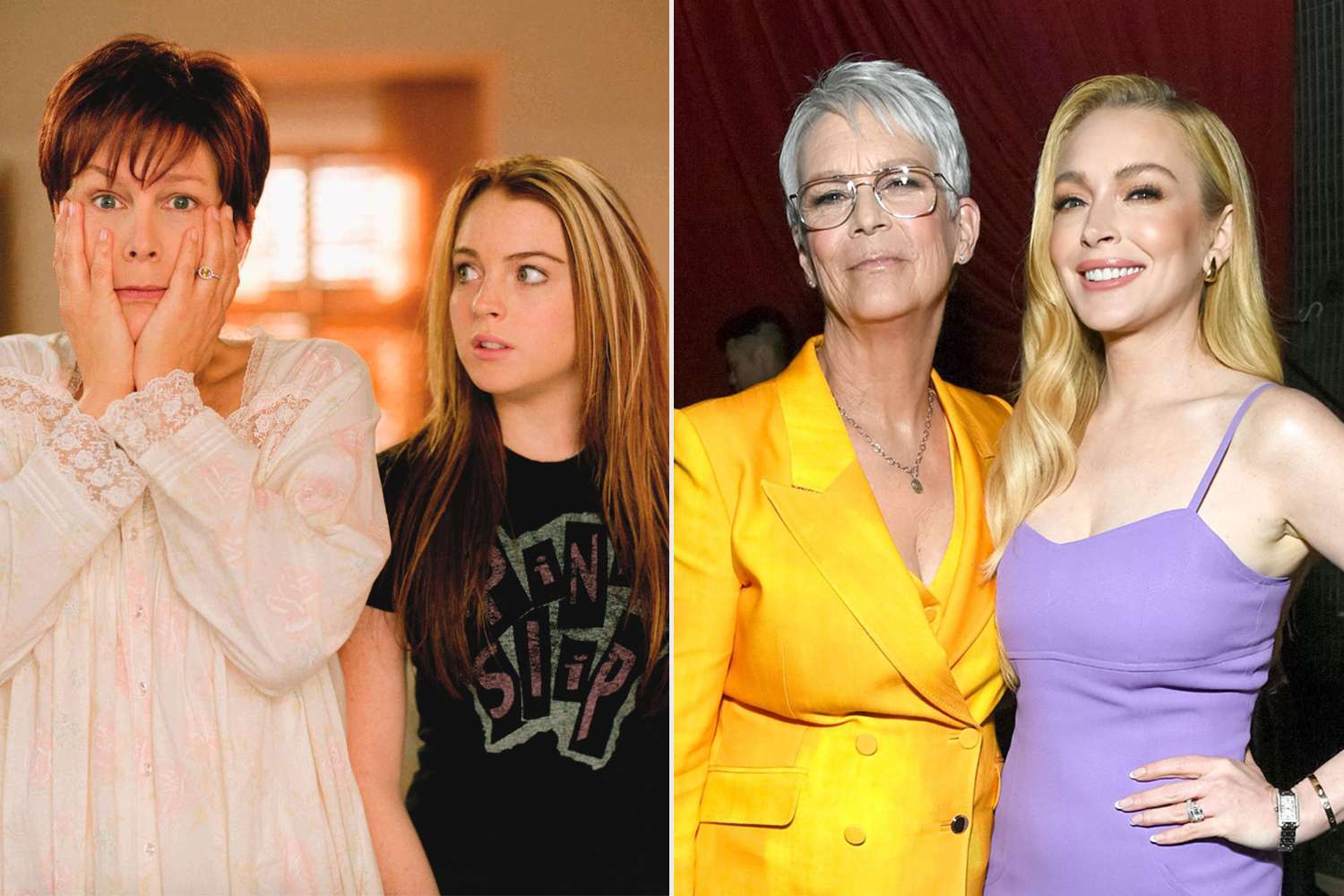

Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 20, 2025

Jamie Lee Curtis Discusses Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 20, 2025 -

Colombian Model And Mexican Influencer Murders Highlight Urgent Need To Combat Femicide

May 20, 2025

Colombian Model And Mexican Influencer Murders Highlight Urgent Need To Combat Femicide

May 20, 2025

Latest Posts

-

New Streaming Ww 1 Epic Daniel Craig Cillian Murphy And Tom Hardy Lead The Cast

May 21, 2025

New Streaming Ww 1 Epic Daniel Craig Cillian Murphy And Tom Hardy Lead The Cast

May 21, 2025 -

St Louis Tornado Aftermath How The Community Is Picking Up The Pieces

May 21, 2025

St Louis Tornado Aftermath How The Community Is Picking Up The Pieces

May 21, 2025 -

Femicide Statistics And Trends Why Are Incidents Increasing Worldwide

May 21, 2025

Femicide Statistics And Trends Why Are Incidents Increasing Worldwide

May 21, 2025 -

Gazas North Final Hospital Hit In Israeli Offensive Casualties Mount

May 21, 2025

Gazas North Final Hospital Hit In Israeli Offensive Casualties Mount

May 21, 2025 -

Concerns About Pacifiers And Thumb Sucking Advice For Parents

May 21, 2025

Concerns About Pacifiers And Thumb Sucking Advice For Parents

May 21, 2025