Potential 2025 US Tourism Decline: Preparing Your Retirement Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Potential 2025 US Tourism Decline: Preparing Your Retirement Investments

The US tourism industry, a significant contributor to the national economy, faces potential headwinds in 2025. This projected decline presents a crucial consideration for retirees and those nearing retirement, impacting not only travel plans but also the crucial stability of retirement investments. Understanding these potential shifts and adapting your financial strategy is key to securing a comfortable retirement.

Economic Headwinds and Tourism's Vulnerability:

Several factors contribute to the forecast of a potential downturn in US tourism in 2025. These include:

- Inflation and Recessionary Fears: Persistent inflation and the lingering threat of recession are impacting consumer spending, leading to reduced discretionary income for leisure travel. This directly impacts the tourism sector, which is highly sensitive to economic fluctuations.

- Global Uncertainty: Geopolitical instability and international economic uncertainties can deter both domestic and international tourists from visiting the US. Travel advisories and safety concerns play a significant role in these decisions.

- Rising Interest Rates: Higher interest rates make borrowing more expensive, affecting not only individual travel budgets but also investment strategies that rely on interest income.

How This Impacts Retirement Investments:

A decline in tourism can have a ripple effect across various investment sectors. For example:

- Real Estate: Reduced tourism can negatively impact the value of properties in popular tourist destinations. Retirees heavily invested in vacation rental properties or real estate in tourism-dependent areas could experience a decrease in their asset value.

- Hospitality Stocks: Companies in the hospitality industry, including hotels, airlines, and restaurants, are directly affected by tourism trends. Investing in these stocks carries increased risk during a tourism decline.

- Travel-Related Businesses: Smaller businesses reliant on tourism, such as tour operators and local guides, are especially vulnerable, potentially impacting the overall economic health and investment climate.

Strategies for Protecting Your Retirement Investments:

Preparing for potential downturns requires a proactive approach:

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't over-concentrate in sectors heavily reliant on tourism.

- Risk Tolerance Assessment: Re-evaluate your risk tolerance and adjust your investment strategy accordingly. Consider shifting towards more conservative investments if you are nearing retirement or have a low risk tolerance.

- Emergency Fund: Maintain a substantial emergency fund to cover unexpected expenses. This is especially important during economic uncertainty.

- Consult a Financial Advisor: Seeking professional advice from a qualified financial advisor can provide personalized guidance tailored to your specific circumstances and risk profile. They can help you navigate the complexities of investment planning during times of economic uncertainty. [Link to reputable financial planning resource]

Looking Ahead:

The potential decline in US tourism in 2025 necessitates a thorough review of your retirement investment strategy. By understanding the contributing factors and implementing proactive measures, you can significantly improve the resilience of your retirement portfolio and ensure a more secure financial future. Don't wait until it's too late; start planning today. This proactive approach will help you weather any economic storm and enjoy a comfortable and secure retirement.

Keywords: Retirement planning, US tourism, 2025 economic forecast, retirement investments, diversification, risk management, financial advisor, inflation, recession, economic uncertainty, hospitality stocks, real estate investment, travel industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Potential 2025 US Tourism Decline: Preparing Your Retirement Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

End Of The Line For I Os 18 4 1 Apple Prevents Downgrades

May 26, 2025

End Of The Line For I Os 18 4 1 Apple Prevents Downgrades

May 26, 2025 -

Their Dc Love Story A Journey From Miles Apart Ended Too Soon

May 26, 2025

Their Dc Love Story A Journey From Miles Apart Ended Too Soon

May 26, 2025 -

Full Coverage Rg Live Sunday May 25th Day 1

May 26, 2025

Full Coverage Rg Live Sunday May 25th Day 1

May 26, 2025 -

Nola To Il Phillies Ace Sidelined Abel To Debut Sunday

May 26, 2025

Nola To Il Phillies Ace Sidelined Abel To Debut Sunday

May 26, 2025 -

Unveiling The Facts A Critical Look At South Koreas Adoption Practices

May 26, 2025

Unveiling The Facts A Critical Look At South Koreas Adoption Practices

May 26, 2025

Latest Posts

-

Michelle Mones Rise And Fall From Rags To Riches And Back Again

May 27, 2025

Michelle Mones Rise And Fall From Rags To Riches And Back Again

May 27, 2025 -

Memorial Day Weekend Mayhem Mass Arrests On Jersey Shore Boardwalk

May 27, 2025

Memorial Day Weekend Mayhem Mass Arrests On Jersey Shore Boardwalk

May 27, 2025 -

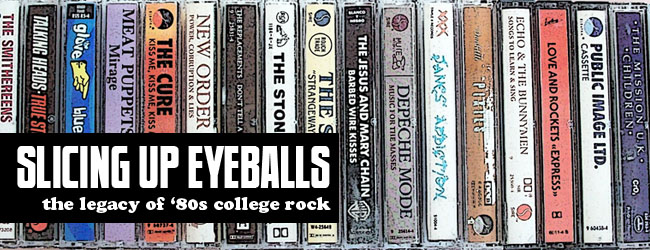

Dark Wave Music Sirius Xm Playlist From Slicing Up Eyeballs 5 25 25

May 27, 2025

Dark Wave Music Sirius Xm Playlist From Slicing Up Eyeballs 5 25 25

May 27, 2025 -

Israeli Blockades Toll Bbc Highlights Hungry Gaza Infant

May 27, 2025

Israeli Blockades Toll Bbc Highlights Hungry Gaza Infant

May 27, 2025 -

New Orleans Jail Escape The Seven Suspects And Their Alleged Involvement

May 27, 2025

New Orleans Jail Escape The Seven Suspects And Their Alleged Involvement

May 27, 2025