Potential 401(k) Reforms: How They Could Affect Your Retirement Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Potential 401(k) Reforms: How They Could Affect Your Retirement Savings

Are you worried about securing your financial future? Changes are brewing in the world of 401(k) retirement plans, and understanding these potential reforms is crucial for anyone saving for retirement. This article breaks down the key proposed changes and how they could impact your nest egg.

The 401(k) system, while lauded for its contribution to retirement savings, has also faced criticism for its inherent complexities and potential for unequal outcomes. Recent proposals aim to address these issues, potentially leading to significant changes in how Americans save for retirement.

H2: Key Proposed 401(k) Reforms

Several reforms are currently under discussion, focusing on improving accessibility, affordability, and overall effectiveness of 401(k) plans. These include:

-

Automatic Enrollment with Increased Default Contribution Rates: Many proposals suggest automatically enrolling employees in 401(k) plans with a higher default contribution rate than currently common. This aims to address the issue of inertia, where many employees fail to enroll due to procrastination or lack of awareness. This could significantly boost retirement savings for many, particularly lower-income workers. [Link to a relevant government resource on automatic enrollment].

-

Increased Matching Contributions from Employers: Some reforms advocate for incentivizing employers to increase their matching contributions. Higher matching contributions encourage greater employee participation and accelerate savings growth. This could be achieved through tax credits or other incentives for businesses.

-

Improved Transparency and Fee Disclosure: Current 401(k) fees can be opaque and complex. Proposed reforms aim to increase transparency, making it easier for participants to understand and compare fees charged by different plans. This could lead to lower fees overall, ultimately benefiting savers. [Link to an article about 401k fee comparisons].

-

Expansion of Retirement Savings Options: Proposals are also under consideration to expand access to retirement savings options, particularly for gig workers and the self-employed. This could involve creating simpler, more accessible retirement vehicles or improving the portability of existing plans.

-

Addressing the Issue of High-Cost Investment Options: Some reforms are aimed at reducing the presence of high-fee, underperforming investment options within 401(k) plans. This would protect participants from unknowingly paying excessive fees that erode their retirement savings.

H2: How These Reforms Could Affect Your Retirement Savings

The impact of these reforms on your personal retirement savings will depend on several factors, including your employer's participation, your current savings habits, and the specific details of the enacted legislation. However, some general effects are likely:

- Increased Savings: Automatic enrollment and increased matching contributions will likely lead to increased savings for many individuals.

- Lower Fees: Improved transparency and regulations could result in lower fees, ultimately boosting your retirement nest egg.

- Greater Accessibility: Expanded retirement savings options will benefit self-employed individuals and gig workers who currently lack easy access to traditional 401(k) plans.

H2: What You Can Do Now

While waiting for legislative changes, you can proactively improve your retirement savings:

- Maximize your employer's matching contributions: This is essentially free money, so don't miss out!

- Increase your contribution rate gradually: Even small increases over time can make a significant difference.

- Diversify your investments: Spread your risk across different asset classes.

- Consult a financial advisor: They can help you create a personalized retirement savings plan.

H2: Conclusion

Potential 401(k) reforms represent a significant opportunity to improve the retirement security of millions of Americans. By understanding the proposed changes and taking proactive steps to manage your own retirement savings, you can significantly enhance your financial future. Stay informed about legislative developments and consult with a financial professional to tailor your retirement strategy to these potential changes.

Call to action: Are you prepared for these potential changes? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Potential 401(k) Reforms: How They Could Affect Your Retirement Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ennis Rakestraws Apology Following Social Media Backlash

Aug 09, 2025

Ennis Rakestraws Apology Following Social Media Backlash

Aug 09, 2025 -

Golfer Tommy Fleetwoods Net Worth And Marital Challenges

Aug 09, 2025

Golfer Tommy Fleetwoods Net Worth And Marital Challenges

Aug 09, 2025 -

Wta Showdown Collins Vs Townsend Predictions Live Stream Details And More

Aug 09, 2025

Wta Showdown Collins Vs Townsend Predictions Live Stream Details And More

Aug 09, 2025 -

Debanking Crackdown Trump Set To Sign Sweeping Executive Order

Aug 09, 2025

Debanking Crackdown Trump Set To Sign Sweeping Executive Order

Aug 09, 2025 -

2025 Western And Southern Open Predicting The Collins 61 Vs Townsend 75 Encounter

Aug 09, 2025

2025 Western And Southern Open Predicting The Collins 61 Vs Townsend 75 Encounter

Aug 09, 2025

Latest Posts

-

Shockwaves In Indy Car Officials And Pato O Ward Respond To Ice Controversy

Aug 10, 2025

Shockwaves In Indy Car Officials And Pato O Ward Respond To Ice Controversy

Aug 10, 2025 -

Former Packers Star And Nflpas Inaugural President Billy Howton Dies At 95

Aug 10, 2025

Former Packers Star And Nflpas Inaugural President Billy Howton Dies At 95

Aug 10, 2025 -

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025 -

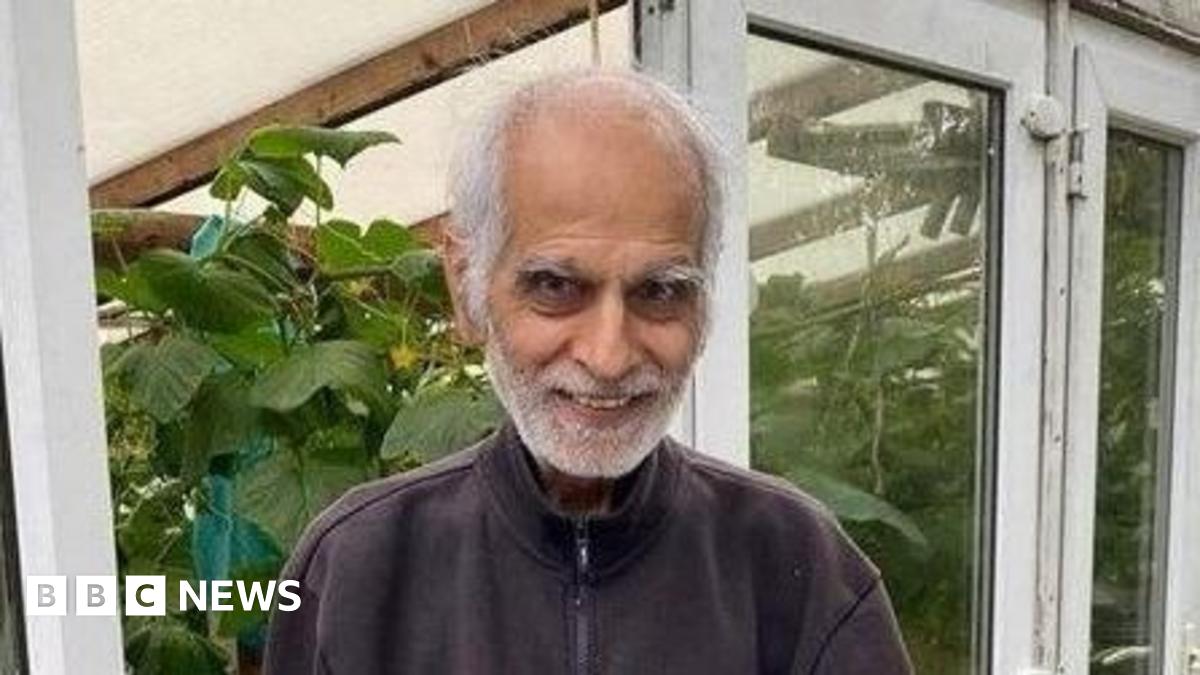

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025 -

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025