Potential 401(k) Reforms: What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Potential 401(k) Reforms: What Investors Need to Know

Are significant changes coming to your retirement savings? The future of 401(k) plans is under discussion, with potential reforms sparking both excitement and apprehension among millions of American investors. This article breaks down the key proposals, their potential impact on your retirement savings, and what you should be doing now to prepare.

What are the proposed 401(k) reforms?

Several reform proposals are circulating, aiming to address concerns about the current system's accessibility, affordability, and overall effectiveness in ensuring a comfortable retirement. Key areas of focus include:

-

Automatic enrollment and escalation: Many proposals suggest automatically enrolling employees in 401(k) plans with automatic contribution increases over time. This aims to boost participation rates and encourage long-term saving. While seemingly beneficial, understanding the implications of default contribution rates is crucial. Are they sufficient to meet your retirement goals? This is a critical question to consider.

-

Increased employer matching contributions: Some proposals focus on incentivizing employers to offer more generous matching contributions. This would significantly boost retirement savings for many employees. However, the long-term sustainability of this model for businesses needs careful consideration.

-

Improved transparency and fee disclosure: Greater transparency in fees and investment options is a recurring theme. Currently, many employees struggle to understand the complexities of their 401(k) plans and the associated fees. Simpler, clearer disclosures would empower investors to make more informed decisions.

-

Default investment options: Proposals exist to reform the default investment options offered in 401(k) plans. A move towards target-date funds (TDFs) or other low-cost, diversified options is frequently discussed, aiming to reduce risk and improve long-term returns. However, finding the right balance between risk and return for your specific circumstances remains essential.

How will these reforms impact my retirement savings?

The impact of these reforms will vary depending on individual circumstances and the specific details of the final legislation. However, some potential benefits include:

-

Higher savings rates: Automatic enrollment and escalation features could lead to significantly higher retirement savings over time, particularly for those who might otherwise not participate.

-

Improved investment outcomes: Increased transparency and better default investment options can lead to more informed investment decisions and potentially better long-term returns.

-

Greater financial security in retirement: Overall, successful reforms could lead to greater financial security for millions of Americans in retirement.

What should I do now?

While waiting for potential legislative changes, it's crucial to take proactive steps to secure your retirement:

-

Maximize your contributions: Contribute as much as you can afford to your 401(k) plan, especially if your employer offers matching contributions.

-

Diversify your investments: Spread your investments across different asset classes to reduce risk.

-

Review your fees: Understand the fees associated with your 401(k) plan and consider switching to lower-cost options if available.

-

Consult a financial advisor: A financial advisor can help you develop a personalized retirement plan and make informed investment decisions.

The bottom line: Potential 401(k) reforms represent a significant opportunity to improve retirement security for many Americans. Staying informed about these developments and taking proactive steps to manage your retirement savings is crucial, regardless of any legislative changes. Understanding your current 401(k) plan and actively engaging in its management is the best way to prepare for a secure future. Don't wait – start planning today!

(Note: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Potential 401(k) Reforms: What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Police Make Arrests In Antisemitic Water Spraying Incident Against Orthodox Community

Aug 09, 2025

Police Make Arrests In Antisemitic Water Spraying Incident Against Orthodox Community

Aug 09, 2025 -

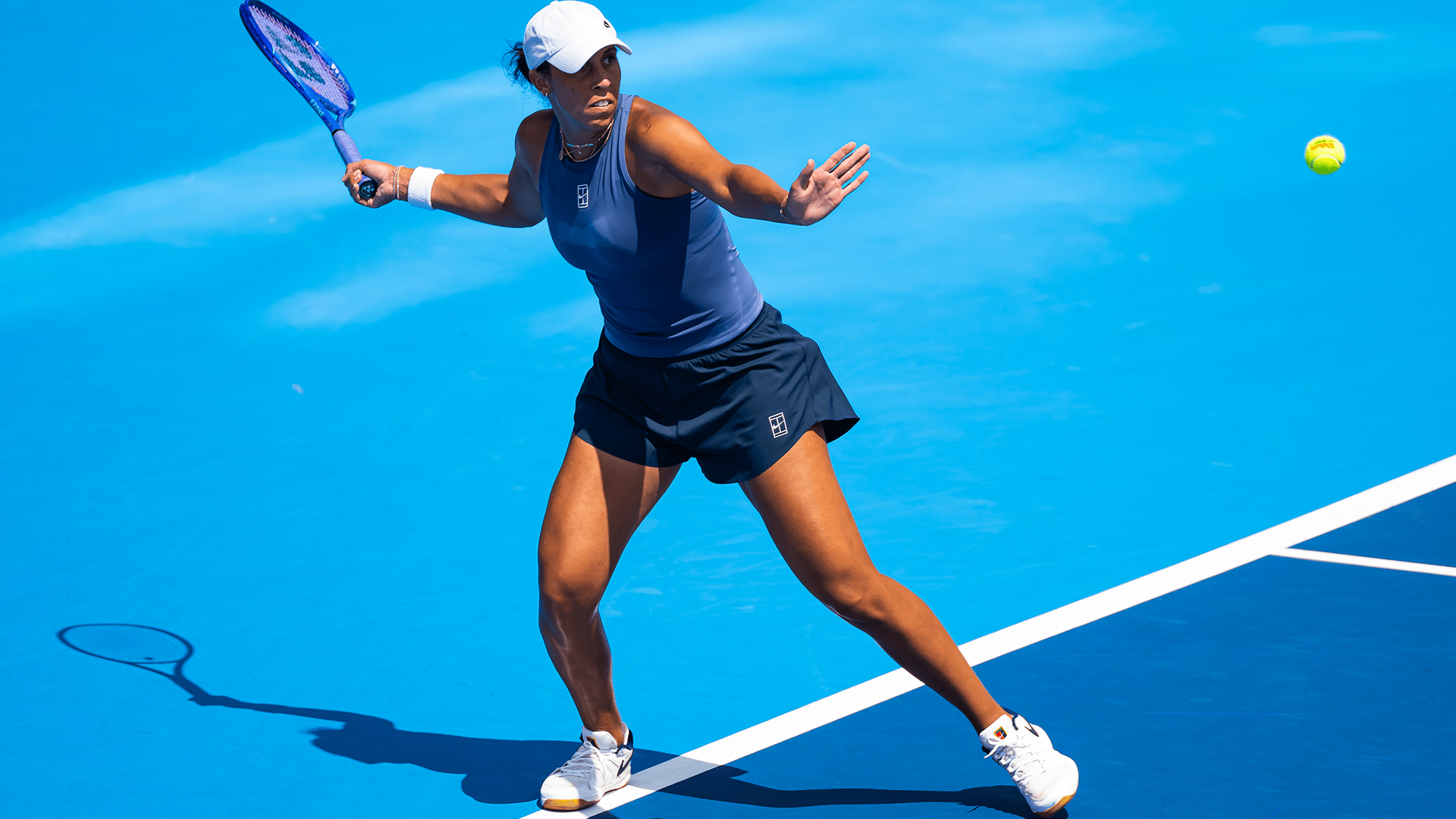

Danielle Collins Vs Taylor Townsend Where To Watch And Match Analysis

Aug 09, 2025

Danielle Collins Vs Taylor Townsend Where To Watch And Match Analysis

Aug 09, 2025 -

Pronostic Tennis Gratuit Stearns Contre Wang Le 08 08 2025

Aug 09, 2025

Pronostic Tennis Gratuit Stearns Contre Wang Le 08 08 2025

Aug 09, 2025 -

South Park Takes Aim At Kristi Noem A Scathing New Episode

Aug 09, 2025

South Park Takes Aim At Kristi Noem A Scathing New Episode

Aug 09, 2025 -

Preseason Nfl Trade Predictions One Player To Watch From Every Team

Aug 09, 2025

Preseason Nfl Trade Predictions One Player To Watch From Every Team

Aug 09, 2025

Latest Posts

-

Gaza Suffers Calamity While Uk Faces 30 Billion Chagos Compensation Claim

Aug 12, 2025

Gaza Suffers Calamity While Uk Faces 30 Billion Chagos Compensation Claim

Aug 12, 2025 -

Edinburghs Arthurs Seat Wildfire Prompts Evacuation

Aug 12, 2025

Edinburghs Arthurs Seat Wildfire Prompts Evacuation

Aug 12, 2025 -

Jennifer Aniston Breaks Silence Comments On Brad Pitt Angelina Jolie Relationship

Aug 12, 2025

Jennifer Aniston Breaks Silence Comments On Brad Pitt Angelina Jolie Relationship

Aug 12, 2025 -

Democratic Party Rift Bernie Sanders And The Struggle To Regain Voter Trust

Aug 12, 2025

Democratic Party Rift Bernie Sanders And The Struggle To Regain Voter Trust

Aug 12, 2025 -

Madison Keys On Cincinnati Win Blackout Moment Against Eva Lys

Aug 12, 2025

Madison Keys On Cincinnati Win Blackout Moment Against Eva Lys

Aug 12, 2025