Pre-Earnings Broadcom Options Strategy: How To Play The Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-Earnings Broadcom Options Strategy: How to Play the Surge

Broadcom (AVGO) is a tech giant, and its earnings reports often send ripples through the market. For savvy options traders, this volatility presents a lucrative opportunity. But navigating the pre-earnings period requires a carefully crafted strategy. This article will explore how to potentially profit from the anticipated surge in Broadcom's stock price following its earnings announcement. We'll outline a potential options strategy, discuss risk management, and offer crucial considerations before deploying your capital.

Understanding the Pre-Earnings Volatility

Before diving into a specific strategy, it's crucial to understand why Broadcom's stock price often experiences significant fluctuations around earnings announcements. Several factors contribute to this volatility:

- High Expectations: As a major player in semiconductors and infrastructure software, Broadcom faces intense scrutiny. Any deviation from analysts' consensus estimates can trigger substantial market reactions.

- Market Sentiment: The overall market sentiment significantly impacts how investors react to Broadcom's earnings. A generally positive market might absorb negative surprises more easily, while a bearish market might amplify them.

- Guidance: Broadcom's forward guidance – its predictions for future performance – is closely watched. Positive guidance often fuels price increases, while negative guidance can lead to sharp declines.

A Bullish Call Spread Strategy

One potential options strategy to profit from an anticipated price surge in Broadcom is a bullish call spread. This strategy limits risk while offering defined profit potential. Here's how it works:

- Buy 1 call option with a lower strike price: This gives you the right, but not the obligation, to buy AVGO shares at this lower price.

- Simultaneously sell 1 call option with a higher strike price: This sale generates premium income, reducing the net cost of the trade.

This strategy profits most if the stock price rises significantly above the higher strike price before the options expire. The maximum profit is capped at the difference between the strike prices minus the net debit paid. The maximum loss is limited to the net debit paid.

Example:

Let's say AVGO is trading at $600. You could:

- Buy 1 call option with a strike price of $610 (expiring soon after the earnings announcement)

- Sell 1 call option with a strike price of $630 (same expiration date)

This strategy limits your risk while allowing you to profit from a significant price increase.

Risk Management and Considerations:

- Implied Volatility (IV): IV is a key factor influencing options prices. High IV before earnings reflects market uncertainty and can make options more expensive. Consider waiting for IV to peak before entering the trade.

- Time Decay (Theta): Options lose value as they approach expiration. Choose an expiration date that aligns with your outlook and risk tolerance.

- Earnings Surprise: Even with careful planning, unexpected earnings can dramatically impact the stock price. Be prepared for potential losses.

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across various assets to mitigate risk.

Before you trade:

- Thoroughly research Broadcom's financial performance: Understand its recent trends and the factors that may influence its earnings.

- Consult a financial advisor: Seek professional advice before making any investment decisions. Options trading involves significant risk, and it's crucial to understand these risks before engaging.

- Practice with a paper trading account: Gain experience with options trading in a risk-free environment before committing real capital.

Conclusion:

The pre-earnings period for Broadcom presents both opportunities and challenges for options traders. A well-planned bullish call spread can be a powerful tool for profiting from an anticipated price surge, but thorough research, risk management, and a clear understanding of the underlying factors are crucial for success. Remember to always trade responsibly and within your risk tolerance. This information is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-Earnings Broadcom Options Strategy: How To Play The Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

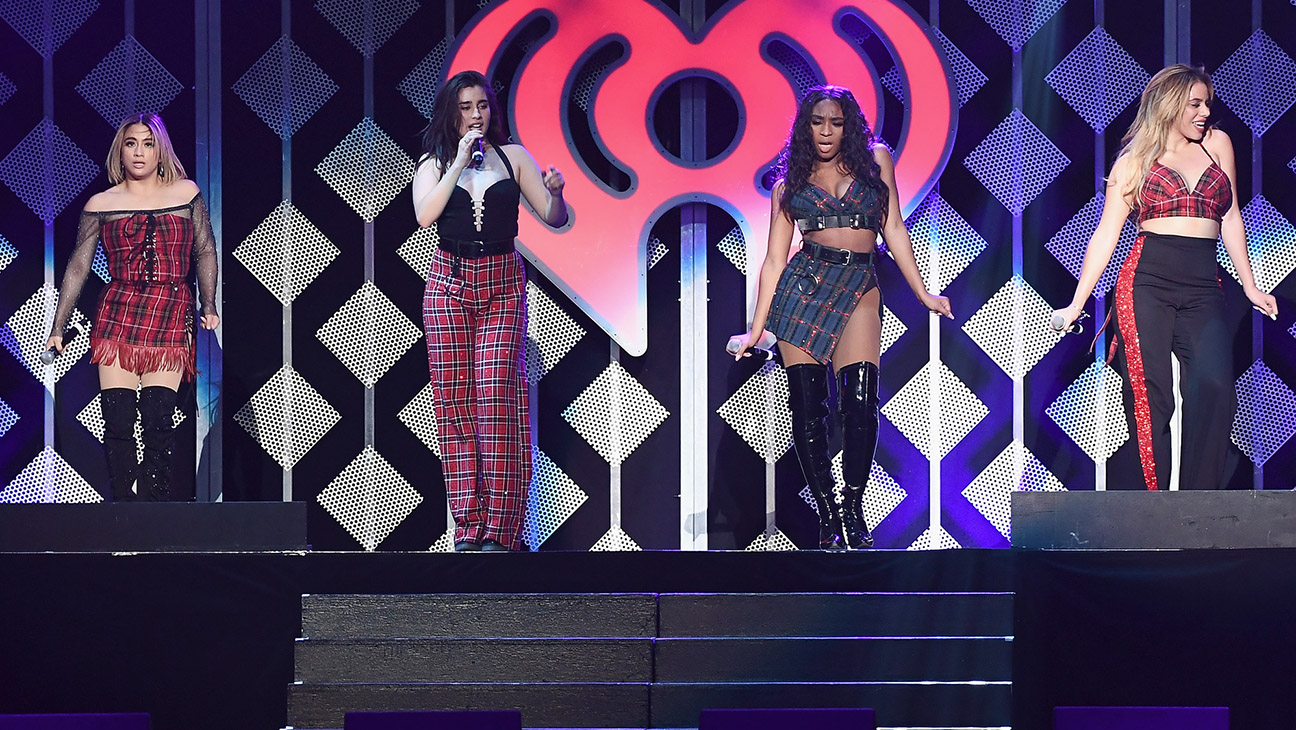

Exclusive Fifth Harmony Without Camila Cabello Explores Reunion

Jun 06, 2025

Exclusive Fifth Harmony Without Camila Cabello Explores Reunion

Jun 06, 2025 -

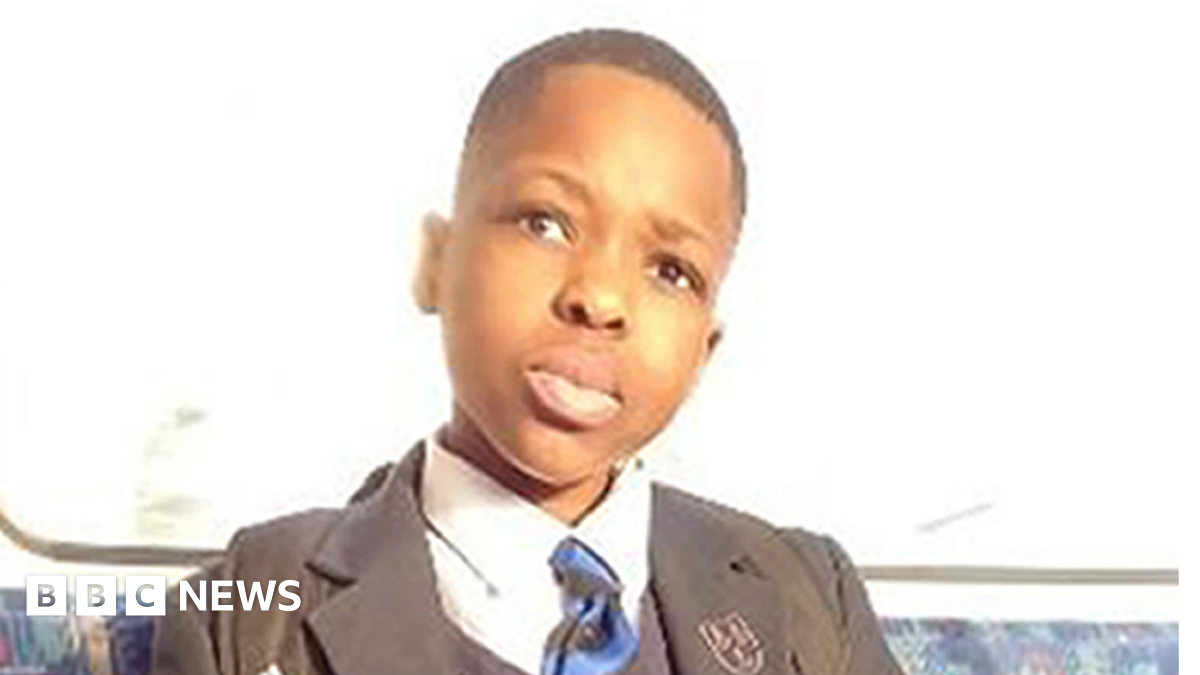

Murder Accused Marcus Monzos Alleged Plot To Kill Daniel Anjorin

Jun 06, 2025

Murder Accused Marcus Monzos Alleged Plot To Kill Daniel Anjorin

Jun 06, 2025 -

Impact Of Villanovas Departure Reshaping The Future Of Caa Football

Jun 06, 2025

Impact Of Villanovas Departure Reshaping The Future Of Caa Football

Jun 06, 2025 -

Microbiomes Role In Preventing Hospital Admissions Early Life Influences

Jun 06, 2025

Microbiomes Role In Preventing Hospital Admissions Early Life Influences

Jun 06, 2025 -

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025

Latest Posts

-

Can Ghost Hurricanes Improve Hurricane Prediction Accuracy

Jun 07, 2025

Can Ghost Hurricanes Improve Hurricane Prediction Accuracy

Jun 07, 2025 -

Analysis The 12 Countries Subject To Trumps Travel Restrictions And The Underlying Causes

Jun 07, 2025

Analysis The 12 Countries Subject To Trumps Travel Restrictions And The Underlying Causes

Jun 07, 2025 -

K9 Officer Retirement Ensuring A Comfortable Life For Faithful Servants

Jun 07, 2025

K9 Officer Retirement Ensuring A Comfortable Life For Faithful Servants

Jun 07, 2025 -

Political Shift Karine Jean Pierre Leaves Democratic Party Becomes Independent

Jun 07, 2025

Political Shift Karine Jean Pierre Leaves Democratic Party Becomes Independent

Jun 07, 2025 -

Karine Jean Pierre Declares Independence A New Chapter For Bidens Former Press Secretary

Jun 07, 2025

Karine Jean Pierre Declares Independence A New Chapter For Bidens Former Press Secretary

Jun 07, 2025