Pre-Earnings Options Strategies For Maximizing Returns On Broadcom Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-Earnings Options Strategies for Maximizing Returns on Broadcom Stock

Broadcom (AVGO) is a tech giant known for its consistent growth and strong performance. As earnings season approaches, many investors are looking for ways to maximize their returns on AVGO stock. Options trading offers a powerful toolkit for navigating the volatility surrounding earnings announcements. However, choosing the right strategy requires careful consideration of market sentiment, risk tolerance, and your investment goals. This article explores pre-earnings options strategies for Broadcom, designed to help you make informed decisions.

Understanding the Risks and Rewards

Before diving into specific strategies, it’s crucial to understand the inherent risks involved in options trading. Options contracts are derivatives, meaning their value is derived from the underlying asset (in this case, Broadcom stock). While options offer leverage and the potential for significant returns, they also carry the risk of substantial losses if the underlying asset moves against your prediction. Proper risk management is paramount.

Popular Pre-Earnings Options Strategies for AVGO

Several strategies can be employed before Broadcom's earnings release. Here are a few popular choices:

1. Bullish Call Spread: If you're bullish on Broadcom and expect a significant price increase after earnings, a bull call spread can be a strategic option. This involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price, both with the same expiration date. This strategy limits your potential profit but significantly reduces your upfront cost compared to buying a single call option outright.

2. Bearish Put Spread: Conversely, if you anticipate a price decline following the earnings report, a bearish put spread might be suitable. This involves buying a put option with a higher strike price and simultaneously selling a put option with a lower strike price. Like the bull call spread, this strategy limits your potential losses while also limiting your potential gains.

3. Long Straddle/Strangle: For investors expecting significant volatility regardless of direction, a long straddle (buying a call and a put with the same strike price and expiration date) or a long strangle (buying a call and a put with different strike prices but the same expiration date) can be considered. These strategies profit from large price swings but require a substantial initial investment.

Analyzing Broadcom's Fundamentals Before Implementing a Strategy

Before choosing a strategy, thoroughly analyze Broadcom's recent performance, analyst expectations, and any relevant news impacting the company. Consider factors like:

- Recent Revenue and Earnings Growth: Has Broadcom been consistently exceeding expectations?

- Analyst Ratings and Price Targets: What are analysts predicting for the upcoming earnings report?

- Market Sentiment: Is the overall market sentiment positive or negative towards Broadcom?

- Industry Trends: Are there any industry-specific factors that could impact Broadcom's performance?

Managing Risk and Setting Stop-Loss Orders

Regardless of the chosen strategy, effective risk management is crucial. Setting stop-loss orders can help limit potential losses if the market moves against your prediction. Diversifying your portfolio and avoiding over-leveraging are also vital components of responsible options trading.

Disclaimer: This article provides general information and should not be considered financial advice. Options trading involves significant risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Ready to enhance your understanding of options trading? Explore reputable resources and educational platforms dedicated to options strategies to further refine your approach. Remember that careful research and risk management are key to successful trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-Earnings Options Strategies For Maximizing Returns On Broadcom Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Coca Cola Ko Stock A Buy Current Market Analysis

Jun 05, 2025

Is Coca Cola Ko Stock A Buy Current Market Analysis

Jun 05, 2025 -

Another Portland Energy Firm Threatened With Closure

Jun 05, 2025

Another Portland Energy Firm Threatened With Closure

Jun 05, 2025 -

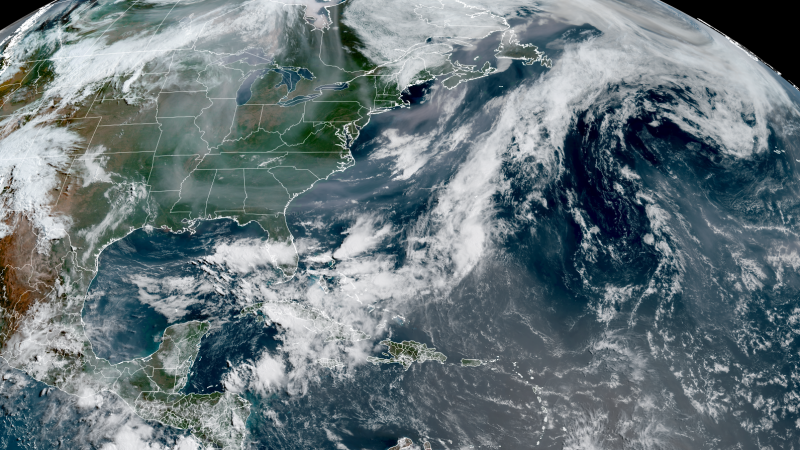

Air Quality Alert Wildfire Smoke And Dust Storm Convergence Expected In Southern Us

Jun 05, 2025

Air Quality Alert Wildfire Smoke And Dust Storm Convergence Expected In Southern Us

Jun 05, 2025 -

Backyard Concert Bust Police Shut Down All American Rejects College Town Show

Jun 05, 2025

Backyard Concert Bust Police Shut Down All American Rejects College Town Show

Jun 05, 2025 -

The Reality Of Daily Grooming Survivors Experiences

Jun 05, 2025

The Reality Of Daily Grooming Survivors Experiences

Jun 05, 2025

Latest Posts

-

Donny Schatz Secures Ride In Upcoming World Of Outlaws Races

Aug 17, 2025

Donny Schatz Secures Ride In Upcoming World Of Outlaws Races

Aug 17, 2025 -

Topshops Return Will The Brands Comeback Be Successful

Aug 17, 2025

Topshops Return Will The Brands Comeback Be Successful

Aug 17, 2025 -

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025 -

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025 -

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025