Preparing For A Potential 2025 US Tourism Crisis: Retirement Planning Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preparing for a Potential 2025 US Tourism Crisis: Retirement Planning Strategies

The US tourism industry, a significant contributor to the national economy, faces potential headwinds in 2025. Experts predict a confluence of factors—from economic uncertainty to shifting travel preferences—that could impact both the industry's health and the retirement plans of millions reliant on its success. This article explores these potential challenges and offers crucial strategies for retirement planning in the face of this looming crisis.

Understanding the Potential Crisis:

Several key factors contribute to the predicted tourism downturn:

- Inflation and Economic Uncertainty: High inflation and potential recessionary pressures are likely to reduce discretionary spending, impacting travel budgets significantly. Families may prioritize essential expenses over leisure travel, creating a ripple effect throughout the tourism sector.

- Changing Travel Preferences: The rise of remote work and evolving travel styles are reshaping the industry. The traditional "vacation" model is changing, with a greater emphasis on extended stays, remote workcations, and more budget-conscious travel choices.

- Infrastructure Challenges: Aging infrastructure and capacity constraints in popular tourist destinations could limit the number of visitors accommodated, leading to potential bottlenecks and reduced revenue.

- Geopolitical Instability: Global events and geopolitical uncertainty can significantly impact international travel, affecting both inbound and outbound tourism for the US.

How These Factors Impact Retirement Planning:

For individuals whose retirement plans rely heavily on the tourism sector – be it through direct employment, investments in tourism-related businesses, or real estate in tourist areas – this potential crisis poses a serious threat. A significant downturn could lead to:

- Job Losses: Reduced tourism could lead to layoffs and business closures across various sectors, from hospitality and transportation to retail and entertainment.

- Reduced Investment Returns: Investments in tourism-related stocks or real estate could experience significant losses, impacting retirement savings.

- Lower Property Values: Properties in heavily tourism-dependent areas might see a decrease in value, impacting retirement wealth.

Strategies for Mitigating Risk:

Given these potential risks, proactive retirement planning is crucial:

1. Diversify Your Investments: Don't put all your eggs in one basket. Diversify your retirement portfolio across various asset classes, reducing your dependence on the tourism sector's performance. Consider investing in sectors less susceptible to economic downturns. [Link to resource on diversification strategies]

2. Develop Multiple Income Streams: Relying solely on one income source increases your vulnerability. Explore additional income streams, such as part-time work, freelance opportunities, or rental income from properties outside tourism hotspots.

3. Increase Emergency Savings: Building a robust emergency fund is crucial to weathering economic storms. Aim for 3-6 months' worth of living expenses in readily accessible savings.

4. Reassess Your Retirement Timeline: If you are nearing retirement and heavily reliant on the tourism sector, consider delaying your retirement to allow time to adjust your financial plan.

5. Consult a Financial Advisor: Seek professional financial advice to create a personalized retirement plan that considers your specific circumstances and risk tolerance. A financial advisor can help you navigate the complexities of retirement planning and develop strategies to mitigate potential risks. [Link to resource on finding a financial advisor]

Conclusion:

While a 2025 tourism crisis is a possibility, proactive planning and risk mitigation strategies can significantly reduce its impact. By diversifying investments, developing multiple income streams, and seeking professional financial advice, individuals can better protect their retirement savings and ensure a secure financial future, regardless of the tourism industry's performance. Don't wait until it's too late; start planning today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preparing For A Potential 2025 US Tourism Crisis: Retirement Planning Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heavy Defeat Prompts Coach Sammy To Demand More From Wi Players

May 25, 2025

Heavy Defeat Prompts Coach Sammy To Demand More From Wi Players

May 25, 2025 -

Top Six I Phone Settings To Adjust After I Os 18 5 Update

May 25, 2025

Top Six I Phone Settings To Adjust After I Os 18 5 Update

May 25, 2025 -

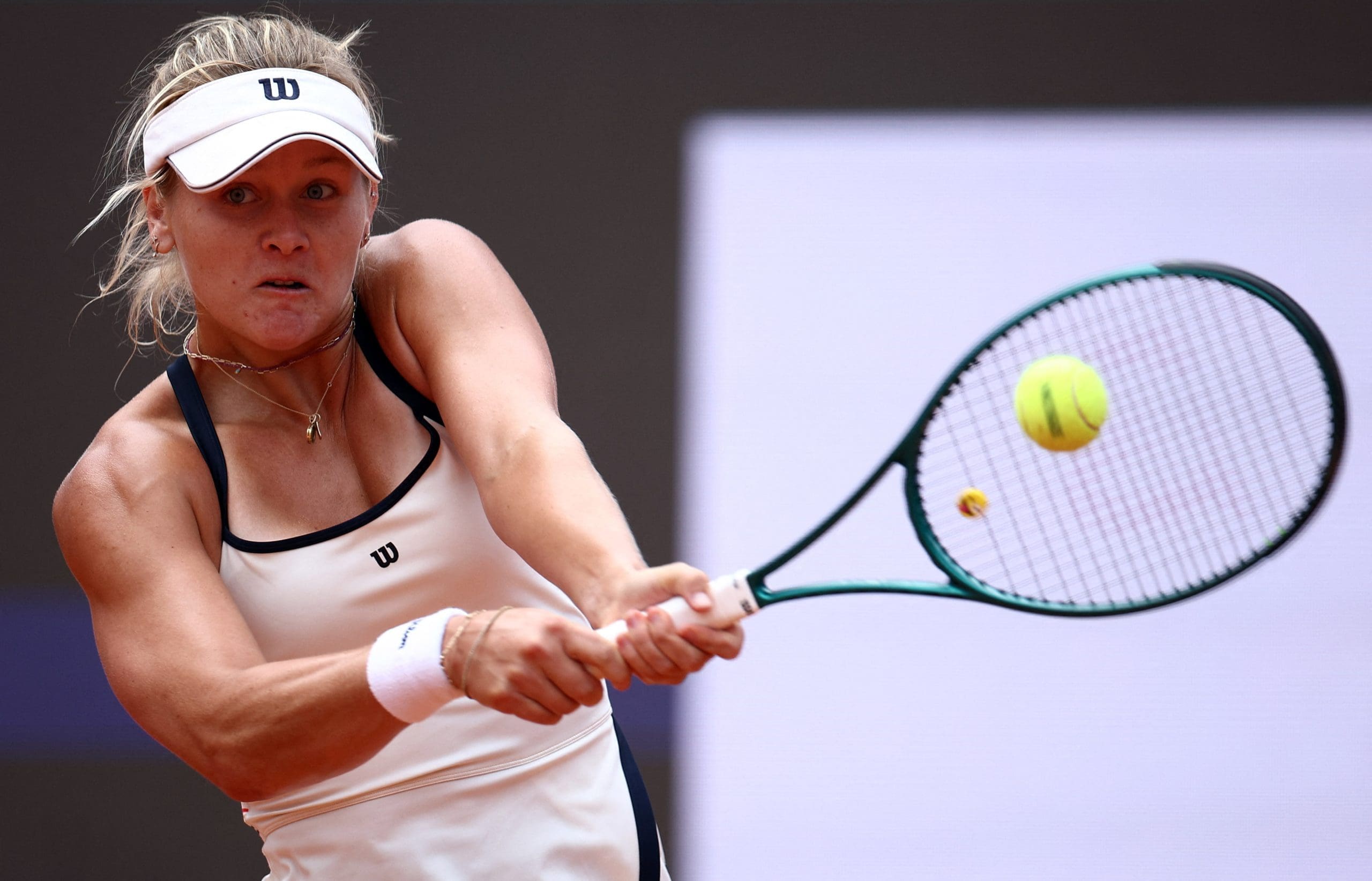

Peyton Stearns Bold French Open Prediction Stuns Tennis World

May 25, 2025

Peyton Stearns Bold French Open Prediction Stuns Tennis World

May 25, 2025 -

Source Louisiana Inmates Attempted New Orleans Jail Escape With Hair Trimmers

May 25, 2025

Source Louisiana Inmates Attempted New Orleans Jail Escape With Hair Trimmers

May 25, 2025 -

Deep Sleep Man Sleeps Through Shipping Container Vessel Grounding

May 25, 2025

Deep Sleep Man Sleeps Through Shipping Container Vessel Grounding

May 25, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025