Preparing For A Potential 2025 US Tourism Crisis: Safeguarding Your Retirement Funds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preparing for a Potential 2025 US Tourism Crisis: Safeguarding Your Retirement Funds

The US tourism industry, a significant contributor to the national economy, faces potential headwinds in 2025. Experts predict a confluence of factors – from inflation and recessionary fears to geopolitical instability – that could dramatically impact travel patterns and, consequently, the financial health of those reliant on tourism-related income streams, particularly retirees. This article explores these potential risks and offers strategies to safeguard your retirement funds in the face of a possible crisis.

Understanding the Looming Threats

Several interconnected factors point to a potentially challenging year for US tourism in 2025:

-

Economic Uncertainty: Inflation remains stubbornly high, and the threat of recession continues to loom large. This directly impacts consumer spending, with discretionary activities like leisure travel often the first to be cut. [Link to reputable economic forecast].

-

Geopolitical Instability: Global events, including ongoing conflicts and political tensions, can significantly disrupt travel plans and deter both domestic and international tourists. This uncertainty creates volatility in the tourism sector. [Link to relevant news source on geopolitical issues].

-

Rising Travel Costs: The combined impact of inflation and increased fuel prices translates into higher airfares, accommodation costs, and overall travel expenses. This price sensitivity makes budget-conscious travelers more hesitant to book trips.

-

Changing Travel Preferences: The pandemic accelerated the shift towards remote work and digital nomadism. This changing landscape affects traditional tourism models and necessitates adaptation for businesses and individuals alike.

Protecting Your Retirement Nest Egg

For retirees heavily reliant on income generated from tourism-related investments (real estate, businesses, etc.), a downturn in the industry poses a significant threat. Here are some strategies to mitigate the risks:

1. Diversification is Key: Don't put all your eggs in one basket. Diversify your retirement portfolio across various asset classes, including stocks, bonds, and real estate, to reduce exposure to the volatility of the tourism sector. [Link to article on portfolio diversification].

2. Emergency Fund Cushion: Build a robust emergency fund that can cover at least six months of living expenses. This safety net will provide financial security during unexpected downturns.

3. Review Your Investments: Regularly review your investment portfolio and adjust your asset allocation as needed, taking into account the evolving economic landscape and potential tourism sector risks. Consider consulting a financial advisor.

4. Explore Alternative Income Streams: Consider supplementing your retirement income with other sources, such as part-time work, rental income from properties outside the tourism sector, or investments in stable, less volatile industries.

5. Debt Management: Minimize high-interest debt to free up more resources for unexpected expenses and to improve your financial resilience during economic uncertainty.

6. Stay Informed: Keep abreast of economic forecasts, industry trends, and potential disruptions that could affect the tourism sector. This informed approach allows for proactive adjustments to your financial plan.

Preparing for the Future

While predicting the future with complete accuracy is impossible, proactive planning and diversification are crucial for safeguarding your retirement funds in the face of potential challenges. By implementing these strategies, you can build a more resilient financial foundation and navigate the uncertainties of the 2025 tourism landscape with greater confidence. Remember to consult with financial professionals for personalized advice tailored to your specific circumstances. Don't wait; start planning your financial resilience today!

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preparing For A Potential 2025 US Tourism Crisis: Safeguarding Your Retirement Funds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Os 18 5 Six Immediate Post Installation Steps To Optimize Your I Phone

May 25, 2025

I Os 18 5 Six Immediate Post Installation Steps To Optimize Your I Phone

May 25, 2025 -

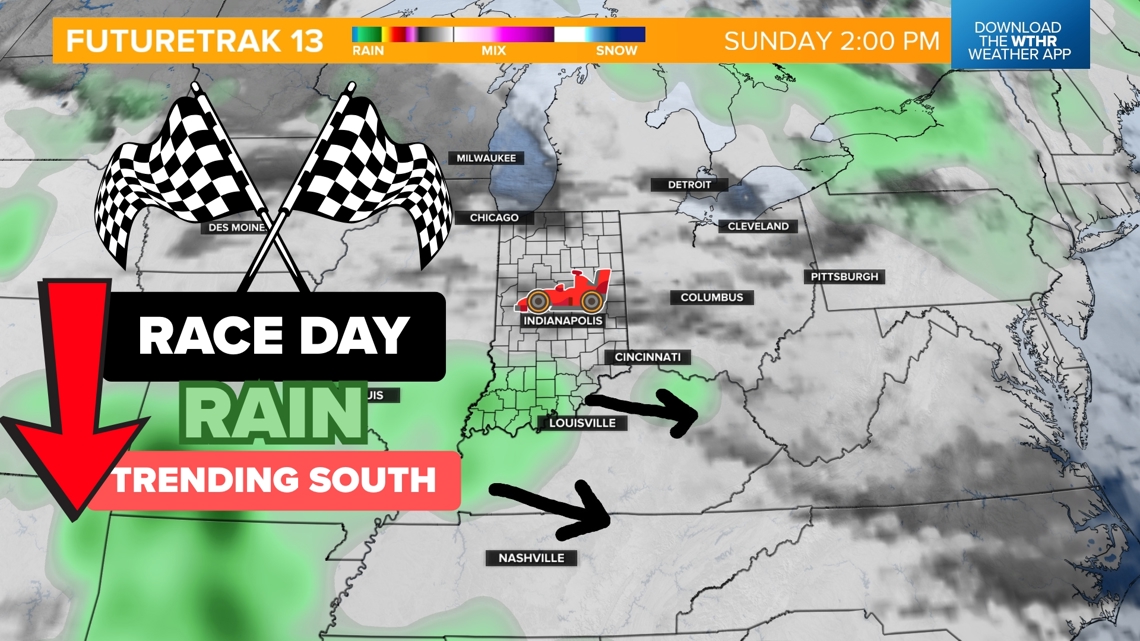

Indy 500 Race Weekend 2025 Complete Weather Outlook

May 25, 2025

Indy 500 Race Weekend 2025 Complete Weather Outlook

May 25, 2025 -

I Phone I Os 18 5 Six Post Installation Tips And Optimizations

May 25, 2025

I Phone I Os 18 5 Six Post Installation Tips And Optimizations

May 25, 2025 -

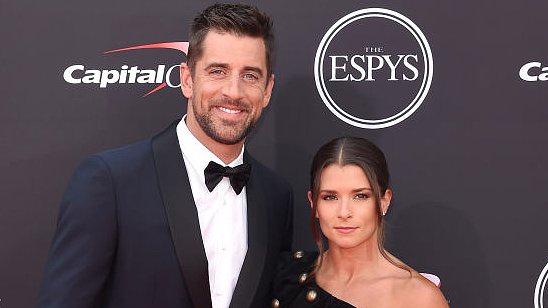

Danica Patricks Account The Toll Of Her Relationship With Aaron Rodgers

May 25, 2025

Danica Patricks Account The Toll Of Her Relationship With Aaron Rodgers

May 25, 2025 -

Ship Footage Captures Ocean Gate Titan Subs Fatal Implosion

May 25, 2025

Ship Footage Captures Ocean Gate Titan Subs Fatal Implosion

May 25, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025