Preparing For A Potential 2025 US Tourism Crisis: Securing Your Retirement Funds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preparing for a Potential 2025 US Tourism Crisis: Securing Your Retirement Funds

The US tourism industry, a significant contributor to the national economy, faces potential headwinds in 2025. Concerns around inflation, economic slowdown, and geopolitical instability are raising anxieties for retirees heavily reliant on tourism-related investments or those planning future travel. This article explores these potential threats and offers crucial strategies to safeguard your retirement funds.

The Looming Storm Clouds: Threats to the US Tourism Sector in 2025

Several factors contribute to the potential crisis:

-

Inflation and Economic Slowdown: High inflation erodes purchasing power, potentially leading to decreased travel spending. A looming recession could further exacerbate this, forcing individuals to prioritize essential expenses over leisure travel. This directly impacts businesses within the tourism sector, from airlines and hotels to restaurants and attractions.

-

Geopolitical Instability: Global events, including ongoing conflicts and political uncertainties, can significantly impact international travel. Concerns about safety and security can deter tourists, leading to reduced revenue for tourism-dependent businesses.

-

Over-reliance on International Tourism: While domestic tourism provides a buffer, the US tourism industry relies heavily on international visitors. A decline in international arrivals due to global economic woes or travel restrictions can severely impact the sector.

-

Climate Change Impacts: Extreme weather events and climate-related disruptions can severely damage tourism infrastructure and deter tourists from visiting affected areas. This poses a significant threat to coastal destinations and national parks, popular tourist hotspots.

Protecting Your Retirement Nest Egg: Strategies for Mitigation

The potential downturn in the tourism sector necessitates proactive steps to protect your retirement savings. Here's how:

1. Diversify Your Investments: Don't put all your eggs in one basket. Diversifying your portfolio across various asset classes, including stocks, bonds, real estate, and alternative investments, mitigates risk. Reducing your exposure to tourism-related stocks is crucial. Consider consulting with a [link to reputable financial advisor website] for personalized advice.

2. Re-evaluate Your Retirement Plan: If a significant portion of your retirement income relies on tourism-related assets, it's time to reassess your strategy. Explore alternative income streams, such as part-time work or rental properties, to bolster your financial security.

3. Monitor Economic Indicators: Stay informed about economic trends and geopolitical developments that may impact the tourism industry. Regularly review financial news and reports from reputable sources like the [link to Bureau of Economic Analysis website] and the [link to World Travel & Tourism Council website].

4. Consider Delaying Travel Plans: If you're planning a significant trip in 2025, consider delaying it until economic conditions improve. This could save you money and reduce the risk of encountering disruptions.

5. Build an Emergency Fund: An emergency fund provides a financial cushion during unexpected downturns. Having 3-6 months' worth of living expenses saved can alleviate stress and provide financial stability during a crisis.

Looking Ahead: Navigating Uncertainty in the Tourism Sector

While the potential for a tourism crisis in 2025 is a serious concern, proactive planning and diversification can significantly mitigate the risks. By carefully monitoring economic indicators, diversifying investments, and building a strong financial foundation, retirees can secure their financial future and navigate the uncertainties of the tourism sector with greater confidence. Remember to seek professional financial advice tailored to your individual circumstances. Don't hesitate to contact a qualified financial advisor to discuss your specific retirement plan and develop a robust strategy to weather potential economic storms.

Call to Action: Schedule a consultation with a financial advisor today to review your retirement plan and explore strategies to protect your investments. [Link to a general financial planning resource or a contact form].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preparing For A Potential 2025 US Tourism Crisis: Securing Your Retirement Funds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unveiling The Facts A Critical Look At South Koreas Adoption Practices

May 26, 2025

Unveiling The Facts A Critical Look At South Koreas Adoption Practices

May 26, 2025 -

Exclusive Audio Evidence Reveals The Catastrophic Fate Of The Titan Sub

May 26, 2025

Exclusive Audio Evidence Reveals The Catastrophic Fate Of The Titan Sub

May 26, 2025 -

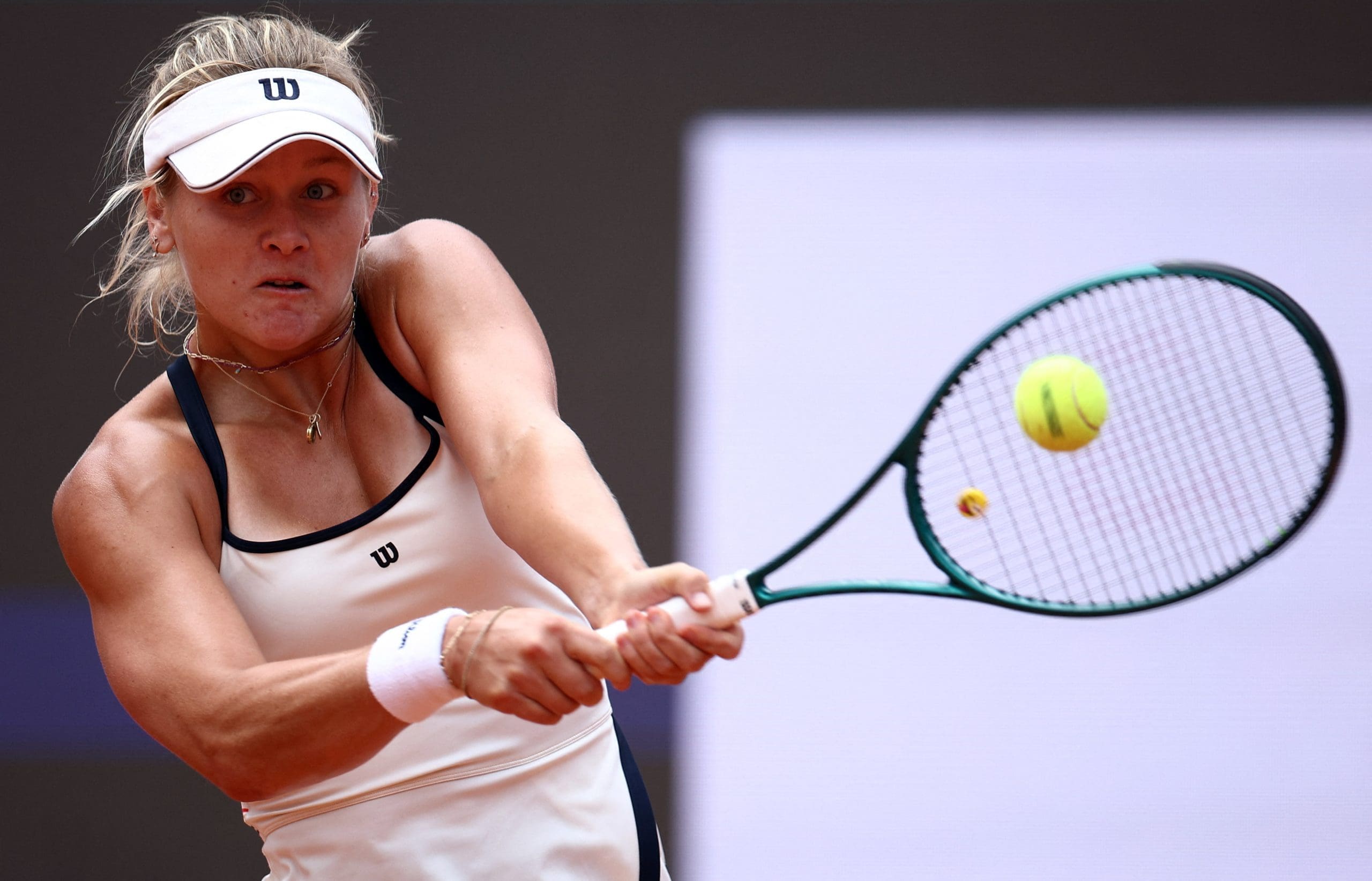

Is Peyton Stearns The Next Big Thing French Open Prediction Analysis

May 26, 2025

Is Peyton Stearns The Next Big Thing French Open Prediction Analysis

May 26, 2025 -

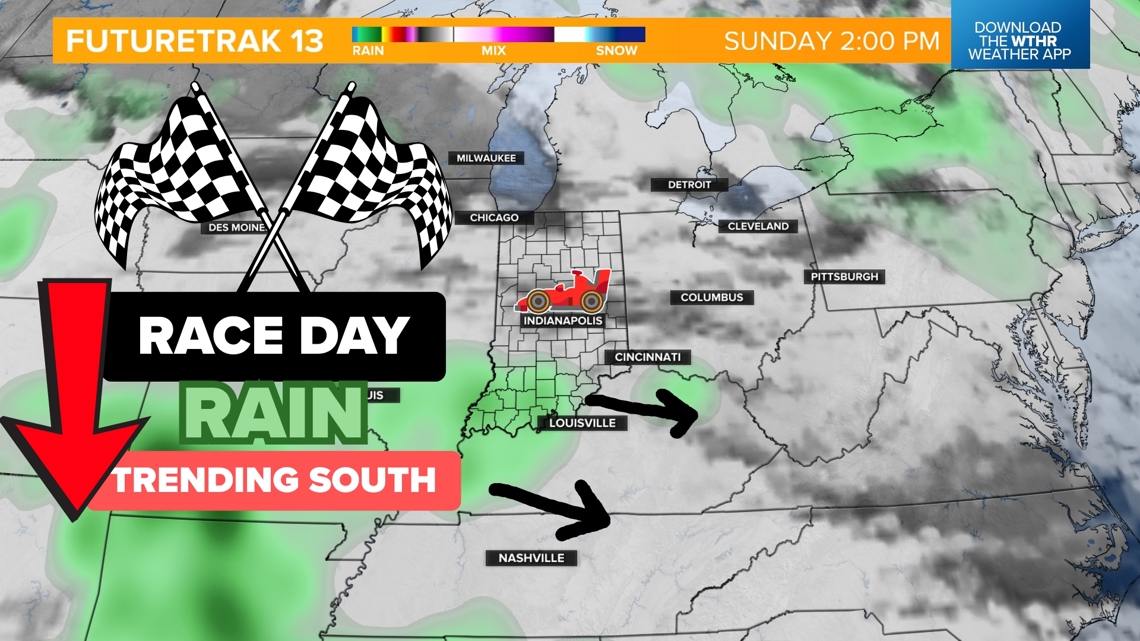

Indy 500 Weather 2025 Your Guide To Race Weekend Conditions

May 26, 2025

Indy 500 Weather 2025 Your Guide To Race Weekend Conditions

May 26, 2025 -

Residential Area Hit By Shipping Accident Container Ship Aground

May 26, 2025

Residential Area Hit By Shipping Accident Container Ship Aground

May 26, 2025

Latest Posts

-

Neurological Disorder Prompts Billy Joel To Cancel Tour

May 26, 2025

Neurological Disorder Prompts Billy Joel To Cancel Tour

May 26, 2025 -

Ipl 2025 Live Gujarat Titans Battle Chennai Super Kings Dhonis Last Dance

May 26, 2025

Ipl 2025 Live Gujarat Titans Battle Chennai Super Kings Dhonis Last Dance

May 26, 2025 -

Front Lawn Shipwreck How A Container Ship Ended Up On A Homeowners Property

May 26, 2025

Front Lawn Shipwreck How A Container Ship Ended Up On A Homeowners Property

May 26, 2025 -

Indy 500 2025 Complete Guide To Sundays Race Start Time Tv And Live Stream

May 26, 2025

Indy 500 2025 Complete Guide To Sundays Race Start Time Tv And Live Stream

May 26, 2025 -

Phillies Beat Athletics In Extra Innings Thanks To Late Game Heroics From Marsh And Schwarber

May 26, 2025

Phillies Beat Athletics In Extra Innings Thanks To Late Game Heroics From Marsh And Schwarber

May 26, 2025