Preparing For A Potential 2025 US Tourism Crisis: Securing Your Retirement Nest Egg

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Preparing for a Potential 2025 US Tourism Crisis: Securing Your Retirement Nest Egg

The US tourism industry, a behemoth contributing trillions to the national economy, faces potential headwinds in 2025. Experts predict a confluence of factors – from inflation and recessionary fears to evolving travel trends and geopolitical instability – could significantly impact tourism revenue and related job markets. This uncertainty poses a significant threat to retirees relying on tourism-related investments or employment, demanding proactive measures to safeguard their retirement nest eggs.

Understanding the Looming Threats

Several interconnected issues contribute to the potential 2025 tourism crisis:

-

Inflation and Economic Slowdown: Rising inflation and the possibility of a recession are expected to curtail discretionary spending, impacting travel budgets significantly. Fewer tourists mean less revenue for hotels, airlines, and related businesses.

-

Geopolitical Instability: Ongoing global conflicts and political uncertainties create travel advisories and deter international tourists, further diminishing revenue streams.

-

Shifting Travel Preferences: The pandemic accelerated the shift towards sustainable and experiential travel. Businesses unprepared for this change might struggle to attract customers. Furthermore, the rise of remote work allows for greater flexibility in travel timing, potentially impacting peak season revenue.

-

Labor Shortages: The tourism sector continues to grapple with labor shortages, potentially impacting service quality and operational efficiency.

Protecting Your Retirement Investments

The potential downturn necessitates a strategic review of your retirement portfolio. Here are some key steps to consider:

1. Diversify Your Investments: Over-reliance on tourism-related stocks or real estate can be risky. Diversification across various asset classes, including bonds, stocks outside the tourism sector, and real estate investment trusts (REITs) outside of tourism-heavy areas, is crucial. Consider consulting with a to create a tailored strategy.

2. Monitor Your Portfolio Regularly: Keep a close eye on market trends and adjust your investment strategy accordingly. Regular reviews allow for timely responses to economic shifts and mitigate potential losses.

3. Consider Alternative Income Streams: Explore supplemental income sources, such as part-time work or freelance opportunities, to cushion against potential losses in your tourism-related investments.

4. Reduce Debt: Lowering debt reduces your financial vulnerability during economic downturns. Prioritize paying off high-interest debt to improve your financial resilience.

5. Emergency Fund: Building a substantial emergency fund (ideally 3-6 months of living expenses) provides a financial safety net during unexpected economic hardship.

Beyond Investments: Safeguarding Your Retirement Lifestyle

Protecting your retirement income goes beyond investments. Consider:

-

Healthcare Costs: Factor in potential increases in healthcare costs and plan accordingly. Review your insurance coverage and explore cost-saving options.

-

Budgeting: Develop a realistic budget that accounts for potential reductions in income. Identify areas where you can cut expenses without significantly impacting your quality of life.

Preparing for the Future

The potential 2025 tourism crisis highlights the importance of proactive financial planning. By diversifying investments, monitoring your portfolio, and adopting a cautious approach to spending, you can significantly improve your chances of maintaining a comfortable retirement, even amidst economic uncertainty. Don't wait until the crisis hits; start taking these steps today to secure your financial future. Consult with a financial professional for personalized advice tailored to your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Preparing For A Potential 2025 US Tourism Crisis: Securing Your Retirement Nest Egg. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Flood Threat Persists Despite Tornado Warning Expiration Wednesday Evening

May 25, 2025

Flood Threat Persists Despite Tornado Warning Expiration Wednesday Evening

May 25, 2025 -

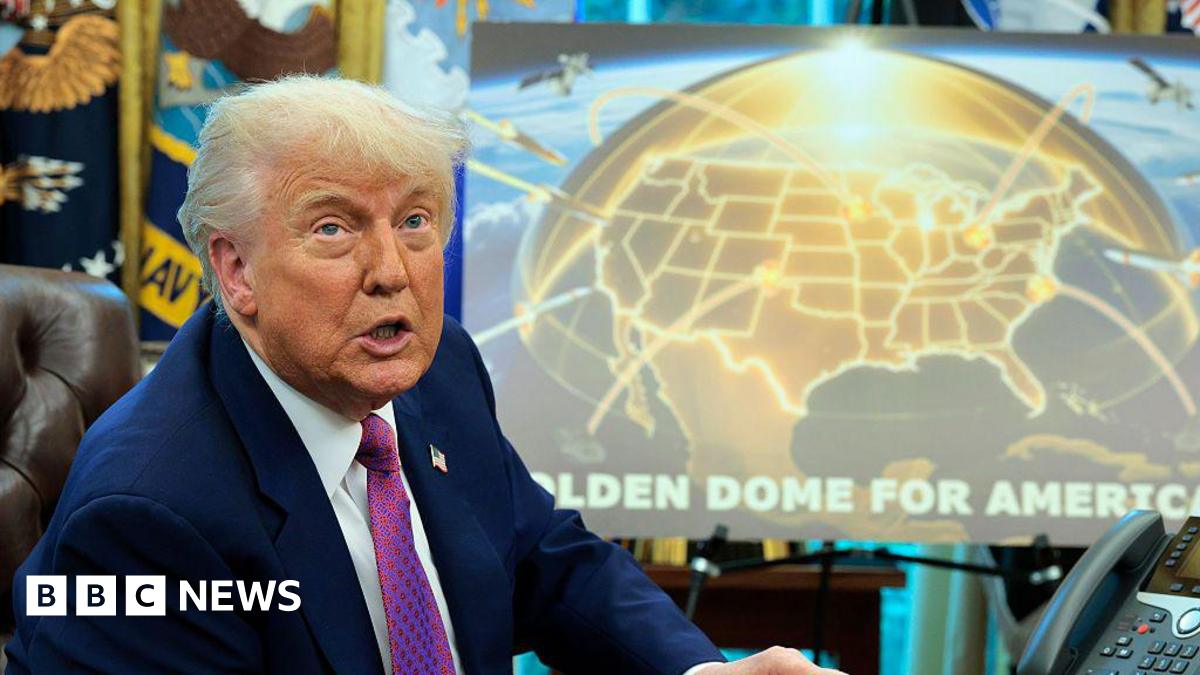

The Golden Dome Evaluating The Technological And Financial Challenges Of Trumps Missile Defense Plan

May 25, 2025

The Golden Dome Evaluating The Technological And Financial Challenges Of Trumps Missile Defense Plan

May 25, 2025 -

Vaping Stockpile Ahead Of The Uk Disposable Vape Ban

May 25, 2025

Vaping Stockpile Ahead Of The Uk Disposable Vape Ban

May 25, 2025 -

Two Sweeps In A Row Phillies Winning Streak Continues With Suarezs Strong Arm

May 25, 2025

Two Sweeps In A Row Phillies Winning Streak Continues With Suarezs Strong Arm

May 25, 2025 -

Penske Cheating Allegations Impact On Indy Cars Image And The Indy 500

May 25, 2025

Penske Cheating Allegations Impact On Indy Cars Image And The Indy 500

May 25, 2025