Private Sector Employment Plummets: 37,000 Jobs Added, Lowest In Over Two Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Private Sector Employment Plummets: 37,000 Jobs Added, Lowest in Over Two Years

The U.S. private sector added a mere 37,000 jobs in July, marking the weakest monthly gain in over two years and sending shockwaves through financial markets. This significant slowdown raises concerns about the health of the economy and the potential for a recession. Economists had predicted a far more robust increase, with forecasts averaging around 180,000 new jobs. The stark reality paints a picture of a cooling labor market, potentially signaling a broader economic slowdown.

This unexpectedly weak jobs report follows several months of declining job growth, although not to this extent. The previous month saw a revised addition of only 109,000 jobs, highlighting a consistent trend of weakening momentum. This downturn is fueling speculation about the Federal Reserve's upcoming monetary policy decisions and its impact on interest rates.

<h3>What Drove the Plunge in Job Creation?</h3>

Several factors likely contributed to this dramatic drop in private sector employment. One key element is the lingering impact of high interest rates. The Federal Reserve's aggressive interest rate hikes aimed at curbing inflation have made borrowing more expensive for businesses, leading to reduced investment and hiring.

Another significant factor is the continued uncertainty in the economy. High inflation continues to erode consumer purchasing power, impacting businesses' ability to expand and hire new employees. The ongoing uncertainty surrounding potential future interest rate hikes further dampens business confidence and investment.

Furthermore, some sectors experienced significant job losses. The leisure and hospitality sector, which has been a significant driver of job growth in recent years, experienced a net decline in employment. This could be attributed to factors such as seasonal adjustments and reduced consumer spending.

<h3>Implications for the Economy and the Federal Reserve</h3>

This unexpectedly weak jobs report has significant implications for the broader economy. The slowdown in job growth could signal a weakening consumer demand and a potential economic contraction. This could lead to further downward pressure on inflation, although the current inflation rate remains elevated.

The Federal Reserve will be closely monitoring these developments as they make decisions regarding future interest rate adjustments. While a slowdown in job growth could be interpreted as progress in combating inflation, the dramatic nature of this decline raises questions about the effectiveness of the current monetary policy. The Fed faces a delicate balancing act: slowing inflation without triggering a full-blown recession.

<h3>Looking Ahead: What to Expect</h3>

The coming months will be crucial in determining the trajectory of the economy. Economists and market analysts will be closely scrutinizing upcoming economic indicators, such as consumer spending data and inflation reports, to assess the true extent of the slowdown. The Federal Reserve's response to this unexpectedly weak jobs report will also be critical in shaping the economic outlook.

The overall picture is one of significant uncertainty. While a single month's data doesn't necessarily predict a recession, the consistently weak job growth figures warrant serious attention. This situation demands careful monitoring and strategic adjustments from both policymakers and businesses. Staying informed on economic news and understanding the implications of these trends is crucial for individuals and businesses alike. [Link to reputable economic news source]

Keywords: Private sector employment, job growth, unemployment, economy, recession, Federal Reserve, interest rates, inflation, economic slowdown, labor market, job creation, economic indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Private Sector Employment Plummets: 37,000 Jobs Added, Lowest In Over Two Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

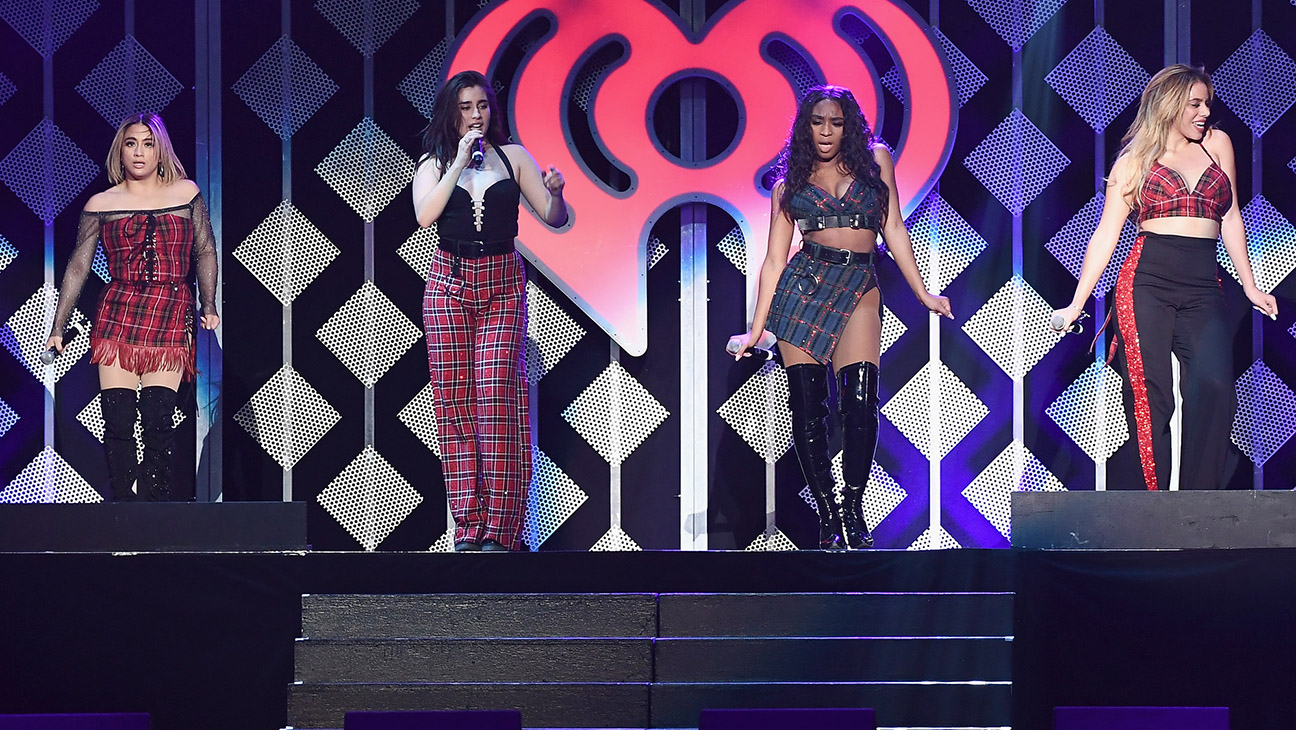

Could Fifth Harmony Reunite Without Camila Cabello Exclusive Details

Jun 06, 2025

Could Fifth Harmony Reunite Without Camila Cabello Exclusive Details

Jun 06, 2025 -

Microbiome And Health How Our Initial Bacteria Impact Hospitalization

Jun 06, 2025

Microbiome And Health How Our Initial Bacteria Impact Hospitalization

Jun 06, 2025 -

Guilty Verdict Wisconsin Man Convicted In Killing And Dismembering Teen After First Date

Jun 06, 2025

Guilty Verdict Wisconsin Man Convicted In Killing And Dismembering Teen After First Date

Jun 06, 2025 -

De Boer Out Sharks Part Ways With Coach Following Disappointing Playoffs

Jun 06, 2025

De Boer Out Sharks Part Ways With Coach Following Disappointing Playoffs

Jun 06, 2025 -

Why Walton Goggins Unfollowed Aimee Lou Wood His Heartfelt Reason

Jun 06, 2025

Why Walton Goggins Unfollowed Aimee Lou Wood His Heartfelt Reason

Jun 06, 2025

Latest Posts

-

Disqualification For Rob Cross Ex Darts Champions Tax Problems Lead To Director Ban

Jun 07, 2025

Disqualification For Rob Cross Ex Darts Champions Tax Problems Lead To Director Ban

Jun 07, 2025 -

First Date Turns Fatal Wisconsin Man Convicted Of Murder And Dismemberment Of Teen

Jun 07, 2025

First Date Turns Fatal Wisconsin Man Convicted Of Murder And Dismemberment Of Teen

Jun 07, 2025 -

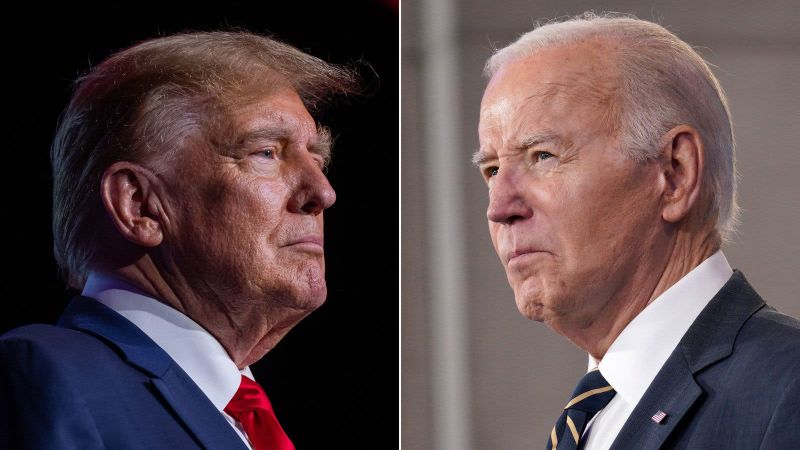

Trumps Investigation Into Biden Autopen Use And Questionable Decisions Under Scrutiny

Jun 07, 2025

Trumps Investigation Into Biden Autopen Use And Questionable Decisions Under Scrutiny

Jun 07, 2025 -

Pete De Boer Fired Dallas Stars Seek New Coach After Playoff Exit

Jun 07, 2025

Pete De Boer Fired Dallas Stars Seek New Coach After Playoff Exit

Jun 07, 2025 -

Matthew Hussey Expecting First Child With Partner A New Chapter

Jun 07, 2025

Matthew Hussey Expecting First Child With Partner A New Chapter

Jun 07, 2025