Property Tax Shake-Up: Are You Suited Or Booted?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Property Tax Shake-Up: Are You Suited or Booted?

A wave of changes is sweeping through property tax systems across the nation, leaving homeowners wondering: will these reforms benefit them, or leave them out in the cold? This isn't just about a minor adjustment; we're talking significant shifts that could dramatically impact your bottom line. From reassessments to new exemptions, understanding these changes is crucial to protecting your financial future.

This article will break down the key property tax shake-ups happening nationwide, exploring the potential winners and losers, and offering advice on how to navigate this complex landscape.

What's Triggering This Property Tax Revolution?

Several factors are driving the current property tax upheaval:

- Soaring Property Values: The recent real estate boom has inflated property values in many areas, leading to significantly higher tax bills for homeowners. This has sparked widespread calls for reform.

- Budgetary Shortfalls: Many local governments are struggling to meet their budgetary needs, leading them to explore ways to increase property tax revenue or implement more efficient collection methods.

- Legislative Changes: Several states have recently passed new legislation aimed at reforming their property tax systems, introducing new exemptions, reassessment schedules, or tax caps.

Who Are the Winners and Losers?

The impact of these changes varies greatly depending on location and individual circumstances. However, some general trends are emerging:

-

Winners: Homeowners in areas with newly implemented tax caps or exemptions may see a decrease in their property tax burden. Those with lower-valued properties might also benefit from certain types of reassessment schedules. Furthermore, senior citizens and low-income families often qualify for specific property tax relief programs.

-

Losers: Homeowners in areas experiencing significant property value increases and lacking sufficient tax relief mechanisms may see their tax bills skyrocket. Those with high-valued properties are particularly vulnerable. Similarly, individuals who haven't kept up with their property's assessed value could face unexpected increases.

Navigating the New Landscape: Key Steps for Homeowners

Here's what you can do to protect yourself:

- Understand Your Local Laws: Familiarize yourself with the specific property tax laws in your area. Check your local government's website or contact your assessor's office for the most up-to-date information.

- Appeal Your Assessment: If you believe your property's assessed value is inaccurate, file an appeal with your local assessor. This could significantly reduce your tax bill. .

- Explore Exemptions and Deductions: Many jurisdictions offer property tax exemptions or deductions for seniors, veterans, or individuals with disabilities. Research whether you qualify for any of these programs.

- Budget Accordingly: Regardless of the changes, it's crucial to budget for your property taxes. Factor in potential increases and set aside funds to cover your expected tax liability.

- Stay Informed: Keep abreast of any changes in property tax laws and regulations. Subscribe to your local government's newsletters or follow relevant news sources.

The Future of Property Taxes: What to Expect

The ongoing changes to property tax systems are likely to continue, driven by economic shifts and evolving governmental needs. Staying informed and proactive is crucial for every homeowner to avoid unexpected financial burdens.

Call to Action: Don't get caught off guard! Take control of your property taxes by reviewing your assessment and exploring available exemptions today. Your financial future depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Property Tax Shake-Up: Are You Suited Or Booted?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Drought And Extreme Heat Damage Herefordshire Broccoli Production

Aug 20, 2025

Drought And Extreme Heat Damage Herefordshire Broccoli Production

Aug 20, 2025 -

D Day At The White House A Historic Days Headlines

Aug 20, 2025

D Day At The White House A Historic Days Headlines

Aug 20, 2025 -

Razing Arizona Key Updates From The Guardians

Aug 20, 2025

Razing Arizona Key Updates From The Guardians

Aug 20, 2025 -

Expanding Hbcus Nationwide A Critical Response To The Assault On Dei

Aug 20, 2025

Expanding Hbcus Nationwide A Critical Response To The Assault On Dei

Aug 20, 2025 -

Public Cooling Centers Open A List Of Locations And Hours

Aug 20, 2025

Public Cooling Centers Open A List Of Locations And Hours

Aug 20, 2025

Latest Posts

-

Covid 19 Key Updates On Case Numbers Vaccine Guidelines And Areas Of Concern

Aug 20, 2025

Covid 19 Key Updates On Case Numbers Vaccine Guidelines And Areas Of Concern

Aug 20, 2025 -

Your Weekly Covid 19 Briefing Where Cases Are Rising And Latest Vaccine Advice

Aug 20, 2025

Your Weekly Covid 19 Briefing Where Cases Are Rising And Latest Vaccine Advice

Aug 20, 2025 -

Guardians Arizona Redevelopment A Progress Report

Aug 20, 2025

Guardians Arizona Redevelopment A Progress Report

Aug 20, 2025 -

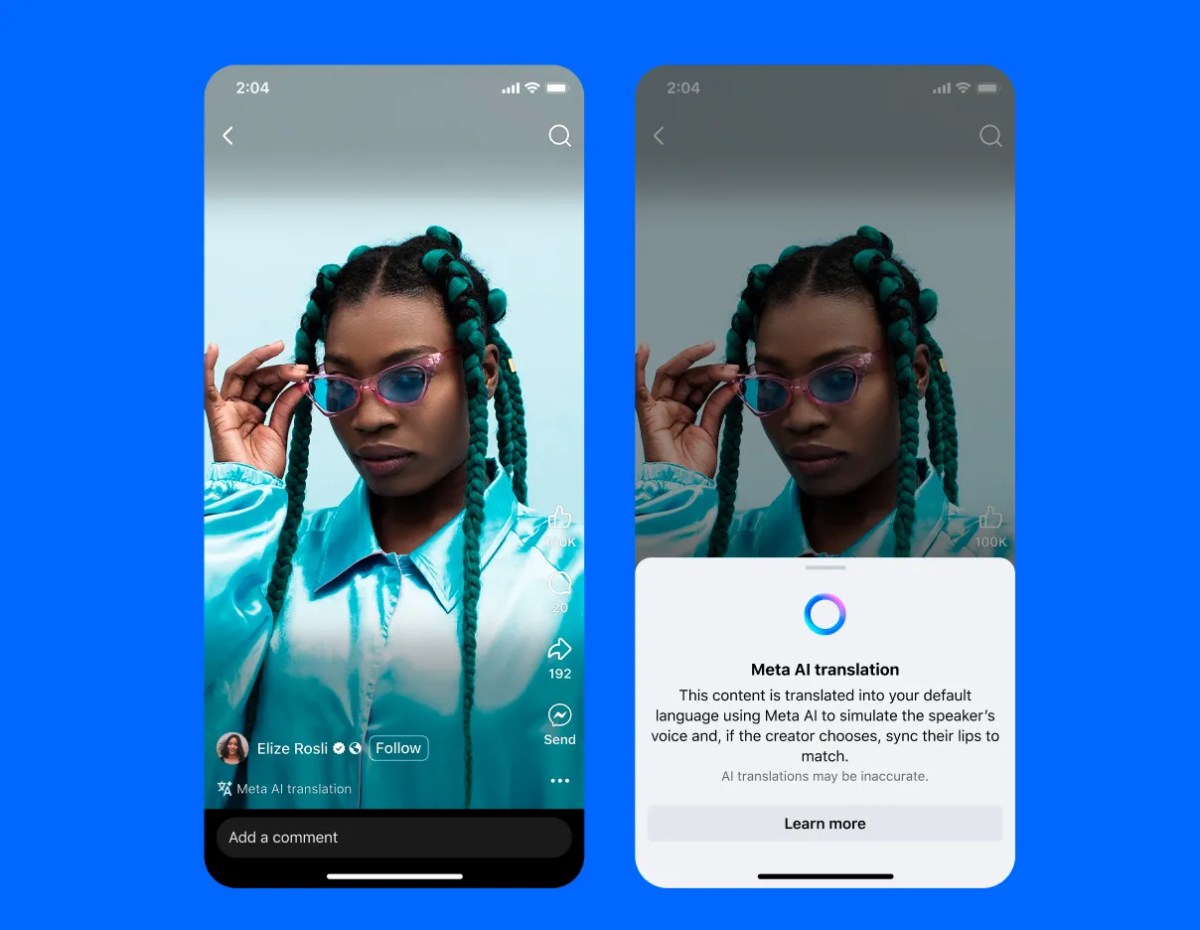

Metas Global Rollout Of Ai Powered Translation For Creators

Aug 20, 2025

Metas Global Rollout Of Ai Powered Translation For Creators

Aug 20, 2025 -

Confirmation Hamas Accepts Proposed Gaza Ceasefire

Aug 20, 2025

Confirmation Hamas Accepts Proposed Gaza Ceasefire

Aug 20, 2025