Property Tax Shake-Up: What The "Suited Not Booted" Headline Means For You

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Property Tax Shake-Up: What the "Suited Not Booted" Headline Means for You

The recent headline, "Suited Not Booted," has sent shockwaves through the property market, leaving many homeowners wondering what it means for their property taxes. This seemingly cryptic phrase refers to a significant shift in how property valuations are being conducted, potentially leading to dramatic changes in tax bills across the nation. Understanding this shift is crucial for protecting your financial interests.

What Does "Suited Not Booted" Actually Mean?

The phrase "Suited Not Booted" highlights a crucial change in the assessors' approach to property valuations. Traditionally, assessors have relied heavily on "boots-on-the-ground" assessments – physically inspecting properties to determine their value. This method, while seemingly thorough, is often time-consuming and prone to inconsistencies.

The new approach emphasizes a more data-driven, "suited" method. This involves using sophisticated algorithms and advanced data analysis techniques to assess property values, incorporating factors such as:

- Comparable Sales Data: Analyzing recent sales of similar properties in the area to establish a market value.

- Market Trends: Considering broader economic trends and fluctuations in the housing market.

- Property Characteristics: Taking into account size, location, amenities, and condition of the property.

- High-Resolution Imagery: Utilizing aerial photography and satellite imagery for a more comprehensive view of properties.

While this shift promises greater efficiency and accuracy, it also raises concerns about potential inaccuracies and disparities in valuation.

Potential Impacts on Your Property Taxes:

The shift to a "suited" approach could result in several outcomes, both positive and negative:

- Increased Property Tax Bills: For some homeowners, this new method might lead to higher property tax assessments, resulting in increased tax bills. This is especially true if the algorithm identifies factors that were previously overlooked in traditional assessments.

- Decreased Property Tax Bills: Conversely, some homeowners might see their property tax bills decrease if the new data-driven assessment reveals a lower market value than previously assessed.

- Greater Consistency: The aim is for greater consistency in valuations across the board, reducing discrepancies between similar properties in the same area. This improved consistency should lead to a fairer tax system overall.

What You Can Do to Protect Yourself:

Understanding the potential impact of this shift is only half the battle. Here are some steps you can take to protect your interests:

- Review Your Property Assessment: Carefully review your property tax assessment notice to ensure accuracy. If you believe there are discrepancies, don't hesitate to challenge the assessment.

- Gather Supporting Documentation: Compile evidence to support your case, including comparable property sales, recent improvements to your home, and any relevant market data.

- Consult a Property Tax Professional: Consider seeking help from a qualified property tax consultant or attorney who specializes in property tax appeals. They can guide you through the process and help you build a strong case.

- Stay Informed: Keep abreast of any updates and announcements regarding property tax assessments in your area. Attend public hearings and stay connected with your local government.

The Future of Property Tax Assessments:

The "Suited Not Booted" approach represents a significant shift in how property taxes are assessed. While the intention is to create a fairer and more efficient system, it’s crucial for homeowners to be vigilant and proactive in protecting their financial interests. By understanding the changes and taking appropriate action, you can ensure that your property taxes reflect the true market value of your home. Remember, staying informed is key to navigating this complex landscape.

Call to Action: Have you experienced any changes in your property tax assessment? Share your experiences in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Property Tax Shake-Up: What The "Suited Not Booted" Headline Means For You. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Protecting Children Online The Urgent Need To Address Vpn Access To Porn

Aug 21, 2025

Protecting Children Online The Urgent Need To Address Vpn Access To Porn

Aug 21, 2025 -

Madelyn Cline And Kj Apa Exploring Their On Screen Chemistry

Aug 21, 2025

Madelyn Cline And Kj Apa Exploring Their On Screen Chemistry

Aug 21, 2025 -

Managing Exam Results Stress A Guide For Neurodivergent Students

Aug 21, 2025

Managing Exam Results Stress A Guide For Neurodivergent Students

Aug 21, 2025 -

Bryan Kohbergers Dominating Personality University Peers Speak Out Before Idaho Crime

Aug 21, 2025

Bryan Kohbergers Dominating Personality University Peers Speak Out Before Idaho Crime

Aug 21, 2025 -

Arizona Facility Update Cleveland Guardians News And Notes

Aug 21, 2025

Arizona Facility Update Cleveland Guardians News And Notes

Aug 21, 2025

Latest Posts

-

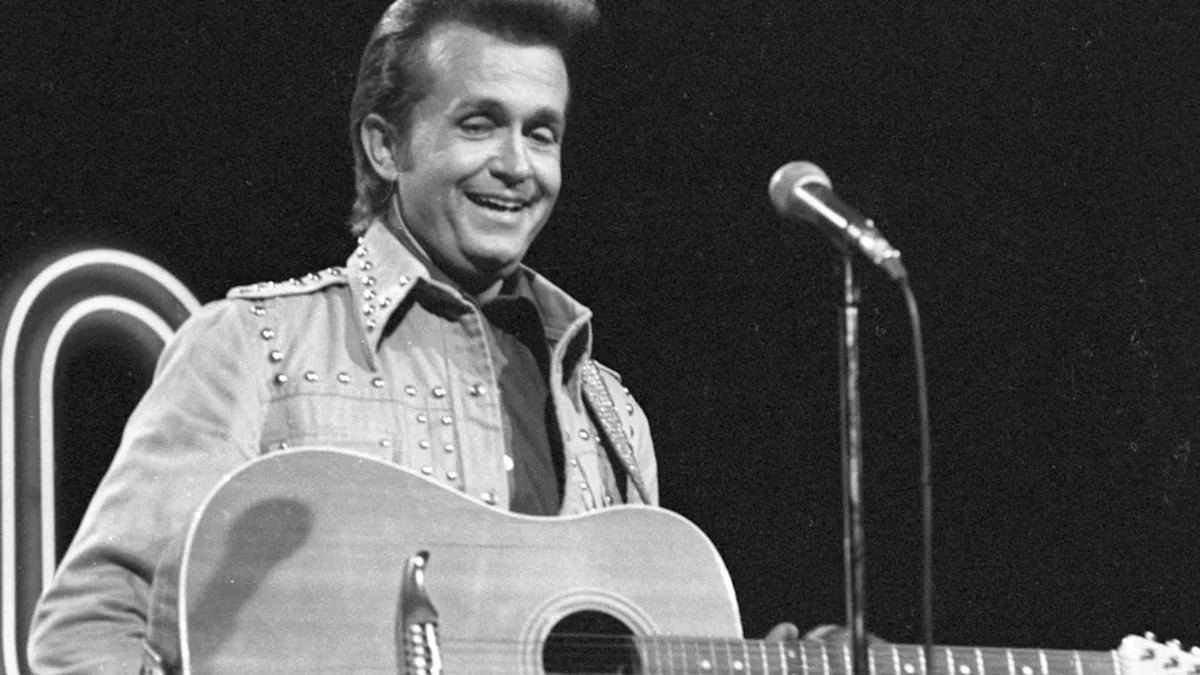

87 Year Old Country Music Icon Postpones Performances Due To Injury

Aug 21, 2025

87 Year Old Country Music Icon Postpones Performances Due To Injury

Aug 21, 2025 -

Independent Uk Space Agency Program Terminated To Reduce Spending

Aug 21, 2025

Independent Uk Space Agency Program Terminated To Reduce Spending

Aug 21, 2025 -

The Anti Tourism Movement Europes Fight Against Overwhelm

Aug 21, 2025

The Anti Tourism Movement Europes Fight Against Overwhelm

Aug 21, 2025 -

Zelensky Putin Talks Kremlin Downplays Prospects Trump Raises Concerns

Aug 21, 2025

Zelensky Putin Talks Kremlin Downplays Prospects Trump Raises Concerns

Aug 21, 2025 -

Noel Gallaghers Proud Declaration Liams Success Celebrated

Aug 21, 2025

Noel Gallaghers Proud Declaration Liams Success Celebrated

Aug 21, 2025